Earnings Tell The Story For Zhaojin Mining Industry Company Limited (HKG:1818)

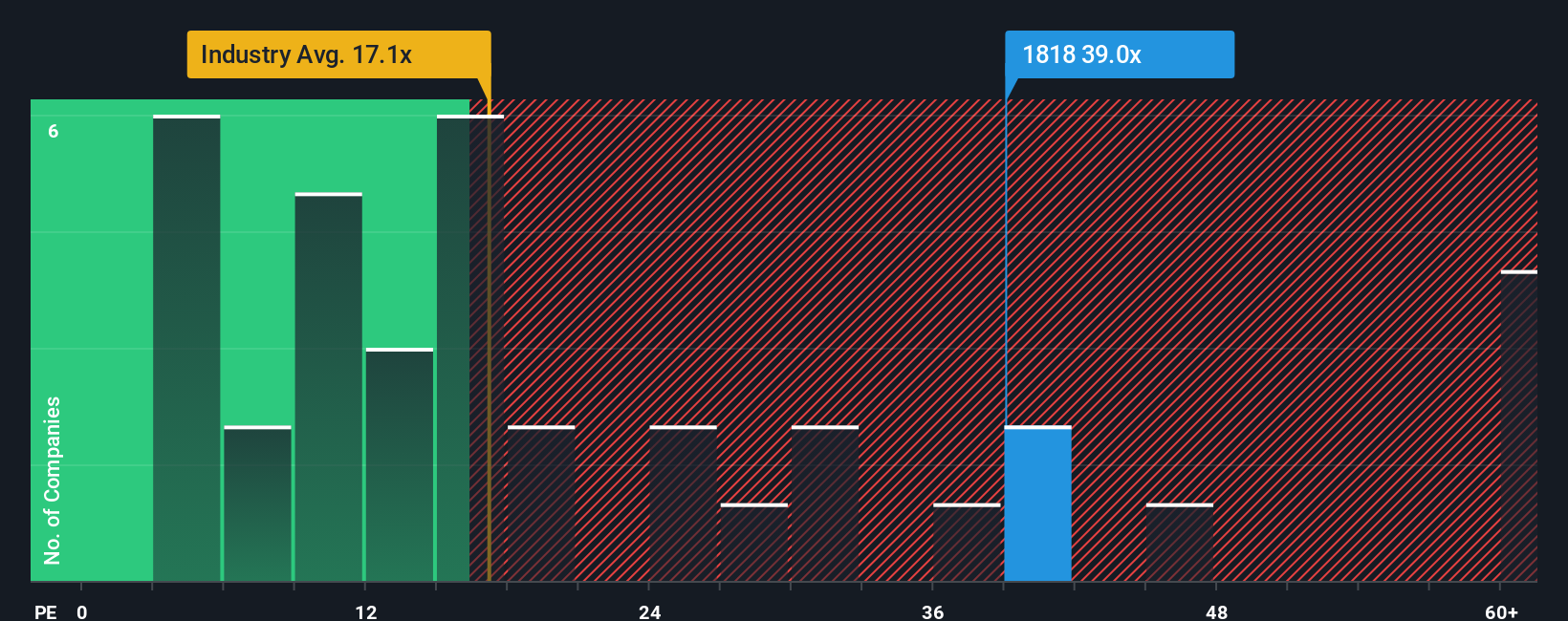

Zhaojin Mining Industry Company Limited's (HKG:1818) price-to-earnings (or "P/E") ratio of 39x might make it look like a strong sell right now compared to the market in Hong Kong, where around half of the companies have P/E ratios below 12x and even P/E's below 7x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

With earnings growth that's superior to most other companies of late, Zhaojin Mining Industry has been doing relatively well. It seems that many are expecting the strong earnings performance to persist, which has raised the P/E. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for Zhaojin Mining Industry

What Are Growth Metrics Telling Us About The High P/E?

The only time you'd be truly comfortable seeing a P/E as steep as Zhaojin Mining Industry's is when the company's growth is on track to outshine the market decidedly.

If we review the last year of earnings growth, the company posted a terrific increase of 111%. The latest three year period has also seen an excellent 750% overall rise in EPS, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing earnings over that time.

Shifting to the future, estimates from the analysts covering the company suggest earnings should grow by 84% over the next year. Meanwhile, the rest of the market is forecast to only expand by 21%, which is noticeably less attractive.

In light of this, it's understandable that Zhaojin Mining Industry's P/E sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Final Word

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Zhaojin Mining Industry maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

The company's balance sheet is another key area for risk analysis. You can assess many of the main risks through our free balance sheet analysis for Zhaojin Mining Industry with six simple checks.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Nasdaq

Nasdaq 華爾街日報

華爾街日報