Is It Too Late To Consider Jackson Financial After Its 259% Three Year Surge?

- If you are wondering whether Jackson Financial at around $105 is still good value after its huge run, or if the easier gains have already been made, this breakdown will help you size up the opportunity with a cool head.

- The stock has climbed 7.7% over the last week, 12.0% in the past month, and is now up 20.6% year to date and 258.8% over three years. This naturally raises questions about how much upside is left versus the risk of a pullback.

- Recently, investors have been paying closer attention to life insurers and annuity providers as higher interest rates and demand for retirement products reshape the landscape. Jackson Financial has featured in discussions around capital returns and long term positioning in the retirement market, which helps explain why sentiment has shifted so decisively in its favor.

- On our valuation framework, Jackson Financial scores 5/6 on undervaluation checks. We will unpack what that means using different valuation approaches, before finishing with a more intuitive way to think about what the market is really pricing in.

Approach 1: Jackson Financial Excess Returns Analysis

The Excess Returns model looks at how much profit Jackson Financial can generate above the return that investors reasonably demand on their equity, then capitalizes those surplus profits into an intrinsic value per share.

For Jackson Financial, the model starts with a Book Value of $141.89 per share and a Stable EPS of $16.71 per share, based on the median return on equity from the past five years. The implied Average Return on Equity is 9.49%, compared with a Cost of Equity of $13.24 per share. The gap between the earnings generated and the required return creates an Excess Return of $3.46 per share.

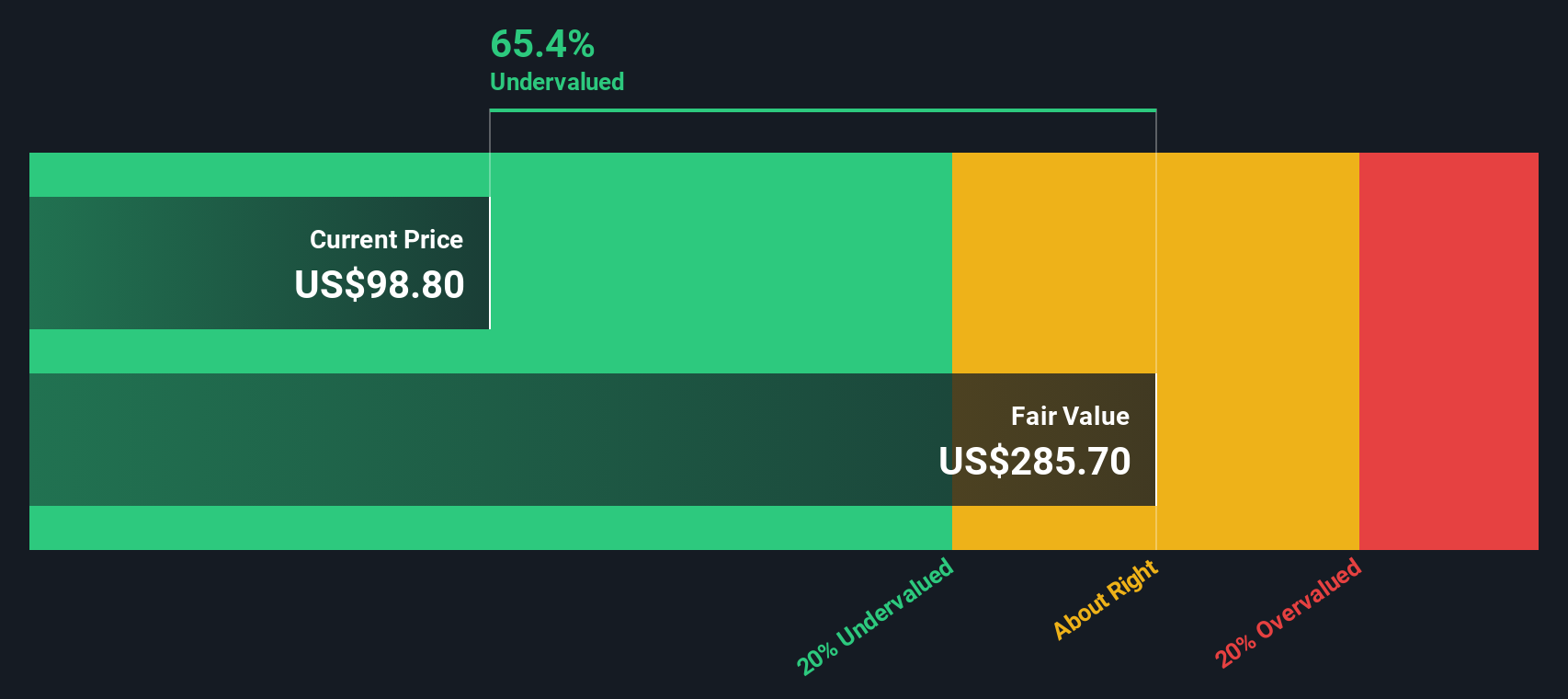

Using a Stable Book Value of $176.05 per share, drawn from weighted future book value estimates by two analysts, the model projects these excess returns forward and discounts them to today. This results in an intrinsic value of about $257 per share, which in this framework suggests the stock is roughly 58.9% undervalued versus the current price around $105.

Result: UNDERVALUED

Our Excess Returns analysis suggests Jackson Financial is undervalued by 58.9%. Track this in your watchlist or portfolio, or discover 903 more undervalued stocks based on cash flows.

Approach 2: Jackson Financial Price vs Earnings

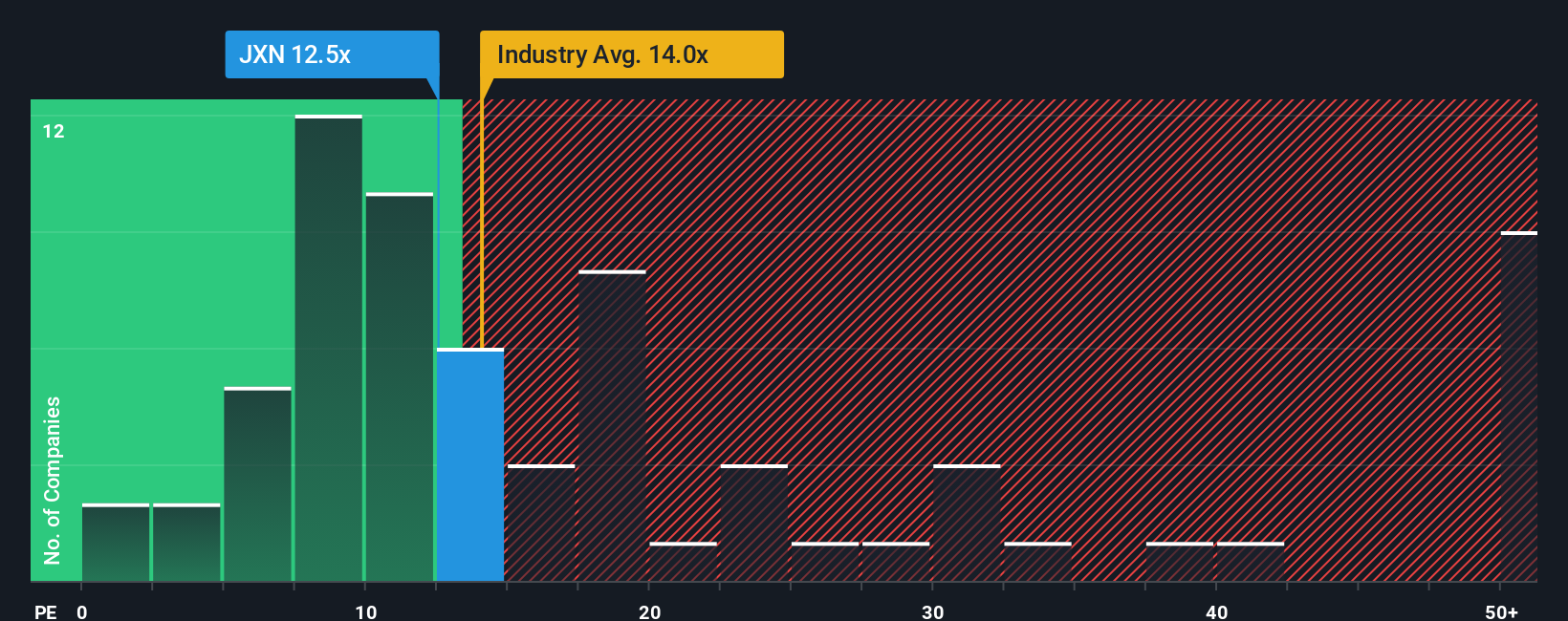

For consistently profitable companies like Jackson Financial, the price to earnings (PE) ratio is a natural way to judge whether investors are paying a reasonable price for each dollar of earnings. A higher PE can be justified when earnings are expected to grow faster and are viewed as relatively low risk, while slower growth or higher uncertainty usually warrant a lower, more conservative multiple.

Jackson Financial currently trades on a PE of about 13.5x. That is roughly in line with the broader diversified financials industry average of around 13.6x, but below the peer group average of about 15.5x, suggesting the market is still applying a modest discount versus comparable names. To get a more tailored view, Simply Wall St uses a proprietary Fair Ratio, which estimates what PE the company should trade on given its earnings growth outlook, profitability, risk profile, industry and market cap. This Fair Ratio for Jackson Financial is 16.5x, which can be more informative than a simple peer or industry comparison because it adjusts for the company’s specific strengths and risks. Compared with the current 13.5x, the shares appear attractively valued on this metric.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1443 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Jackson Financial Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple framework that lets you tell your story about a company and connect it directly to a financial forecast and a fair value estimate. A Narrative on Simply Wall St is your way of saying, based on what I believe about Jackson Financial’s future revenues, earnings and margins, this is the fair value I think is reasonable, and here is why. Narratives live inside the Community page on the platform used by millions of investors, and they make it easy to see how a company’s story translates into numbers and then into an actionable view on whether to buy, hold or sell by comparing your Fair Value to today’s Price. Because Narratives are updated dynamically as new information like earnings or major news arrives, your view can evolve in real time. For Jackson Financial, for example, one investor might build a bullish Narrative close to the higher price target of about $128 while a more cautious investor anchors nearer the lower end around $95, and the platform makes those differing perspectives transparent and comparable.

Do you think there's more to the story for Jackson Financial? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報