Centene (CNC) Valuation Check as Investor Support and Obamacare Subsidy Extension Plans Draw New Attention

Centene (CNC) has landed back on investors radar after value managers highlighted its scale in Medicaid, while a proposed White House push to extend Obamacare subsidies brightens the outlook for ACA marketplace enrollment.

See our latest analysis for Centene.

Those bullish letters and the subsidy headlines help explain why Centene’s recent 90 day share price return of 25.15 percent contrasts sharply with its 12 month total shareholder return of negative 31.25 percent. This suggests momentum is improving from a depressed base.

If this kind of policy driven move has you rethinking healthcare exposure, it could be a good moment to scan other potential winners using healthcare stocks.

With the stock still trading well below long term highs despite signs of earnings normalization and policy support, is Centene quietly offering value, or is the recent rebound simply markets pulling forward the next leg of growth?

Most Popular Narrative: 2.3% Overvalued

With Centene closing at $40.85 against a most popular narrative fair value of $39.94, the stock is framed as only slightly ahead of intrinsic value, setting up a nuanced debate over how sustainable margin recovery really is.

Bullish analysts point to sustained margin recovery in Marketplace and Medicaid as the key driver of outsized EPS growth over 2026 and 2027. They argue that recent pricing actions and rate refilings are now better aligned with risk adjustment mechanics and evolving risk pools, and that updated FY25 and early 2026 commentary supports a multi year earnings re rating story.

Curious how modest revenue growth, leaner margins and a lower future earnings multiple still add up to today’s fair value math. Want to see the full playbook behind that conclusion.

Result: Fair Value of $39.94 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent Medicaid rate uncertainty and elevated specialty drug costs could quickly pressure margins, challenging consensus assumptions on Centene’s earnings recovery path.

Find out about the key risks to this Centene narrative.

Another View: Multiple Based Valuation Signals Deep Discount

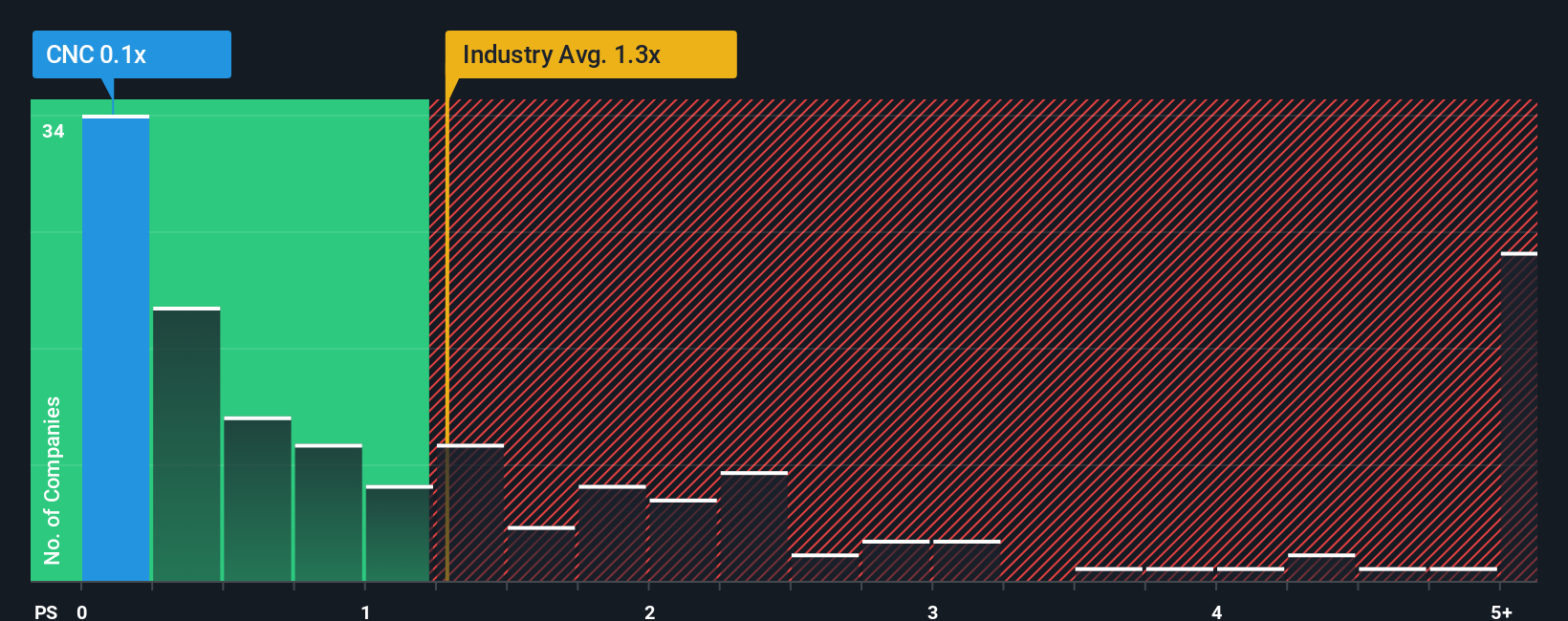

While the popular narrative pegs Centene as 2.3 percent overvalued, its price to sales ratio of just 0.1 times versus 1.3 times for the US Healthcare industry and 1.8 times for peers looks starkly cheap. Especially against a 0.9 times fair ratio baseline, this raises the question of whether the market is overpricing execution risk.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Centene Narrative

If you see the story differently or want to stress test the assumptions yourself, you can build a personalized view in minutes: Do it your way.

A great starting point for your Centene research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before this opportunity window shifts again, put Simply Wall Street to work and uncover a pipeline of stocks that match your strategy with discipline and clarity.

- Capture early stage potential by reviewing these 3611 penny stocks with strong financials, which already pair tiny share prices with solid fundamentals, before broader markets catch on.

- Position your portfolio for the next productivity wave by targeting these 26 AI penny stocks, which shape how data, automation and intelligent software transform entire industries.

- Seek stronger risk reward setups by focusing on these 908 undervalued stocks based on cash flows, where prices lag underlying cash flow strength, not the other way around.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報