Cintas (CTAS): Is the Premium Valuation Justified After Recent Share Price Pause?

Recent performance and context

Cintas (CTAS) has been treading water lately, with the stock roughly flat over the past week and month, and still down about 7 % in the past 3 months.

See our latest analysis for Cintas.

Zooming out, Cintas still sits near all time highs, with a modest year to date share price return that suggests momentum has cooled a bit, even as long term total shareholder returns remain strong.

If Cintas has you thinking about steady compounders, this could be a good moment to explore fast growing stocks with high insider ownership as potential next wave candidates for your watchlist.

With earnings still growing solidly but the share price pausing near record territory, the key question now is whether Cintas is quietly undervalued or if the market is already pricing in its next leg of growth.

Most Popular Narrative: 13% Undervalued

With Cintas last closing at $187.53 versus a narrative fair value of $214.88, the current market price implies only muted confidence in its long term earnings power.

Strategic investments in technology and automation including the SAP platform, SmartTruck fleet optimization, and plant auto sortation are already delivering operational efficiencies and cost savings, enabling sustained margin expansion and improved earnings leverage.

Want to see what is baked into this premium style valuation? The story leans on rising margins, steady top line compounding, and unchanged lofty earnings multiples. Curious which specific financial levers have to keep firing for that to hold? The full narrative breaks down the assumptions line by line.

Result: Fair Value of $214.88 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, structural shifts, such as remote work reducing uniform demand and automation shrinking industrial employment, could challenge the growth and premium valuation embedded in this narrative.

Find out about the key risks to this Cintas narrative.

Another Lens on Value

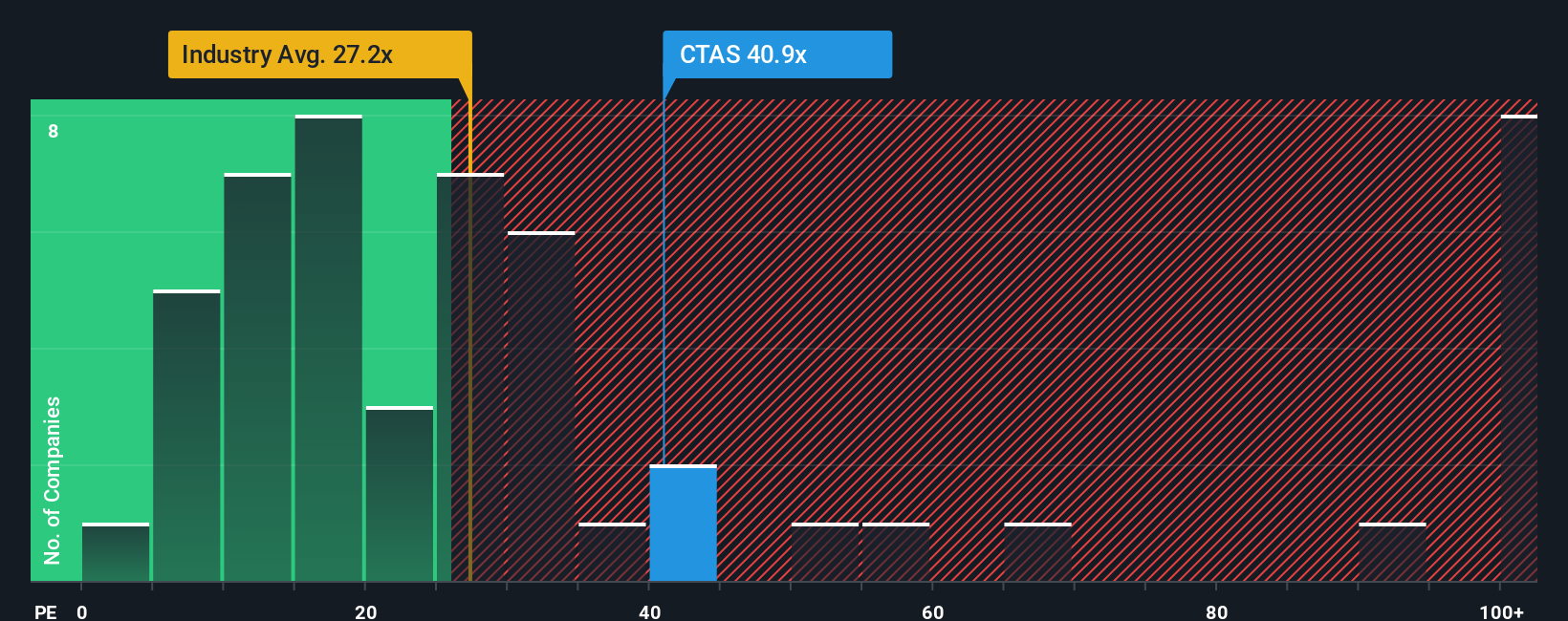

On earnings based valuation, Cintas looks stretched. Its P E ratio of 40.8 times towers over the US Commercial Services average of 24.6 times and even a fair ratio of 32.5 times, suggesting limited margin for error if growth or sentiment cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Cintas Narrative

If you see the story differently or just prefer to dig into the numbers yourself, you can build a fresh view in minutes: Do it your way.

A great starting point for your Cintas research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next investing move?

If Cintas feels priced for perfection, do not stop here. Use Simply Wall Street’s Screener to uncover fresh opportunities before the crowd catches on.

- Capture early stage potential by scanning these 3606 penny stocks with strong financials that pair low share prices with surprisingly solid underlying fundamentals.

- Position ahead of the next tech wave by targeting these 26 AI penny stocks that are applying artificial intelligence in ways the market may be underestimating.

- Lock in quality at a discount by focusing on these 907 undervalued stocks based on cash flows that trade below their cash flow based fair values yet still show healthy business momentum.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報