How BHP’s US$2 Billion Power Network Sale At BHP Group (ASX:BHP) Has Changed Its Investment Story

- Earlier in December 2025, BHP Group agreed to sell a 49% stake in its Western Australia Iron Ore inland power network to BlackRock’s Global Infrastructure Partners for US$2.00 billion, retaining 51% ownership and full operational control while paying usage-linked tariffs over 25 years.

- The deal effectively converts a core-but-non-mining asset into cash that can be redirected toward areas like copper and potash growth, while partnering with a long-term infrastructure investor to support future power and decarbonisation needs in the Pilbara.

- We’ll now explore how monetising this power network stake while keeping operational control may influence BHP’s broader investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

BHP Group Investment Narrative Recap

BHP’s investment case rests on belief in long life, low cost iron ore plus a growing copper and potash pipeline. The US$2.00 billion Pilbara power deal modestly supports near term growth catalysts by freeing capital, while current legal developments, including the UK Fundão Dam ruling, keep regulatory and ESG risk firmly in focus.

The recent Federal Court approval of the Australian Samarco shareholder class action settlement, with BHP paying A$110 million and expecting to recover most from insurers, sits alongside the power deal as part of a broader balance sheet and risk clean up. Together they help clear nearer term overhangs, but do not remove the bigger uncertainty tied to the ongoing UK Fundão proceedings and potential future obligations.

Yet even with strong assets and new capital flexibility, investors should be aware of the unresolved UK Fundão Dam litigation and its potential to...

Read the full narrative on BHP Group (it's free!)

BHP Group’s narrative projects $49.6 billion revenue and $10.0 billion earnings by 2028. This implies a 1.1% yearly revenue decline and a $1.0 billion earnings increase from $9.0 billion today.

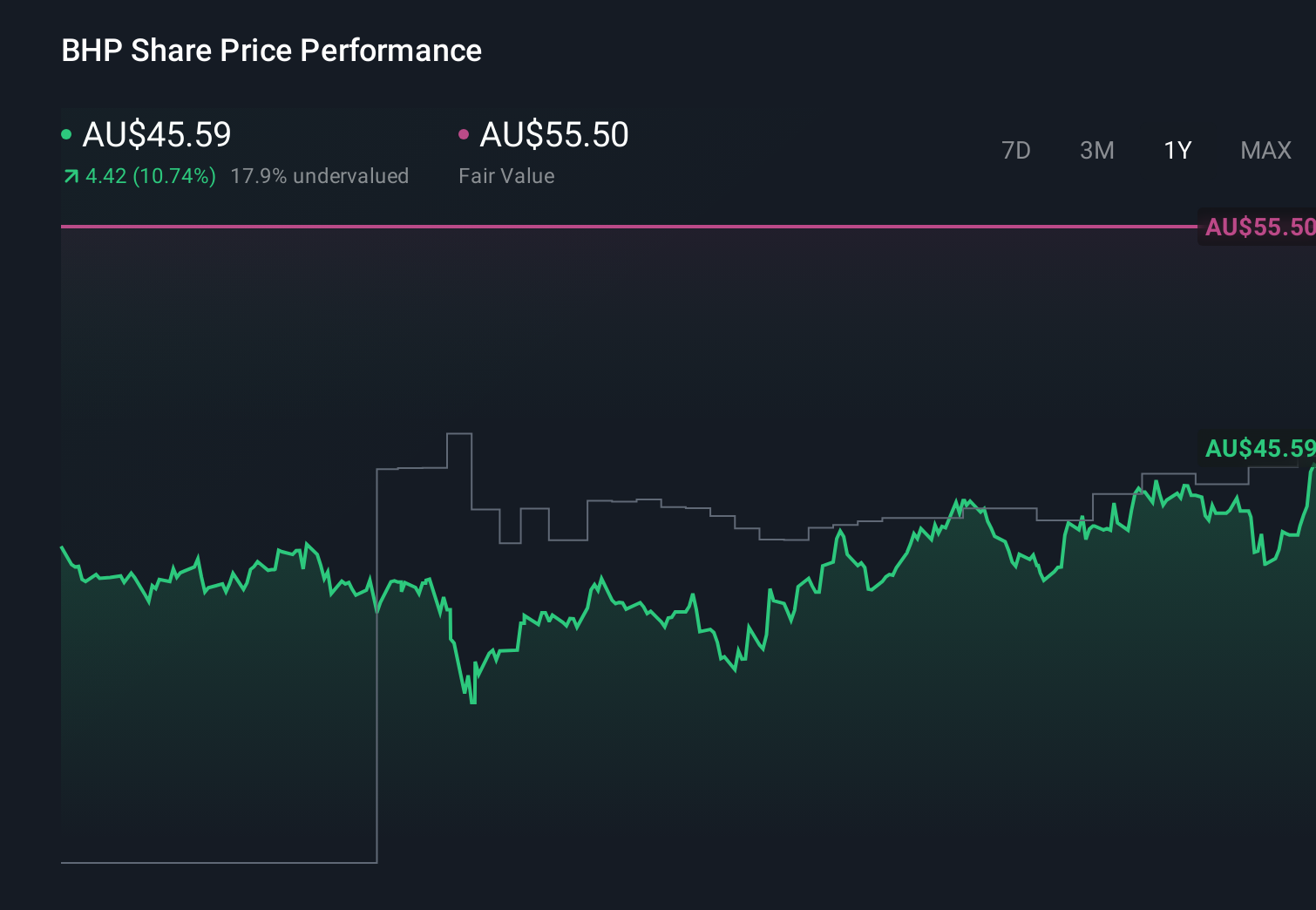

Uncover how BHP Group's forecasts yield a A$45.21 fair value, in line with its current price.

Exploring Other Perspectives

Fair value estimates from 22 Simply Wall St Community members range widely, from A$29.94 to A$55.50, showing how differently you and other investors may view BHP’s outlook. Against that diversity, BHP’s heavy reliance on Western Australian iron ore still ties a large part of future performance to Chinese steel demand and global iron ore pricing.

Explore 22 other fair value estimates on BHP Group - why the stock might be worth 34% less than the current price!

Build Your Own BHP Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your BHP Group research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free BHP Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate BHP Group's overall financial health at a glance.

Looking For Alternative Opportunities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報