Assessing Champion Iron (ASX:CIA) Valuation After Falling Returns On Capital Despite Heavier Investment

Recent analysis showing Champion Iron (ASX:CIA) ROCE sliding from around 47% to roughly 9% in five years has investors rethinking how effectively its heavier spending is translating into future profitability.

See our latest analysis for Champion Iron.

Despite those softer returns on capital, the market has been more upbeat lately. The 3 month share price return of 38.7% has pushed Champion Iron to A$6.24 and backed up a solid 1 year total shareholder return of 10.9%.

If this shift in sentiment has you rethinking your watchlist, it could be a good time to explore fast growing stocks with high insider ownership for other growth stories with committed insiders behind them.

So with returns on capital falling even as the share price surges and the stock trading slightly above analyst targets, should investors see hidden value here, or assume the market is already pricing in Champion Iron’s future growth?

Most Popular Narrative Narrative: 4.5% Overvalued

With the most followed narrative setting fair value just below Champion Iron’s A$6.24 close, the story hinges on ambitious growth and margin rebuilding.

The analysts have a consensus price target of A$5.572 for Champion Iron based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$7.08, and the most bearish reporting a price target of just A$4.65.

Want to see what powers this tight valuation band? The narrative leans on rising sales, improving margins, and a future earnings multiple usually reserved for market leaders.

Result: Fair Value of $5.97 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, lingering operational bottlenecks and the capital heavy expansion pipeline mean that any project delays or cost overruns could quickly pressure margins and valuation.

Find out about the key risks to this Champion Iron narrative.

Another View: Market Ratios Point to a Richer Price

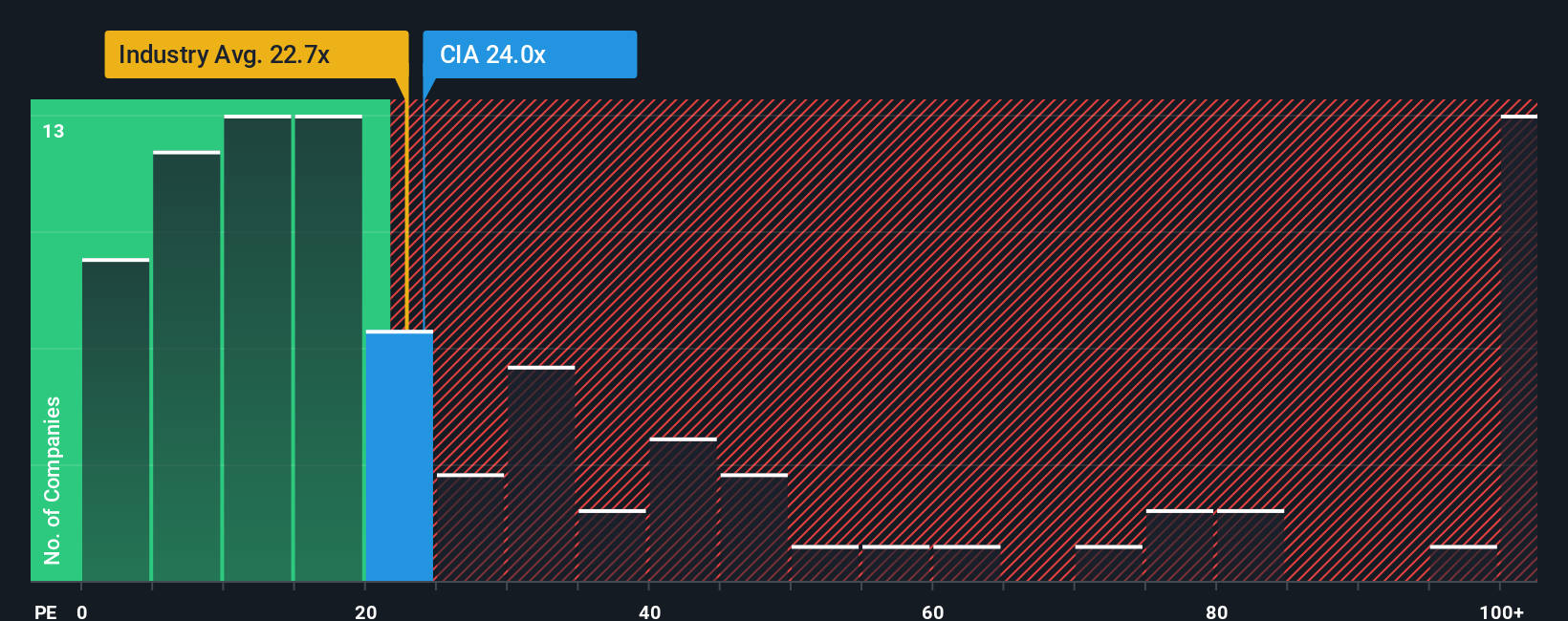

While the narrative pegs Champion Iron at around 4.5% over fair value, its 25.1x price to earnings versus a 22.3x industry average and a 20.8x fair ratio hints at a steeper premium. If sentiment turns, that gap could compress faster than growth can catch up.

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Champion Iron for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 903 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Champion Iron Narrative

If you see the story differently or prefer to dig into the numbers yourself, you can craft a fresh narrative in minutes, Do it your way.

A great starting point for your Champion Iron research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Ready for more investment ideas?

Champion Iron might be on your radar, but you could miss outstanding opportunities if you ignore what the rest of the market is quietly offering today.

- Capture early-stage momentum by scanning these 3610 penny stocks with strong financials that pair tiny market caps with resilient balance sheets and improving fundamentals.

- Position yourself ahead of major technological shifts by targeting these 26 AI penny stocks that use artificial intelligence to transform traditional industries and pursue scalable growth.

- Review these 903 undervalued stocks based on cash flows where strong cash flows and discounted valuations are combined in a single place.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報