Here's Why Shanghai Chicmax Cosmetic (HKG:2145) Has Caught The Eye Of Investors

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Shanghai Chicmax Cosmetic (HKG:2145). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

How Quickly Is Shanghai Chicmax Cosmetic Increasing Earnings Per Share?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. That means EPS growth is considered a real positive by most successful long-term investors. Recognition must be given to the that Shanghai Chicmax Cosmetic has grown EPS by 53% per year, over the last three years. Growth that fast may well be fleeting, but it should be more than enough to pique the interest of the wary stock pickers.

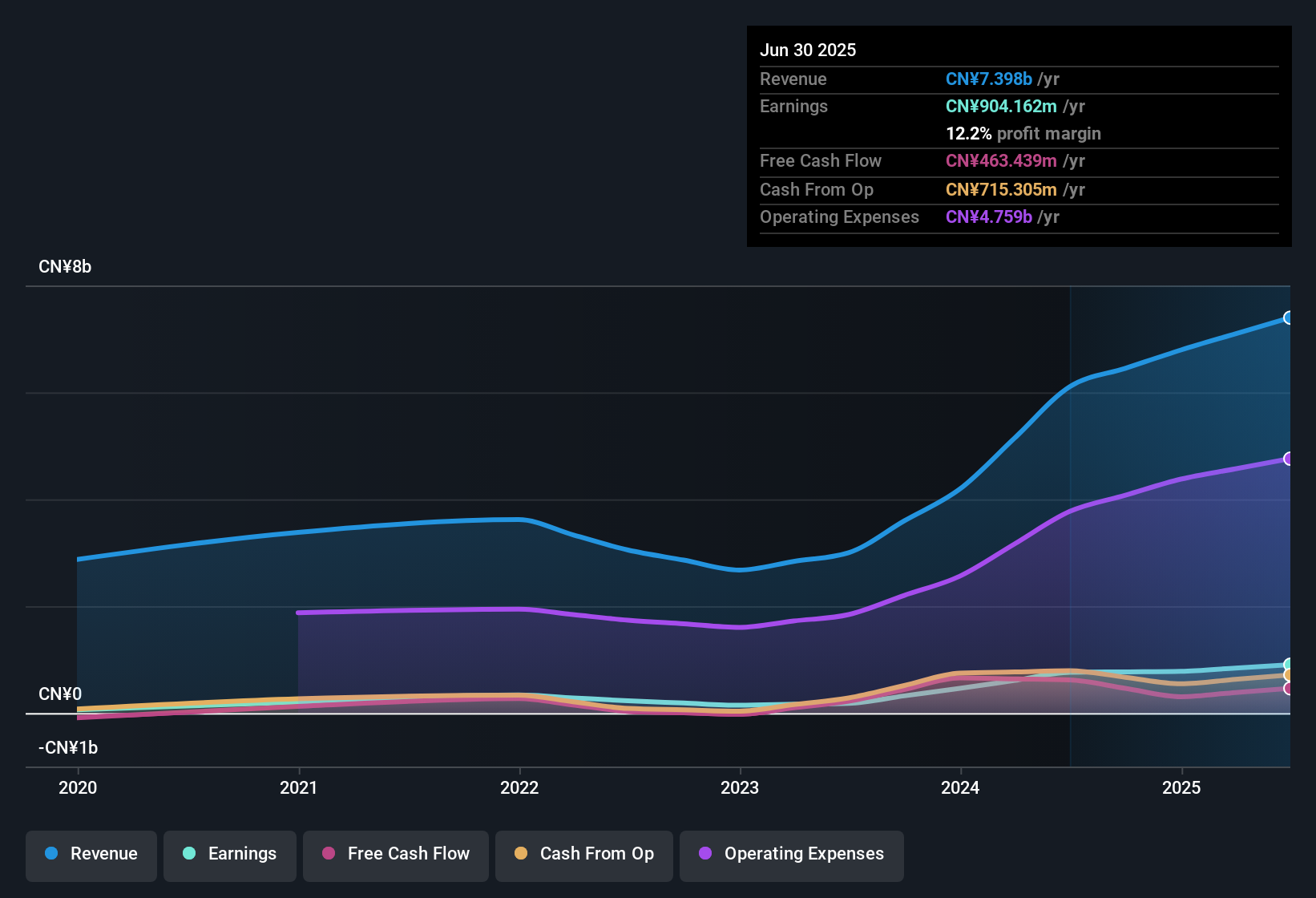

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. While Shanghai Chicmax Cosmetic did well to grow revenue over the last year, EBIT margins were dampened at the same time. If EBIT margins are able to stay balanced and this revenue growth continues, then we should see brighter days ahead.

In the chart below, you can see how the company has grown earnings and revenue, over time. For finer detail, click on the image.

Check out our latest analysis for Shanghai Chicmax Cosmetic

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of Shanghai Chicmax Cosmetic's forecast profits?

Are Shanghai Chicmax Cosmetic Insiders Aligned With All Shareholders?

Theory would suggest that it's an encouraging sign to see high insider ownership of a company, since it ties company performance directly to the financial success of its management. So as you can imagine, the fact that Shanghai Chicmax Cosmetic insiders own a significant number of shares certainly is appealing. Owning 39% of the company, insiders have plenty riding on the performance of the the share price. This should be a welcoming sign for investors because it suggests that the people making the decisions are also impacted by their choices. And their holding is extremely valuable at the current share price, totalling CN¥13b. This is an incredible endorsement from them.

While it's always good to see some strong conviction in the company from insiders through heavy investment, it's also important for shareholders to ask if management compensation policies are reasonable. Our quick analysis into CEO remuneration would seem to indicate they are. For companies with market capitalisations between CN¥14b and CN¥45b, like Shanghai Chicmax Cosmetic, the median CEO pay is around CN¥4.3m.

The CEO of Shanghai Chicmax Cosmetic only received CN¥1.1m in total compensation for the year ending December 2024. That looks like a modest pay packet, and may hint at a certain respect for the interests of shareholders. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of good governance, more generally.

Is Shanghai Chicmax Cosmetic Worth Keeping An Eye On?

Shanghai Chicmax Cosmetic's earnings have taken off in quite an impressive fashion. The cherry on top is that insiders own a bucket-load of shares, and the CEO pay seems really quite reasonable. The strong EPS improvement suggests the businesses is humming along. Shanghai Chicmax Cosmetic certainly ticks a few boxes, so we think it's probably well worth further consideration. We don't want to rain on the parade too much, but we did also find 2 warning signs for Shanghai Chicmax Cosmetic (1 doesn't sit too well with us!) that you need to be mindful of.

There's always the possibility of doing well buying stocks that are not growing earnings and do not have insiders buying shares. But for those who consider these important metrics, we encourage you to check out companies that do have those features. You can access a tailored list of Hong Kong companies which have demonstrated growth backed by significant insider holdings.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Nasdaq

Nasdaq 華爾街日報

華爾街日報