Assessing Core & Main (CNM) Valuation After Steady Q3 Results and Renewed Growth, M&A and Buyback Push

Core & Main (CNM) just checked several important boxes for investors, delivering steady third quarter growth, reaffirming its full year outlook, and leaning into acquisitions, buybacks, and expansion in Canada.

See our latest analysis for Core & Main.

That mix of steady execution and bolder moves on M&A and buybacks has helped CNM rebound, with a 7 day share price return of 11.67% and a powerful three year total shareholder return of 182.14%, suggesting momentum is rebuilding after earlier volatility.

If Core & Main’s steady compounding appeals to you, this could be a good moment to broaden your search and discover fast growing stocks with high insider ownership.

With shares now within single digits of analyst targets after a sharp rebound, investors face a familiar dilemma: is Core & Main still quietly undervalued, or is the market already pricing in years of steady growth?

Most Popular Narrative: 5.9% Undervalued

With Core & Main shares last closing at $56.09, the most widely followed narrative pegs fair value modestly higher at about $59.63, hinting at a small valuation gap driven by long term fundamentals rather than short term excitement.

Core & Main anticipates generating strong operating cash flows, enabling further investment in organic growth and M&A, in addition to returning capital to shareholders through share repurchases, positively impacting earnings per share.

Want to see the full math behind that upside call? The narrative is based on disciplined expansion, rising profitability, and a future earnings multiple more often reserved for market darlings. Curious which growth and margin assumptions would need to fall into place to support that premium valuation path? Read on and decide whether this fair value aligns with your own expectations.

Result: Fair Value of $59.63 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upside could easily be challenged if tariff costs rise unexpectedly or a sharper construction slowdown undercuts Core & Main’s municipal and nonresidential demand.

Find out about the key risks to this Core & Main narrative.

Another View: Market Ratios Paint a Richer Picture

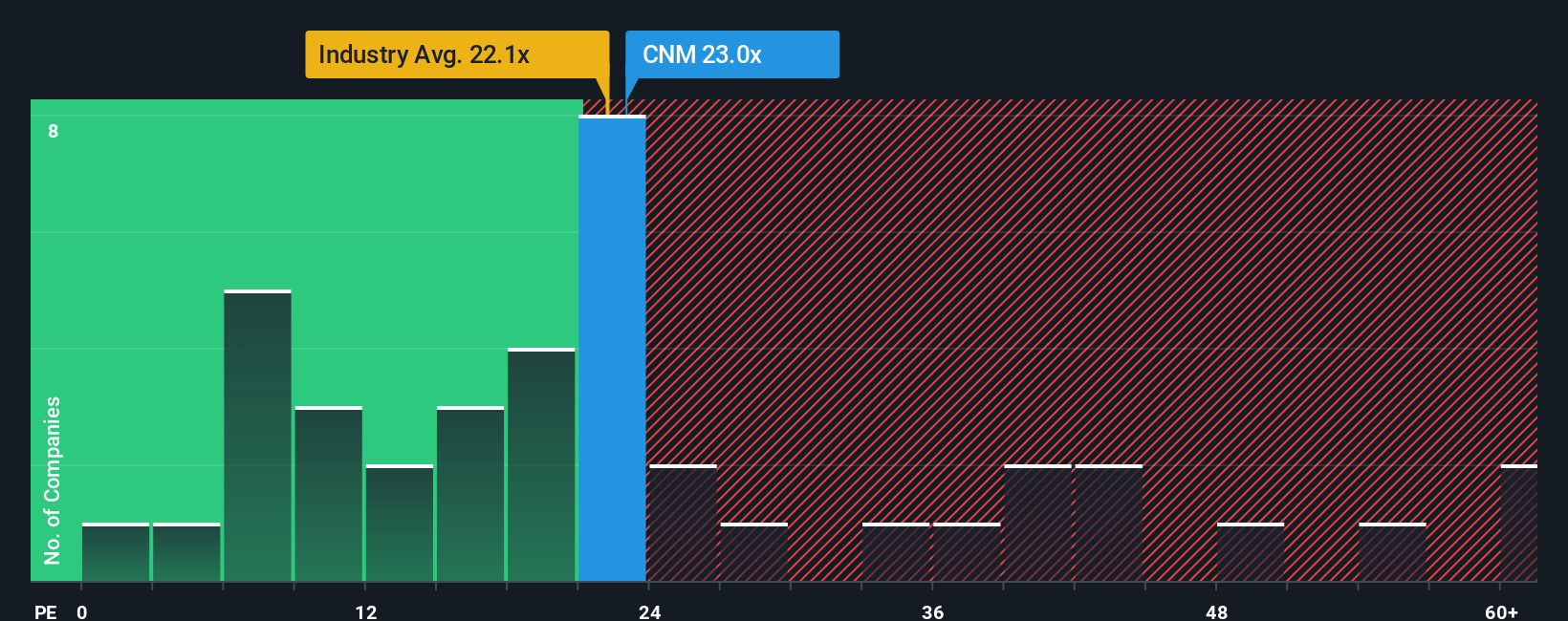

Our price to earnings cross check is less forgiving, with Core & Main trading around 24.3 times earnings versus about 20.3 times for the US Trade Distributors group and roughly 19.9 times for close peers, yet still below a fair ratio of 27.5 times.

That mix of richer pricing than the peer group but some room below the fair ratio suggests a narrower margin of safety, not a screaming bargain or bubble. This raises the real question: what happens to the share price if growth or margins wobble from here?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Core & Main Narrative

If you see the numbers differently or simply prefer your own research, you can build a personalised view in minutes with Do it your way.

A great starting point for your Core & Main research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If you only stop at Core & Main, you could miss standout opportunities. Use the Simply Wall St Screener to uncover fresh, high conviction candidates today.

- Capture potential mispricings early by reviewing these 907 undervalued stocks based on cash flows that the market may be overlooking despite strong cash flow support.

- Position yourself for the next wave of innovation by scanning these 26 AI penny stocks at the forefront of artificial intelligence breakthroughs.

- Strengthen your income strategy by assessing these 13 dividend stocks with yields > 3% that can help anchor your portfolio with reliable cash payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報