The Bull Case For Lumentum Holdings (LITE) Could Change Following New AI-Driven Optical Demand Forecasts - Learn Why

- In early December, JPMorgan analyst Samik Chatterjee reiterated an Overweight rating on Lumentum Holdings and cited stronger financial expectations for optical players, pointing to tightening supply-demand conditions and emerging opportunities in scale-across, multi-rail infrastructure and Optical Circuit Switches.

- Lumentum’s own outlook, including anticipated supply-driven price increases as demand outpaces supply and a push toward US$100 million in quarterly Optical Circuit Switch revenue by December 2026, underscores how firmly it is tying its growth prospects to AI and data center infrastructure spending.

- We’ll now examine how Lumentum’s expectation of demand outstripping supply by up to 30% could reshape its existing investment narrative.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Lumentum Holdings Investment Narrative Recap

To own Lumentum, you need to believe that AI and hyperscale data center spending will keep pulling through more advanced optical components and switches, and that the company can convert today’s demand into durable, profitable growth. JPMorgan’s higher estimates and price target do not materially change the near term catalyst, which still hinges on execution in easing supply constraints, nor the biggest risk, which is Lumentum’s heavy reliance on a small set of hyperscale customers.

The most relevant development here is Lumentum’s outlook for supply driven price increases and its target of US$100 million in quarterly Optical Circuit Switch revenue by December 2026. This ties directly into the current catalyst of tight supply and strong AI related demand supporting pricing and margins, while also sharpening the execution risk around expanding manufacturing capacity in time to meet what it expects to be a 25% to 30% demand-supply gap.

Yet those same tight supply conditions could quickly cut both ways if hyperscale customers start to...

Read the full narrative on Lumentum Holdings (it's free!)

Lumentum Holdings' narrative projects $3.1 billion revenue and $389.1 million earnings by 2028. This requires 23.4% yearly revenue growth and about a $363 million earnings increase from $25.9 million today.

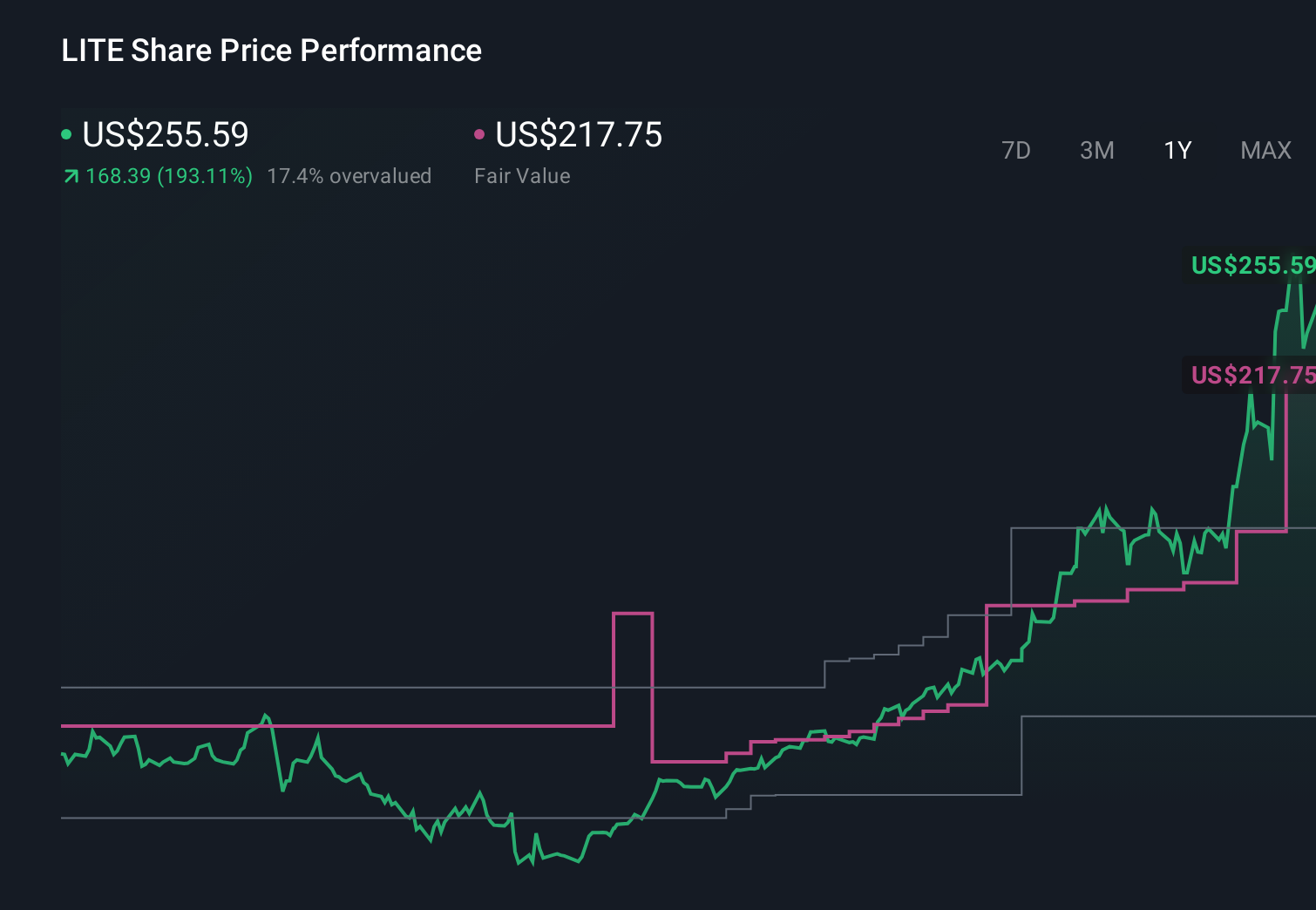

Uncover how Lumentum Holdings' forecasts yield a $255.14 fair value, a 21% downside to its current price.

Exploring Other Perspectives

Eleven members of the Simply Wall St Community currently see Lumentum’s fair value anywhere from US$68 to US$578 per share, with views spread across the entire range. As you weigh those very different opinions, remember that much of Lumentum’s current appeal rests on supply constraints and pricing power in AI focused optics, which could look very different if capacity ramps slower or faster than expected.

Explore 11 other fair value estimates on Lumentum Holdings - why the stock might be worth as much as 78% more than the current price!

Build Your Own Lumentum Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Lumentum Holdings research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Lumentum Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Lumentum Holdings' overall financial health at a glance.

Ready For A Different Approach?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報