Is eToro Group a Bargain After a 43.4% Slump in 2025?

- If you are wondering whether eToro Group is a beaten down opportunity or a value trap at current levels, you are not alone. This article will walk through what the numbers are really saying about the stock.

- Despite solid brand recognition, the share price has had a rough ride recently, falling about 11.8% over the last week, 8.2% over the past month, and 43.4% year to date. This naturally raises questions about whether the risk reward balance has shifted.

- Recent headlines have focused on eToro's ongoing expansion of its trading platform, new product launches, and efforts to deepen its presence across multiple regions. These moves help explain some of the shifting sentiment around the stock. At the same time, broader market volatility in fintech and online brokerages has amplified price swings, making it harder to separate short term noise from long term value.

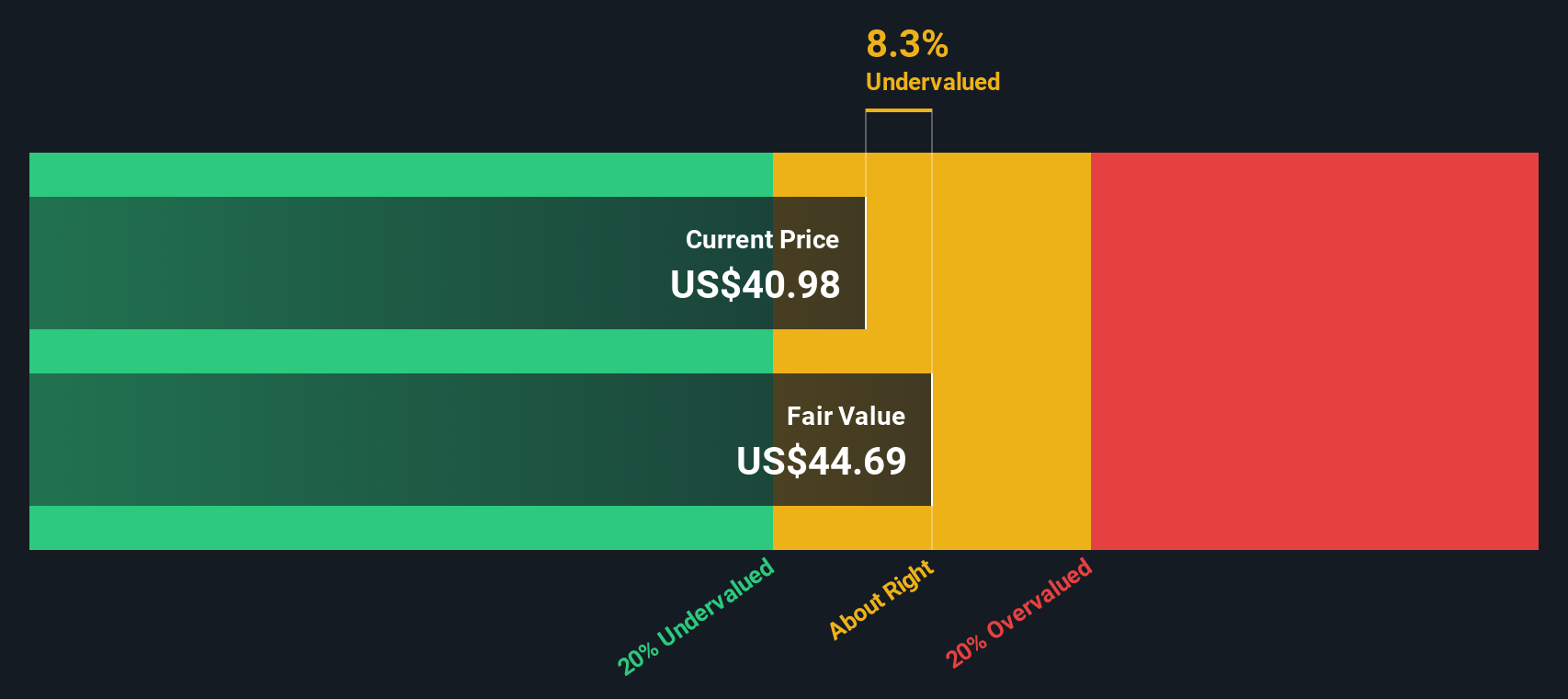

- On our framework, eToro Group scores a 4/6 valuation score, reflecting that it screens as undervalued on four of six key checks. Next we will break down what each of the major valuation methods says about that score, before finishing with a more holistic way to think about the company’s true worth.

Approach 1: eToro Group Excess Returns Analysis

The Excess Returns model asks whether eToro Group generates enough profit on shareholders capital, after accounting for the risk of owning the stock, to justify a higher valuation. Instead of focusing on near term earnings, it looks at how efficiently management can reinvest equity over time.

For eToro, the starting point is a book value of about $15.90 per share and a stable book value estimate of $16.17 per share, both based on the median levels seen over the past five years. On that base, the company is estimated to earn stable EPS of roughly $3.52 per share, derived from an average return on equity of 21.77%. After subtracting a cost of equity of $1.65 per share, the model arrives at an excess return of $1.87 per share, indicating that eToro is creating value above its required return.

When these excess returns are projected forward and discounted, the model output suggests that NasdaqGS:ETOR is about 12.0% below the model’s estimate of intrinsic value. This points to a modest level of undervaluation rather than a deep bargain or a potential value trap.

Result: UNDERVALUED

Our Excess Returns analysis suggests eToro Group is undervalued by 12.0%. Track this in your watchlist or portfolio, or discover 907 more undervalued stocks based on cash flows.

Approach 2: eToro Group Price vs Earnings

For profitable businesses like eToro Group, the price to earnings ratio is a useful yardstick because it directly links what investors pay today to the profits the company is generating. A higher PE can be justified when markets expect stronger, more reliable growth, while companies facing slower growth or higher risk typically warrant a lower, more conservative PE.

eToro currently trades at about 15.41x earnings, which sits below both the broader Capital Markets industry average of roughly 25.35x and the peer group average of around 19.17x. On the surface, that discount suggests the market is assigning more caution to eToro than to many of its listed peers.

Simply Wall St’s Fair Ratio framework refines this comparison by estimating the PE multiple that would be reasonable given eToro’s specific earnings growth outlook, industry positioning, profit margins, market cap and risk profile. This produces a Fair Ratio of about 19.20x. This is more tailored than a simple industry or peer average because it adjusts for the company’s own strengths and vulnerabilities rather than assuming it should trade like a generic fintech stock. With the market currently valuing eToro at 15.41x, meaningfully below the Fair Ratio, the multiple analysis indicates that the shares may be undervalued on an earnings basis.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1448 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your eToro Group Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is simply your story about a company, backed by your own numbers, where you connect what you believe about its business, competitive position and execution to assumptions about future revenue, earnings and margins, and then to a personal estimate of fair value. Narratives link three things: the company’s story, a financial forecast and a fair value that you can compare to today’s share price to decide whether to buy, hold or sell. On Simply Wall St’s Community page, millions of investors use Narratives as an easy, accessible tool that turns their views on companies like eToro Group into structured forecasts that are automatically updated when new news or earnings are released. For example, one investor might see eToro Group compounding rapidly and assign a higher fair value, while another expects slower growth and assigns a lower fair value, and those two Narratives will coexist side by side for you to compare.

Do you think there's more to the story for eToro Group? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報