Did LGI Homes' November Closings and Rental Mix Just Shift LGI Homes' (LGIH) Investment Narrative?

- In November 2025, LGI Homes closed 398 homes, including 8 current or former single-family rental properties, across 140 active selling communities.

- This mix of traditional and rental home closings highlights LGI Homes’ continued push to diversify revenue streams within its existing community footprint.

- Next, we’ll explore how softer sector demand signaled by Toll Brothers’ forecast could reshape LGI Homes’ investment narrative amid its recent November closings.

We've found 13 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

LGI Homes Investment Narrative Recap

To own LGI Homes today, you have to believe that long term demand for affordable entry level housing will ultimately outweigh current headwinds from high mortgage rates and softer sentiment. Toll Brothers’ weaker 2026 outlook reinforces that the biggest near term risk remains demand softness across new homebuilders, but LGI’s November closings update does not appear to materially change that risk or the key catalyst of a cyclical recovery in first time buyer demand.

The November report of 398 home closings across 140 active communities, including a handful of previously leased rental homes, ties directly into the near term catalyst of converting existing community inventory into cash flow. In a sector reacting to Toll Brothers’ cautious forecast and LGI’s own recent earnings miss, steady monthly closings and active community count help frame how much operating momentum the company is bringing into a tougher demand backdrop.

Yet, in contrast, investors should be aware that LGI’s heavy exposure to entry level buyers means that if affordability worsens further...

Read the full narrative on LGI Homes (it's free!)

LGI Homes' narrative projects $2.8 billion revenue and $178.8 million earnings by 2028. This requires 10.5% yearly revenue growth and a $22.8 million earnings increase from $156.0 million today.

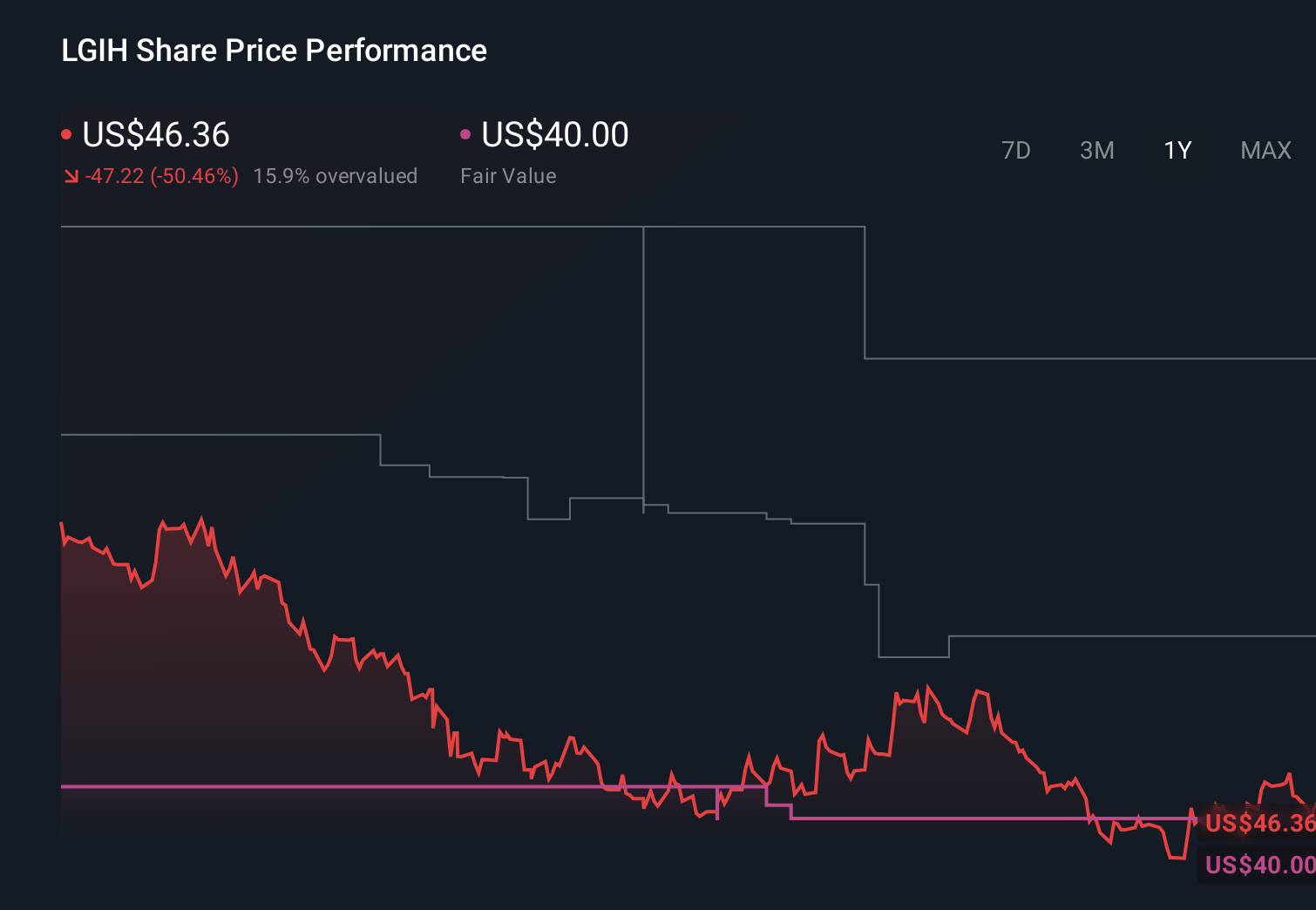

Uncover how LGI Homes' forecasts yield a $75.67 fair value, a 55% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members currently see LGI Homes’ fair value between US$47 and about US$75.67 across 2 independent views, showing how far apart expectations can be. You can weigh those against concerns that persistent affordability pressure on LGI’s entry level buyers could keep absorption rates and margins under strain, with clear implications for how the business might perform through the next housing cycle.

Explore 2 other fair value estimates on LGI Homes - why the stock might be worth just $47.00!

Build Your Own LGI Homes Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your LGI Homes research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free LGI Homes research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate LGI Homes' overall financial health at a glance.

Seeking Other Investments?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報