CITIC Construction Investment: Vaccine Industry Investment Outlook 2026

The Zhitong Finance App learned that CITIC Construction Investment released a research report saying that the vaccine industry suggests focusing on product sales improvements and innovation pipeline progress. Sales performance of some products is good, and the volume trend is expected to continue. In the first three quarters, inventory levels of some product channels continued to be optimized, and the competitive pattern was relatively good. Companies continued to promote terminal sales, thus maintaining a good volume trend. It is expected that in 25Q4 and '26, some major vaccine varieties with large market space and a good competitive pattern are still expected to maintain the sales growth trend.

CITIC Construction Investment's main views are as follows:

Vaccines: Business continues to be under pressure, and we look forward to a month-on-month improvement in sales and the contribution of new products

Industry performance: After years of development, it has continued to be under pressure since 2024

After years of development, the vaccine industry has continued to be under pressure since 2024. China's vaccine industry has gone through many years of development. It used to be dominated by immunization planning vaccines. There were too many negative events before 2019, affecting the development of the industry. As the country continues to strengthen supervision of the vaccine industry, the adverse factors affecting the industry are phased out, compounded by the launch and gradual release of major domestic vaccine products, the non-immunization planning market has gradually become an important factor driving the development of the vaccine industry. In 2023, the vaccine industry's attention waned. Some companies relied on newly launched products or blockbuster products to continue to expand, and their business performance continued to grow. In 2024, due to the impact of the macroeconomic environment of the market, vaccine sales channels were under pressure for a short period of time. Combined with increased market competition for some varieties, the price system loosened, and the overall performance of the vaccine industry was weaker than that of pharmaceuticals as a whole. From January to October 2025, the Shenwan Vaccine Index fell 5.4%, which was weaker than the Shenwan Pharmaceutical Index (+18.3%) and the Shanghai and Shenzhen 300 Index (+16.6%).

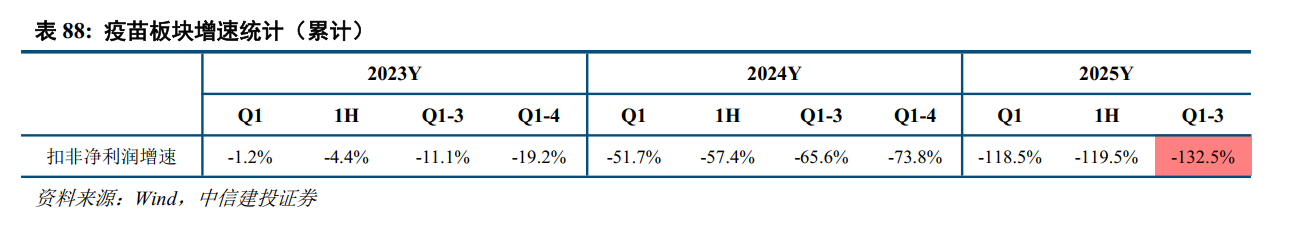

The revenue and profit side of the vaccine sector declined sharply year on year in the first three quarters of 2025: in the first three quarters of 2025, the vaccine sector's revenue fell 52.5% year on year, net profit to mother fell 121.6% year on year, and net profit after deducting non-return mother fell 132.5% year on year; among them, the operating income of the 25Q3 vaccine sector fell 27.5% year on year, net profit to mother fell 196.7% year on year, and net profit after deducting non-return mother net profit decreased 245.3% year on year.

Product sales continue to be under pressure, and the competitive landscape of the industry is fierce. The vaccine sector's performance in the first three quarters of 2025 showed a downward trend, mainly due to: 1) changes in consumer demand due to changes in consumer demand due to market macroeconomic conditions; 2) the competitive pattern of some products, such as bivalent HPV vaccines, PCV13, and rabies vaccines, is becoming intense. The profit side declined faster than the revenue side, mainly due to: 1) the revenue side declined while the cost side was relatively fixed, and the cost ratio increased year on year; some enterprises increased investment in R&D, and R&D expenses increased year on year. 2) Prices of some products dropped significantly year-on-year due to factors such as intense competition and participation in government procurement.

The decline in sales volume, price adjustments, and changes in revenue structure affected gross profit margins, and sales and management expenses increased year-on-year. In the first three quarters of 2025, the average gross margin of the vaccine industry was 65.8% (-7.4pct); the sales expense ratio, management expense ratio, R&D expense ratio, and financial expense ratio were 30.3% (+5.0pct), 12.4% (+3.0pct), 16.7% (same year-on-year), and -0.5% (+0.5%), respectively; net sales margin decreased by 3.1% (-17.1pct) year on year. The decline in the gross margin of the industry in the first three quarters was mainly due to: 1) the decline in sales of vaccine products, leading to an increase in cost sharing; 2) the year-on-year decline in the price of some products; 3) the gross margin of some products was lower, and the increase in revenue share affected the overall gross margin level. The increase in the sales expense ratio is mainly due to increased sales promotion and investment by enterprises; the increase in the management expense ratio is mainly due to factors such as increased depreciation and amortization and inventory destruction. The number of industry receivables turnover days in the first three quarters was 381 days, an increase of 47.5 days over the previous year, reflecting some pressure on corporate repayment.

Domestic vaccine research and development competition is fierce, and I am optimistic about the future pattern of innovative varieties and R&D progress

Domestic vaccine companies are following overseas, and there is a clear trend towards homogenization. The overall development of the domestic vaccine market follows the footsteps of the global market. It mainly uses domestic vaccine manufacturers to achieve domestic substitutions in the vaccine field, such as Wantai Biotech and Watson Biotech's bivalent HPV vaccines, Watson Biotech and Kangtai Biotech's PCV13, and Baike Biotech's live attenuated herpes zoster vaccine. In addition, many vaccine companies are currently developing and releasing Class II vaccine varieties that have already been marketed, including HPV vaccines, pneumonia-conjugated vaccines, meningitis vaccines, influenza vaccines, shingles vaccines, RSV vaccines, etc. The homogenization trend is quite obvious, and competition is becoming fierce in the future.

Domestic innovative vaccine pipeline: Existing products have been upgraded, or the layout does not meet demand. Currently, the overall domestic vaccine research and development pipeline is concentrated, and the trend of homogenization is remarkable. Faced with this situation, various companies have also launched upgraded pipeline research and development projects for existing products, such as higher-cost pneumococcal vaccines, HPV vaccines, and innovative varieties such as herpes zoster vaccines and RSV vaccines. In addition, some companies are developing more innovative product pipelines for unmet needs, such as Staphylococcus aureus vaccine, norovirus vaccine, Helicobacter pylori vaccine, etc.

Tumor Therapeutic Vaccines: Vaccine Indications Expand Hot Areas

Tumor therapeutic vaccines: Currently, vaccine indications are expanding into hot areas. In recent years, immunotherapy has become a hot field of research for cancer treatment. Several novel immunotherapies, including immune checkpoint inhibitors (ICI), oncolytic viruses, and CAR-T cell therapy, have been approved for clinical use. At the same time, researchers are also exploring new immunotherapy methods, such as cancer therapeutic vaccines. Tumor therapeutic vaccines mainly use tumor cells or tumor antigens to activate the patient's own immune system and induce the body to produce specific cellular immunity and humoral immune responses, thereby enhancing the body's ability to fight cancer, preventing the growth, spread and recurrence of tumors, and achieving the goal of removing or controlling tumors.

The application of AI technology helps accelerate the development of cancer vaccines. The application of artificial intelligence (AI) has a significant impact on treatment and research in the field of oncology. Through data-driven pattern recognition, AI has been shown to help detect mutations and unravel complex genomic signatures. The integration of modern immunology and data science has also introduced innovative analytical methods for vaccine development. AI can assist in feature extraction and model training to predict patient-specific cancer antigens. Through complex algorithms, artificial intelligence can optimize and refine these antigens, guide vaccine formulations, and support clinical trial design, making it possible to achieve more personalized vaccination strategies.

Overseas mRNA vaccine giants laid out cancer vaccines earlier. Currently, many overseas companies have deployed tumor vaccine research and development. Among them, overseas mRNA vaccine giants such as Moderna and BioNTech design tumor antigens through mRNA technology and then produce tumor mRNA vaccines through self-developed delivery carriers. Currently, multiple pipelines have entered clinical phase II to III, covering various tumor types including melanoma, lung cancer, and skin cancer.

Domestic cancer vaccine research and development is in its infancy, and pipelines tend to be diverse. Compared with overseas, China's cancer vaccine research and development is in its infancy, and there are many layout companies, most of which are in phase I clinical phase. From a technical perspective, domestic tumor vaccine pipelines are mainly based on mRNA technology. Among them, many pipelines select HPV-related tumors as indications, as well as various other solid tumors. The antigen targets that can be selected for tumor mRNA vaccines are quite diverse, and there are also certain differences in antigen screening, sequence design, and delivery carriers. It is expected that domestic companies will achieve clinical breakthroughs through differentiated technology routes.

Indications for innovative vaccines continue to expand, and subsequent progress is worth watching

Staphylococcus aureus vaccine: An effective means of controlling drug-resistant bacterial infections. Olin Biotech is in clinical phase III. Staphylococcus aureus is a gram-positive bacteria that can cause serious diseases including skin and soft tissue infections, blood infections, and joint infections, to pneumonia and toxic shock syndrome. From 1990 to 2021, the global number of deaths attributed to methicillin-resistant Staphylococcus aureus (MRSA) increased from 261,000 to 55,000, and the number of deaths attributed to it increased from 57,200 to 130,000. WHO estimates that if a vaccine that can prevent Staphylococcus aureus infection is on the market, it would ideally reduce medical expenses by 57.819 billion US dollars per year, reduce social productivity losses by 15.313 billion US dollars, and have huge social and economic benefits.

All clinical phase III clinical enrollment of Olin Biotech's Staphylococcus aureus vaccine has been completed, and we look forward to further progress. In July 2023, “Vaccine” magazine published a research paper on phase II clinical trial of the recombinant Staphylococcus aureus vaccine developed by Olin Biotech in collaboration with the Army Military Medical University of the Chinese People's Liberation Army. The results of the phase II clinical trial showed that the company's recombinant Staphylococcus aureus vaccine was safe among target people aged 18-70 for orthopedic surgery in China; specific antibody levels began to increase on the 7th day after the first dose, and peaked at 10-14 days, and the immunogenicity was good. The Staphylococcus aureus vaccine completed the enrollment of 6,000 cases in phase III clinical trials in May 2025. It is expected that complete phase III clinical report data will be read out later. Pressure sores (decubitus) patients selected for the second indication have already been communicated with the CDE, and the plan is officially submitted after completion of preparations. We look forward to further progress.

PBPV: Broad serotype coverage was achieved, and Cansino PBPV clinical phase I results were positive. The PBPV (pneumococcal protein vaccine) independently developed by Cansino uses pneumococcal surface protein A (pSpA, a highly conserved protein expressed by almost all pneumococci) as an antigen. Compared with existing pneumonia vaccines, PBPV has a higher serum coverage rate (at least 98% coverage of pneumococcal strains), which can effectively prevent the production of “serotype substitutions.” At the same time, the production process of this product is simpler, and it is easy to expand and control quality. PBPV can also induce a T-cell-dependent immune response, and is expected to have a good immune response in infants and the elderly. Cansino carried out phase Ia and phase Ib clinical studies on PBPV. The results showed that PBPV has good safety in adults and the elderly, and that a single dose of vaccination can induce significant conjugate antibodies and functional bactericidal antibody responses against streptococci across family/subclasses of pneumococci, further proving the broad spectrum and potential public health value of this vaccine candidate. The company will evaluate and plan the next stage of PBPV research and development based on the preliminary results obtained in the phase I clinical trial.

Hexavalent norovirus vaccine: Currently the most expensive pipeline in the world, Kanghua Biotech has obtained external licensing. Kanghua Biotech has independently developed a 6-valent norovirus vaccine candidate (Hexa-VLP) based on virus-like particles (VLP), covering GI.1, GII.2, GII.3, GII.4, GII.6, and GII.17 genotypes, along with aluminum hydroxide. Preclinical trials have shown that 2-3 doses of hexa-VLP can induce an effective and long-lasting blocking antibody response, especially for the emerging GII.P16-GII.2 and GII.17 genotypes. Kanghua Biotech signed an “Exclusive License Agreement” with HillEvax in January 2024, authorizing the development, production and commercialization of the recombinant hexavalent norovirus vaccine and its derivatives in regions other than China (including Hong Kong, Macao and Taiwan). The transaction amount includes a down payment of US$15 million, development and sales milestone payments of up to US$255.5 million, and a single-digit percentage of actual annual net sales. The pipeline was approved for clinical trials by the US FDA in September 2023, and it is expected that the partner will soon begin clinical trials in the US.

Kangtai Biotech lays out Klebsiella pneumoniae vaccine to fill gaps in global research and development. Klebsiella pneumoniae is one of the most resistant and pathogenic bacteria in clinical practice. In particular, Klebsiella pneumoniae (CRKP), which is resistant to carbapenem antibiotics, is resistant to almost all current first-line and second-line antibiotics. In the “2024 Catalogue of Key Bacterial Pathogens” issued by the World Health Organization, carbapenem-resistant Klebsiella pneumoniae is listed as a key priority. In August 2025, Kangtai Biotech and Professor Zou Quanming's team from the Army Military Medical University signed a technology transfer contract for the Klebsiella pneumoniae vaccine project. The conversion amount was 530 million yuan, and payment was made according to the milestone. At present, pharmacogenicity studies and preliminary safety evaluations have been completed. The protection rate against clinical strain infection with Klebsiella pneumoniae has stabilized at more than 80% in the pneumonia model, and has good efficacy and broad spectrum.

Future policy trends: Focus on policies related to commercial insurance, health care integration, and industry mergers and acquisitions

The development of commercial insurance is expected to bring about increases on the payment side. In June 2025, the General Office of the CPC Central Committee and the General Office of the State Council announced the previously issued “Opinions on Further Safeguarding and Improving People's Livelihood and Focusing on Resolving People's Urgent Needs”. The “Opinion” suggests that it is necessary to “improve the mechanism for adjusting the basic medical insurance drug catalogue, and develop a catalogue of innovative commercial health insurance drugs to better meet the needs of the people at many levels of drug use coverage.”

The vaccine entered the commercial insurance innovative drug catalogue for the first time, opening up new payment channels. In August 2025, Zhonghui Biotech's quadrivalent influenza virus subunit vaccine became the only vaccine product that passed the formal review in the commercial insurance innovative drug catalogue published by the National Health Insurance Administration. This is the first time that a vaccine has entered the commercial insurance catalogue, marking a break in the ice for preventive biological products in the health insurance payment system. Vaccines are included in the commercial insurance catalogue, helping to reduce the financial burden on the public, revitalize personal health insurance account balances, and open up new payment channels for high-value innovative vaccines. At present, the catalogue has passed formal review, and in the future, it will have to face tests such as expert review, negotiation bid/price negotiation, etc.

Health prevention integration policies have been introduced one after another, from concept proposal to implementation of measures. In China, in the face of the suddenness of public health events and the intensification of population aging, the strategic importance and urgency of integrating health care and prevention is becoming more and more prominent. The integration of medical prevention aims to break the gap between public health and medical service systems, and establish a comprehensive, three-dimensional health service system through the integration and sharing of prevention and medical resources. Since it was first proposed on the policy side in 2018, the country has attached great importance to the concept of integrated health care and prevention, and introduced a series of related policies. Since 2025, the National Administration for Disease Prevention and Control and the Health Commission have successively issued the “Notice on the List of Pilot Units for the Integration of Infectious Disease Prevention and Control” and the “Evaluation Criteria for Level 3 Hospitals (2025 Edition)”, strengthening the functional positioning of medical institutions in vaccination services and promoting the organic integration of vaccination services and clinical care through medical prevention integration pilots, thus promoting the implementation of the concept of medical prevention integration, and laying the institutional foundation for improving vaccination coverage and service quality.

Policies related to industry mergers and acquisitions have been introduced one after another, focusing on the pharmaceutical sector. In recent years, China has introduced a series of top-level design and local supporting policies around industry mergers and acquisitions, forming a “central guidance+local implementation” policy system, which focuses on supporting the strengthening of the technology sector, upgrading traditional industries and industrial chain coordination and integration, and simplifying review processes related to mergers, acquisitions and restructuring transactions, allowing the use of innovative payment tools and enhancing regulatory inclusiveness. Judging from local policies, fields such as biomedicine and electronic technology have become key industries that encourage mergers, acquisitions and restructuring, helping the vaccine industry to achieve mergers and acquisitions integration, increase industry concentration while reducing disorderly competition, and promote the healthy development of the industry.

Vaccines go overseas: Equal emphasis on product sales & technical licensing to promote the internationalization process

The vaccine industry has diversified international entry methods, and the export of finished products is currently the mainstream method. The process of an enterprise entering the international market is the process by which the company enters the target country or region through various means with its own products and resources, such as technology, capital, own brand or management experience. According to the current overseas progress of domestic vaccine companies, there are two main mainstream and highly mature methods: 1) bilateral export of finished products; 2) international organization procurement and non-market-driven product exports (such as local government procurement). In addition, there are various methods such as technology transfer and localized production, authorized introduction of products, and external licensing.

Vaccines go overseas and extend from exports of finished products to upstream and downstream of the value chain. As the overseas business of vaccine companies continues to advance, the overseas movement is also expanding and deepening at an accelerated pace upstream and downstream of the value chain. There is a gradual transition from a single bilateral registration of finished products to the entire chain of filling technology, commercial production of overseas factories, overseas clinical trials, overseas cooperative research and development, or authorization of early varieties.

Product overseas sales are expected to accelerate in the future, and the internationalization model is becoming more diverse. Limited by PQ certification and policy restrictions, the current internationalization strategy of Chinese enterprises mainly exports finished vaccine products, and the export amount and quantity are relatively small. As companies have accumulated rich international experience and resources during the COVID-19 pandemic, and the emphasis on internationalization has increased. In addition, the WHO announced in August 2022 that China has passed the national vaccine supervision system (NRA) evaluation after the standard upgrade, China's vaccine system is further in line with the international community, and the export of products overseas is expected to accelerate in the future. Furthermore, in the future, the internationalization model will tend to diversify, shifting from the supply of finished products to localized production, and further expansion in the direction of cooperative development and licensing.

Vaccine Industry Outlook: Focus on product sales improvements and innovation pipeline progress

Sales performance of some products is good, and the volume trend is expected to continue. In the first three quarters, inventory levels of some product channels continued to be optimized, and the competitive pattern was relatively good. Companies continued to promote terminal sales, thus maintaining a good volume trend. It is expected that in 25Q4 and '26, some major vaccine varieties with large market space and a good competitive pattern are still expected to maintain the sales growth trend.

Nasdaq

Nasdaq 華爾街日報

華爾街日報