Hitachi (TSE:6501) Valuation Check After GlobalLogic Leadership Shift and New Eraneos AI Partnership

Hitachi (TSE:6501) is back in focus after a fresh leadership reshuffle at GlobalLogic and a new digital partnership with Eraneos, both aimed squarely at sharpening its edge in AI driven industrial transformation.

See our latest analysis for Hitachi.

These latest digital moves come as momentum in Hitachi's share price has cooled slightly in the past month after a strong year to date, with a 90 day share price return of 22.46 percent and a 5 year total shareholder return of 547.84 percent. These figures indicate that investors are still rewarding its long term transformation story.

If this kind of AI led industrial pivot has your attention, it may be a good moment to scan other high growth tech and AI names using high growth tech and AI stocks for fresh ideas beyond Hitachi.

With shares up strongly over three and five years, but still trading at a modest discount to analyst targets, the big question now is whether Hitachi remains mispriced as an AI industrial champion or if the market already reflects its next leg of growth.

Most Popular Narrative Narrative: 9% Undervalued

With the narrative fair value sitting modestly above Hitachi's last close of ¥5,010, the current price implies investors may be underestimating its long term earnings power.

Expansion of the Lumada digital platform and related digital services, including synergies from recent acquisitions like GlobalLogic and the increasing adoption of generative AI solutions, are accelerating high margin recurring revenues in IT and modernization projects, enhancing overall profit margins and long term earnings growth.

Want to see what kind of revenue trajectory and margin uplift sit behind this valuation call? The narrative leans on ambitious profitability gains and a premium future earnings multiple. Curious how those moving parts combine into a higher fair value than today’s price suggests? Dive in to unpack the full blueprint.

Result: Fair Value of ¥5,508 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent project cost inflation and underperforming China elevator operations could squeeze margins and blunt the upside implied in this AI industrial narrative.

Find out about the key risks to this Hitachi narrative.

Another Lens on Value

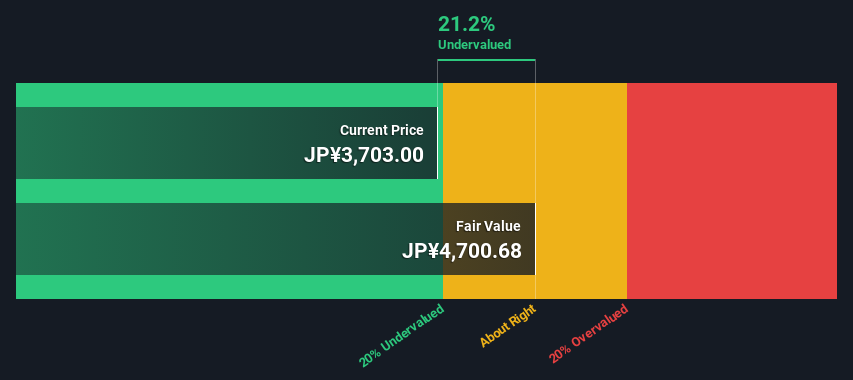

Our DCF model is less upbeat than the narrative fair value, suggesting Hitachi is overvalued with a fair value closer to ¥3,577 versus the current ¥5,010. If cash flows do not scale as optimistically as hoped, today’s price may be incorporating too much AI optimism.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Hitachi for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 903 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Hitachi Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a custom view in just minutes: Do it your way.

A great starting point for your Hitachi research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, consider your next move by checking other opportunities that match your strategy, so you are not relying on just one storyline.

- Explore potential upside by scanning these 3610 penny stocks with strong financials that pair low share prices with resilient fundamentals and the possibility of sentiment improving over time.

- Gain exposure to the AI theme by using these 26 AI penny stocks to find companies that are aiming to translate demand for machine learning into revenue and profit growth.

- Look for value opportunities with these 903 undervalued stocks based on cash flows that appear mispriced based on projected cash flows, before any wider market re-evaluation occurs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報