The Bull Case For National Australia Bank (ASX:NAB) Could Change Following AGM Reforms And Dividend Decision

- At its recent AGM on 12 December 2025, National Australia Bank shareholders approved changes to the company’s constitution, passed all core resolutions, confirmed completion of AUSTRAC remediation, and declared a fully franked final dividend of A$0.85 per share.

- The meeting also underscored NAB’s focus on business bank and deposit growth, proprietary home lending, and strengthened fraud prevention, while shareholder proposals on deforestation were rejected, signalling the board’s preferred ESG and growth priorities.

- We’ll now examine how the AGM’s constitutional changes, dividend decision, and AUSTRAC remediation completion may reshape NAB’s investment narrative.

Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

National Australia Bank Investment Narrative Recap

To own National Australia Bank, you need to believe in its role as a core Australian business bank, balancing steady income from lending and deposits with ongoing investment in technology and risk controls. The latest AGM outcomes, including the A$0.85 fully franked dividend and AUSTRAC remediation completion, appear supportive for near term income confidence, while the biggest ongoing risk remains pressure on asset quality and credit losses rather than anything materially new from this meeting.

The most relevant update here is NAB’s confirmation that it has completed remediation work with AUSTRAC, which helps reduce regulatory overhang at a time when elevated compliance and technology costs are already weighing on the cost to income ratio. With management also emphasizing fraud prevention and business bank growth, investors may focus more squarely on how effectively NAB can convert its digital and branch investments into sustainable earnings and capital returns.

But while regulatory risk has eased, investors should be aware that rising stress in Business & Private Banking could still...

Read the full narrative on National Australia Bank (it's free!)

National Australia Bank's narrative projects A$22.7 billion revenue and A$7.3 billion earnings by 2028. This requires 4.2% yearly revenue growth and about a A$0.3 billion earnings increase from A$7.0 billion today.

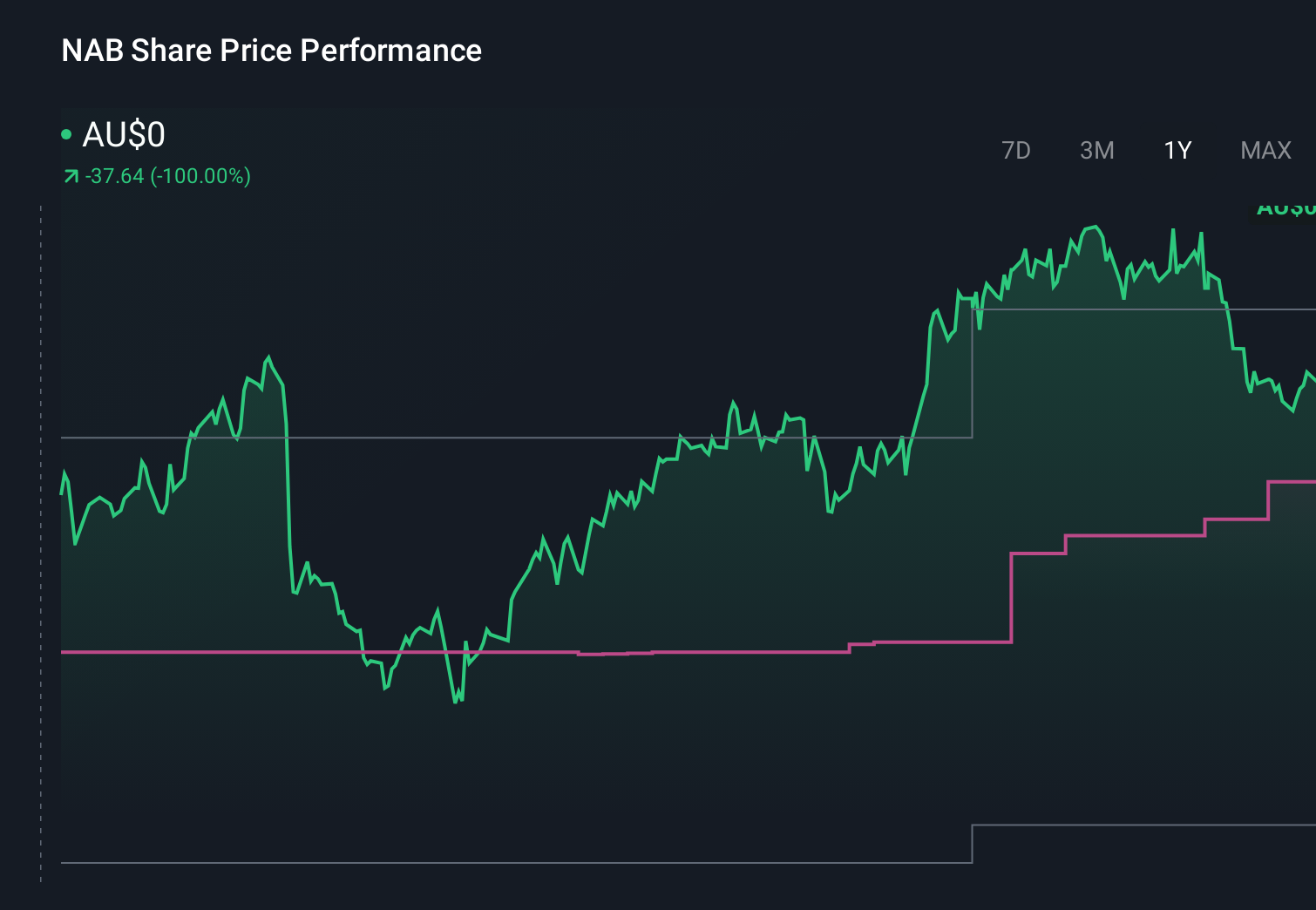

Uncover how National Australia Bank's forecasts yield a A$37.99 fair value, a 10% downside to its current price.

Exploring Other Perspectives

Seven members of the Simply Wall St Community currently see NAB’s fair value between A$29 and A$40, highlighting very different views on upside. Set this against NAB’s ongoing need for heavy technology and compliance investment, which could keep pressure on costs and influence how you think about the bank’s ability to grow earnings over time.

Explore 7 other fair value estimates on National Australia Bank - why the stock might be worth as much as A$40.00!

Build Your Own National Australia Bank Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your National Australia Bank research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free National Australia Bank research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate National Australia Bank's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報