Banco Santander (BME:SAN) Valuation Check as UK Mortgage Strategy Shifts Ahead of Expected BoE Rate Cut

Banco Santander (BME:SAN) is shaking up its UK mortgage lineup, pulling some lower LTV options for first time buyers while rolling out fresh fixed rate deals just as markets brace for a Bank of England cut.

See our latest analysis for Banco Santander.

That mortgage reshuffle comes as sentiment around the stock has turned sharply more upbeat, with a 90 day share price return of 11.87% and a striking 1 year total shareholder return of 110.71% suggesting momentum is still building.

If this kind of strategic shift has you thinking more broadly about financials, it could be a good moment to explore fast growing stocks with high insider ownership as a fresh hunting ground for ideas.

So with profits still climbing, an intrinsic value hinting at a near 20 percent discount and the share price already doubling over 12 months, is there still a buying opportunity here, or are markets simply pricing in future growth?

Most Popular Narrative Narrative: 1.8% Overvalued

With Banco Santander closing at €9.63 against a most popular narrative fair value of about €9.46, expectations are finely balanced around modest upside.

To value all of this in today's terms, we will use a discount rate of 12.15%, as per the Simply Wall St company report.

The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

Curious how steady revenue expansion, slimmer margins and a higher future earnings multiple can still add up to a near fully priced bank? The full narrative lays out the exact growth curve and valuation leap analysts are baking into that fair value, and the assumptions may be bolder than you expect.

Result: Fair Value of €9.46 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent pressure on Brazilian loan quality, or delays in delivering promised cost efficiencies, could quickly challenge the upbeat revenue and valuation story.

Find out about the key risks to this Banco Santander narrative.

Another Lens On Value

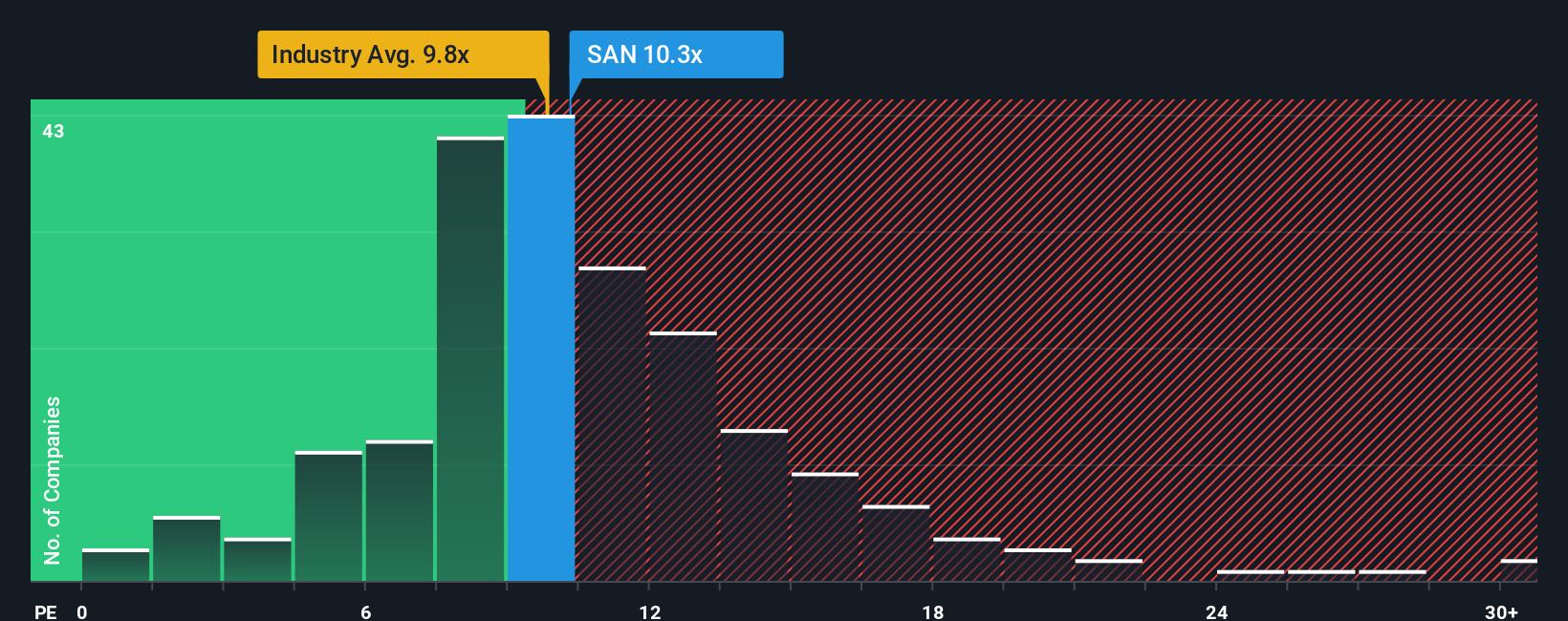

Step away from the narrative fair value, and Banco Santander starts to look different on earnings. It trades at 11.1 times earnings versus a fair ratio of 12.3 times, suggesting upside, yet only slightly above peers at about 11 times. Is that premium really enough compensation?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Banco Santander Narrative

If you see the story differently or want to stress test these assumptions with your own inputs, you can build a personalised view in just minutes: Do it your way.

A great starting point for your Banco Santander research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Ready for more investment ideas?

If you stop with just one bank, you could miss stronger opportunities, so keep your edge by scanning focused stock ideas tailored to your strategy.

- Capitalize on potential mispricings by hunting for companies trading below their cash flow value through these 906 undervalued stocks based on cash flows before the broader market catches on.

- Position yourself early in transformative innovation by targeting businesses powering automation, data intelligence and smart infrastructure with these 26 AI penny stocks.

- Strengthen your income stream by finding companies that combine reliable payouts with attractive yields using these 13 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報