Taking a Fresh Look at Ingredion’s (INGR) Valuation After Its Recent Share Price Weakness

Why Ingredion Stock Has Investors Taking a Second Look

Ingredion (INGR) has quietly outperformed over the past 5 years, even as the stock has slid this year. That mix of long term strength and recent weakness now has value investors circling.

See our latest analysis for Ingredion.

Over the past year, Ingredion’s share price return has been negative as investors reassessed cyclical risks, yet its five year total shareholder return above 60% shows the longer term trend remains constructive rather than broken.

If Ingredion’s mix of steady cash flows and muted sentiment appeals to you, this could be a good moment to broaden your search and explore fast growing stocks with high insider ownership.

With earnings still grinding higher and the share price lagging, the valuation picture looks increasingly intriguing. But is Ingredion genuinely trading below its fundamentals, or are markets already pricing in its future growth?

Most Popular Narrative: 9.6% Undervalued

With Ingredion last closing at $112.42 versus a narrative fair value near $124.33, the story tilts toward upside potential driven by specific earnings assumptions.

The analysts have a consensus price target of $148.667 for Ingredion based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $168.0, and the most bearish reporting a price target of just $140.0.

Want to see what kind of slow but steady revenue climb, disciplined margins, and tighter share count could still add up to double digit upside? Dive in.

Result: Fair Value of $124.33 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent demand softness in legacy ingredients and prolonged Latin American currency volatility could easily derail those slow and steady upside expectations.

Find out about the key risks to this Ingredion narrative.

Another View on Value

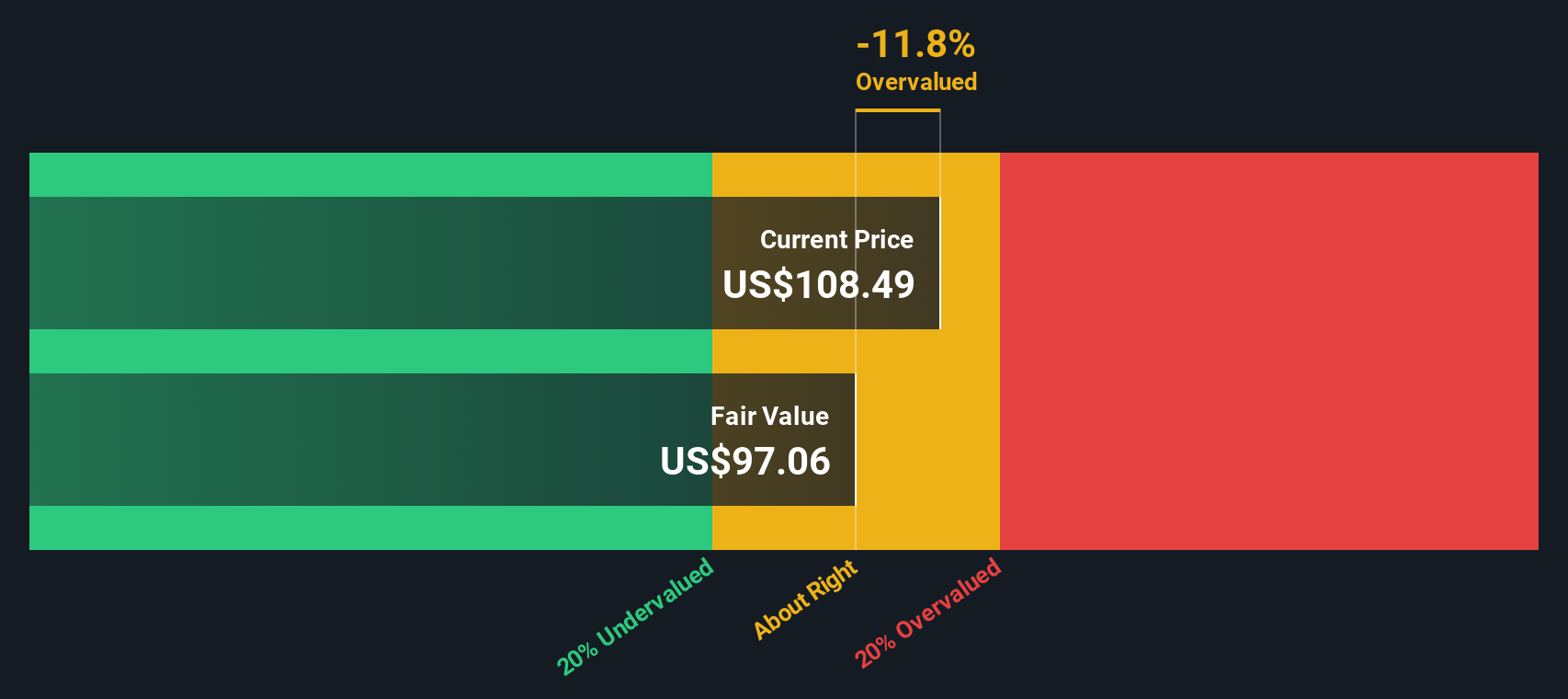

While the narrative framework suggests Ingredion is around 9.6% undervalued versus its fair value of $124.33, our SWS DCF model is more cautious, putting fair value closer to $97.06, which is below today’s $112.42 share price. Could growth be softer than the story implies?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Ingredion for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 901 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Ingredion Narrative

If you see the story differently or want to test your own assumptions, you can build a personalized view in just minutes, Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Ingredion.

Ready for more investment ideas?

Before you move on, explore your next opportunity by scanning hand picked stock ideas on Simply Wall St that match your risk, income, and growth goals.

- Explore early stage potential with these 3610 penny stocks with strong financials that combine low share prices with balance sheets designed to support meaningful upside.

- Consider positioning for the next wave of innovation by targeting these 27 quantum computing stocks at the forefront of real world developments in computing power.

- Strengthen your portfolio’s income engine using these 13 dividend stocks with yields > 3% that aim to keep cash flowing even when markets are volatile.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報