Assessing Bank of Queensland (ASX:BOQ) Valuation After Shareholder-Backed Appointment of Activist Director Stephen Mayne

Bank of Queensland (ASX:BOQ) just saw shareholders vote in activist campaigner Stephen Mayne as a director at its AGM, a rare non board endorsed win that puts governance and strategy firmly in focus.

See our latest analysis for Bank of Queensland.

The activism spotlight has landed on Bank of Queensland just as sentiment has been mixed, with the latest A$6.52 share price sitting against a slightly negative year to date share price return but a positive multi year total shareholder return suggesting steady, if unspectacular, wealth creation rather than sharp momentum.

If this governance shake up has you reassessing your watchlist, it could be a good moment to explore fast growing stocks with high insider ownership as potential next wave opportunities.

With solid but unspectacular returns and only a wafer thin discount to intrinsic value, is Bank of Queensland quietly undervalued ahead of a strategic reset, or are markets already pricing in all the growth this shake up might deliver?

Most Popular Narrative: Fairly Valued

With Bank of Queensland closing at A$6.52 against a narrative fair value near A$6.55, the implied upside is minimal and expectations look finely balanced.

The transformation of BOQ into a simpler, specialist bank with enhanced digital capabilities is expected to deliver improved customer experiences and efficiencies, which could drive higher revenue and margins.

Curious how modest top line growth, expanding margins and a lower future earnings multiple can still point to a near fully priced stock? The most followed narrative quietly leans on a detailed roadmap for revenue mix, profitability and capital intensity that many investors have not yet unpacked. Want to see which assumptions really carry the valuation load and how sensitive that fair value is to even small changes? Read on to uncover the full story behind this finely tuned forecast.

Result: Fair Value of $6.55 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, mounting competition and regulatory pressure, combined with execution risks on BOQ’s digital overhaul, could quickly challenge these finely balanced expectations.

Find out about the key risks to this Bank of Queensland narrative.

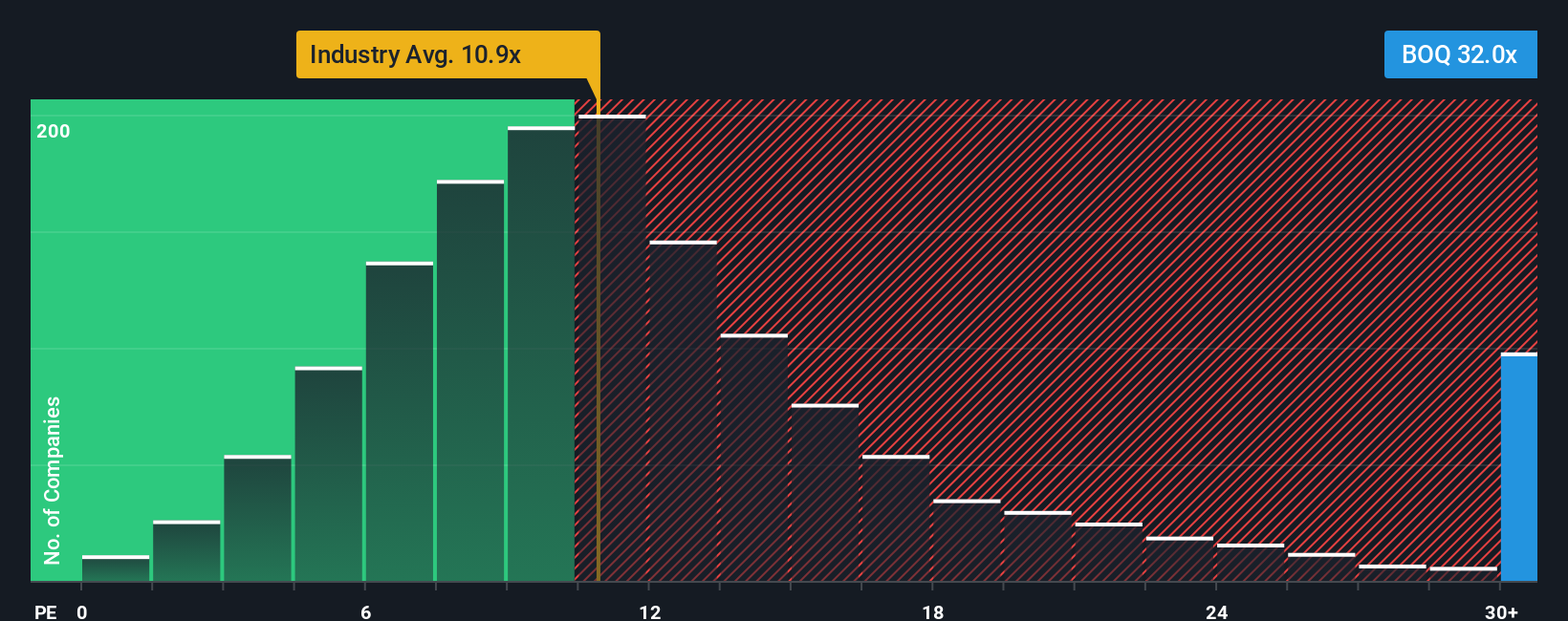

Another View: Earnings Multiple Sends a Caution Flag

While the main narrative suggests BOQ is near fair value, its current price to earnings ratio of 32.2x looks stretched versus peers at 20.2x and a fair ratio of 19.8x. That premium hints at downside risk if sentiment cools or execution slips, rather than hidden upside.

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Bank of Queensland for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 903 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Bank of Queensland Narrative

If you see the numbers differently and want to stress test your own assumptions, you can build a personalized narrative in just a few minutes, starting with Do it your way.

A great starting point for your Bank of Queensland research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Do not stop at one bank when the market is full of potential. Use the Simply Wall St Screener now to uncover your next smart move.

- Capture potential long term compounding by targeting steady income opportunities through these 13 dividend stocks with yields > 3% that may support your portfolio’s cash flow and resilience.

- Seek exposure to structural trends by focusing on innovation leaders using these 26 AI penny stocks that could influence how entire industries evolve.

- Explore asymmetric opportunities among these 3609 penny stocks with strong financials that might offer higher risk and potentially higher variability in outcomes.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報