Wayfair (W): Reassessing Valuation After Strong Multi‑Year Gains and Recent Share Price Pullback

Wayfair (W) has had a choppy run lately, but the stock’s longer track record and recent swings set up an interesting question for investors: is this pullback a chance to reassess its story?

See our latest analysis for Wayfair.

After a huge rebound this year, with the year to date share price return topping triple digits and the 3 year total shareholder return also strongly positive, recent pullbacks from around $97 suggest momentum is cooling a little as investors reassess how sustainable the growth and margin story really is.

If Wayfair’s volatility has you thinking more broadly about opportunity, this could be a good moment to explore fast growing stocks with high insider ownership.

With the share price still below analyst targets yet sitting on hefty multi year gains, is Wayfair now trading at a discount to its renewed fundamentals, or has the market already priced in the next leg of growth?

Most Popular Narrative: 14.6% Undervalued

With Wayfair closing at $97.31 versus a widely followed fair value of $114, the core debate centers on how durable its growth and margin ambitions really are.

The analysts have a consensus price target of $81.207 for Wayfair based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $105.0, and the most bearish reporting a price target of just $51.0.

Want to see the math behind this richer fair value? The narrative leans on modest sales growth, a swing to profitability, and a punchy future earnings multiple. Curious how those moving parts fit together into that target?

Result: Fair Value of $114 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the thesis hinges on a fragile macro backdrop and housing market, where weak demand or higher rates could quickly derail those optimistic margin and growth assumptions.

Find out about the key risks to this Wayfair narrative.

Another View: Multiples Tell a Tougher Story

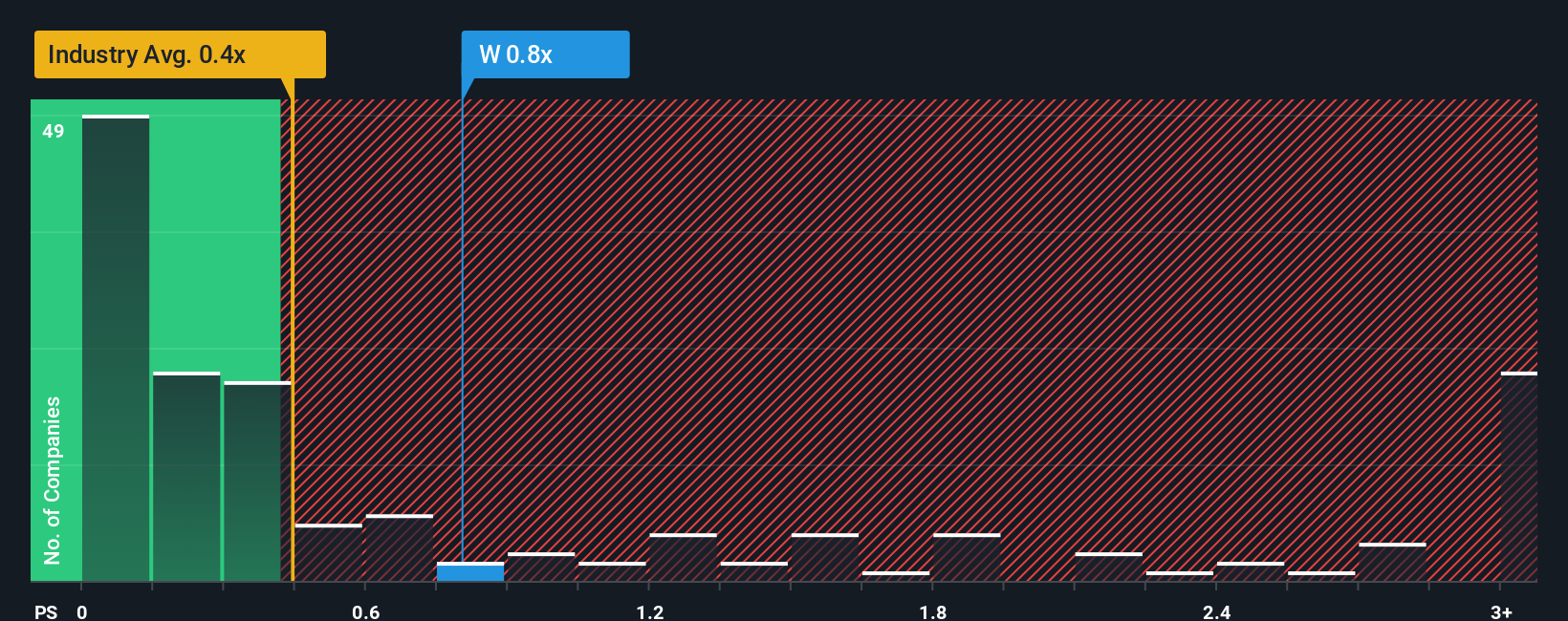

While the narrative points to a 14.6% upside, the price to sales lens is less generous. Wayfair trades around 1x sales versus a 0.7x fair ratio and a 0.5x industry average, even if it still looks cheaper than peers at 1.3x. Is sentiment already running ahead of fundamentals?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Wayfair Narrative

If you see the story differently or want to dig into the numbers yourself, you can easily build a custom view in minutes: Do it your way.

A great starting point for your Wayfair research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors keep fresh opportunities on their radar, and Simply Wall Street’s Screener can surface stocks you might regret overlooking when the next big move arrives.

- Capture early growth stories by scanning these 3611 penny stocks with strong financials that pair small market caps with improving fundamentals and room for serious upside.

- Position yourself for the next productivity boom by targeting these 26 AI penny stocks powering automation, data intelligence, and real world AI adoption.

- Identify potential value opportunities by filtering these 908 undervalued stocks based on cash flows where cash flows suggest the market price still has room to catch up.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報