Entegris (ENTG): Revisiting Valuation After Earnings Beat, Soft Guidance and Ongoing Margin Pressure

Entegris (ENTG) is back in focus after recent investor commentary highlighted a puzzling mix of earnings beats, weaker guidance, and ongoing margin pressure tied to its expansion push in a still soft semiconductor demand environment.

See our latest analysis for Entegris.

The mixed reaction to Entegris’ latest quarter mirrors its share price story, with a recent 1 month share price return of 10.13 percent, a softer year to date share price return of 4.81 percent, and a 1 year total shareholder return of 12.84 percent. Together these figures suggest momentum is tentatively rebuilding after a tougher stretch.

If you are weighing Entegris against other chip related names, this could be a good moment to explore high growth tech and AI stocks as potential additions to your watchlist.

With shares still trading below analyst targets but sitting on a multi year gain and only modest near term growth expected, is Entegris quietly undervalued at this point, or is the market already pricing in a stronger upturn ahead?

Most Popular Narrative: 7.9% Undervalued

With Entegris last closing at $92.55 versus a narrative fair value of about $100.50, the storyline leans toward upside from steady, compounding fundamentals.

Investments and leadership in advanced materials for next generation nodes, including CMP slurries, selective etch, and deposition materials, position Entegris to capitalize on upcoming node transitions (e.g., advanced logic, 3D NAND, HBM) and increasing semiconductor complexity, supporting higher ASPs and improved gross margins.

Want to see the math behind that optimism? This narrative quietly leans on rising margins, durable top line growth, and a punchy future earnings multiple. Curious?

Result: Fair Value of $100.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upside depends on smooth fab ramps and resilient AI driven spending, with any execution slip or capex normalization likely to challenge that fair value case.

Find out about the key risks to this Entegris narrative.

Another Angle on Valuation

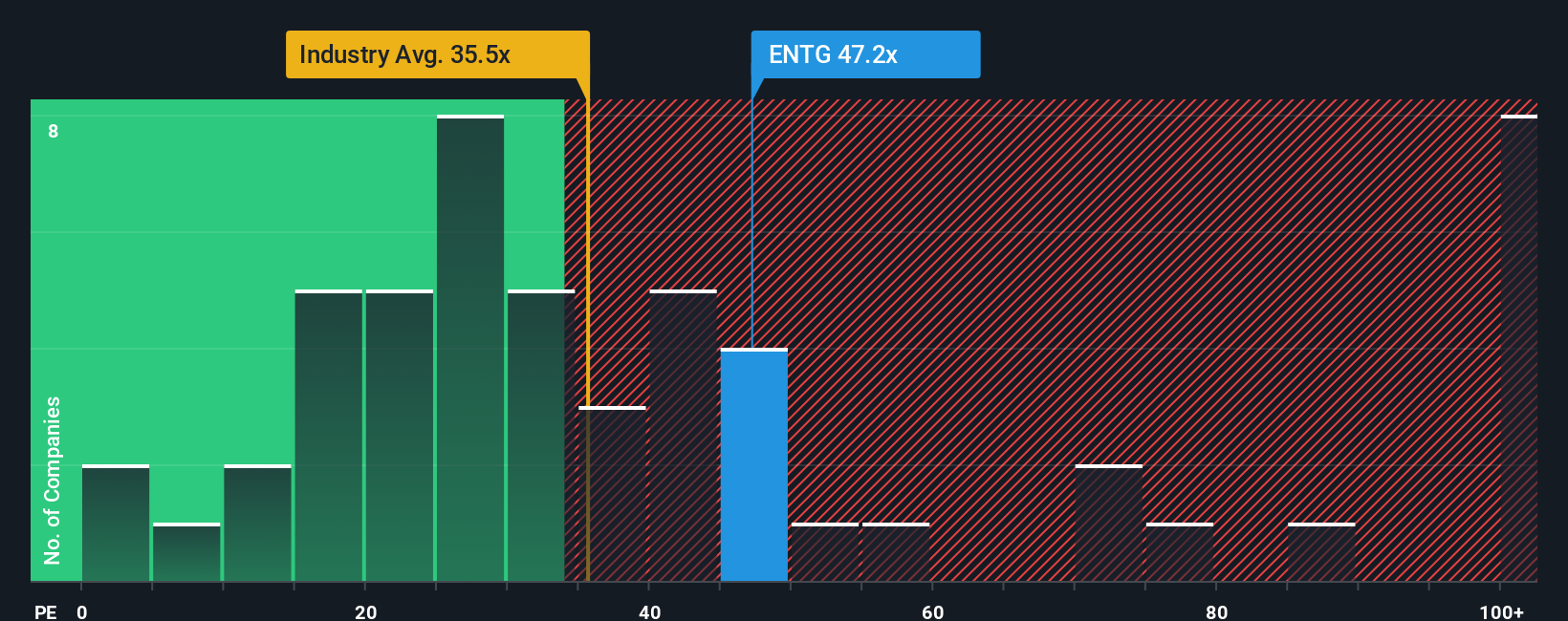

Our valuation checks paint a very different picture. At a price to earnings ratio of 48.6 times, versus a fair ratio of 35.7 times, the US Semiconductor average of 38 times, and a peer average of 34.5 times, Entegris screens as expensive, not cheap. Could the multiple contract just as the story turns?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Entegris Narrative

If you see the story differently or simply want to dig into the numbers yourself, you can build a complete view in minutes: Do it your way.

A great starting point for your Entegris research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Do not stop at a single stock when you can upgrade your whole watchlist using focused ideas from the Simply Wall St Screener, built around real fundamentals.

- Capture potential mispricing by reviewing these 907 undervalued stocks based on cash flows that pair solid cash flow prospects with prices the market may not be fully appreciating yet.

- Position yourself for the next wave of innovation by scanning these 26 AI penny stocks poised to benefit from accelerating adoption of machine learning and automation.

- Strengthen your income strategy through these 13 dividend stocks with yields > 3% that combine attractive yields with businesses designed to sustain regular shareholder payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報