Chevron (CVX) Valuation Check as 2026 Spending Plan Tightens and Cost-Savings Target Rises

Chevron (CVX) just tightened its 2026 playbook by reaffirming $18 billion to $19 billion in capital spending and lifting its cost savings goal to $3 billion to $4 billion, effectively doubling down on efficiency and free cash flow.

See our latest analysis for Chevron.

Against that backdrop, Chevron’s share price has eased in recent months even as governance tweaks, Venezuela negotiations and the Hess integration dominate headlines. However, its five year total shareholder return of about 113% shows the long term story is still intact and momentum is consolidating rather than collapsing around today’s $149.99 level.

If Chevron’s efficiency push has you reassessing the energy space, it is also worth exploring other established names across aerospace and defense stocks to see how different cash flow and risk profiles compare.

With shares lagging despite upgraded cost cuts, a sub $50 per barrel breakeven and a double digit discount to analyst targets, the question is whether Chevron is quietly mispriced or already fully discounting its next leg of free cash flow growth.

Most Popular Narrative Narrative: 13.3% Undervalued

With Chevron last closing at $149.99 versus a narrative fair value of $172.92, the valuation hinges on how far earnings and margins can stretch.

Analysts expect earnings to reach $21.8 billion (and earnings per share of $12.5) by about September 2028, up from $13.7 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $26.1 billion in earnings, and the most bearish expecting $15.7 billion.

Curious what kind of revenue glide path and margin lift could justify that earnings jump and still command a premium multiple in a cyclical sector? The narrative breaks down a tight set of forecasts that stitch modest top line growth, rising profitability and shrinking share count into a surprisingly optimistic long term valuation story.

Result: Fair Value of $172.92 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, structurally weaker long term oil demand, slower renewable diversification, and execution risks across major projects could easily derail that upbeat valuation path.

Find out about the key risks to this Chevron narrative.

Another Angle: Market Ratio Signals Caution

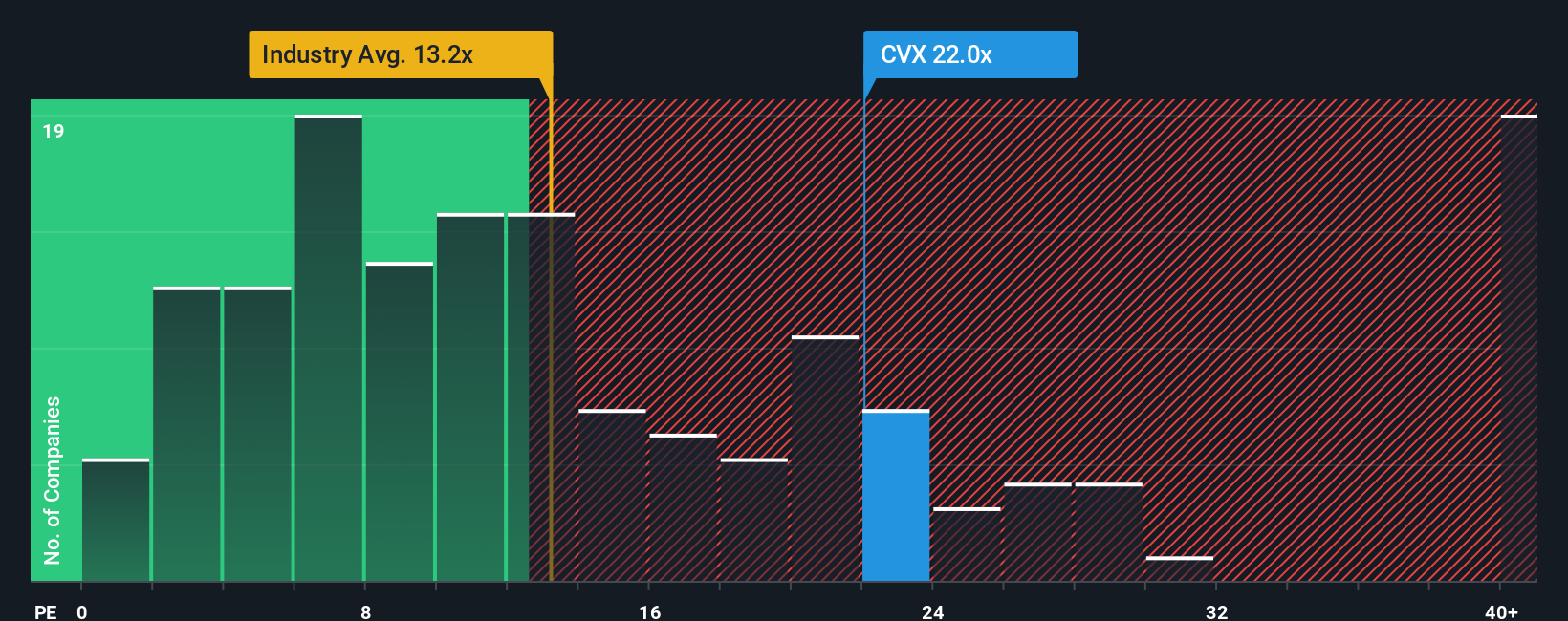

Our fair value work suggests upside, but the current price to earnings ratio of 23.7 times tells a different story. It sits above both peers at 22.2 times and the US Oil and Gas industry at 13.3 times, and only slightly below a fair ratio of 25.2 times that the market could drift toward. That mix hints at limited rerating room and raises the question: is most of the quality already priced in?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Chevron Narrative

If you would rather weigh the numbers yourself and challenge these assumptions, you can build a fresh Chevron storyline in minutes: Do it your way.

A great starting point for your Chevron research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Chevron might fit your thesis today, but you will miss some of the market’s most compelling setups if you ignore other data driven opportunities on Simply Wall Street.

- Capitalize on mispriced quality by scanning these 908 undervalued stocks based on cash flows that pair strong cash flows with compelling upside potential.

- Ride powerful innovation trends by targeting these 26 AI penny stocks positioned at the forefront of intelligent automation and data driven products.

- Lock in reliable income streams through these 13 dividend stocks with yields > 3% that balance attractive yields with sustainable payout profiles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報