FamiCord AG (ETR:V3V) Stock Rockets 28% As Investors Are Less Pessimistic Than Expected

FamiCord AG (ETR:V3V) shares have had a really impressive month, gaining 28% after a shaky period beforehand. Looking back a bit further, it's encouraging to see the stock is up 53% in the last year.

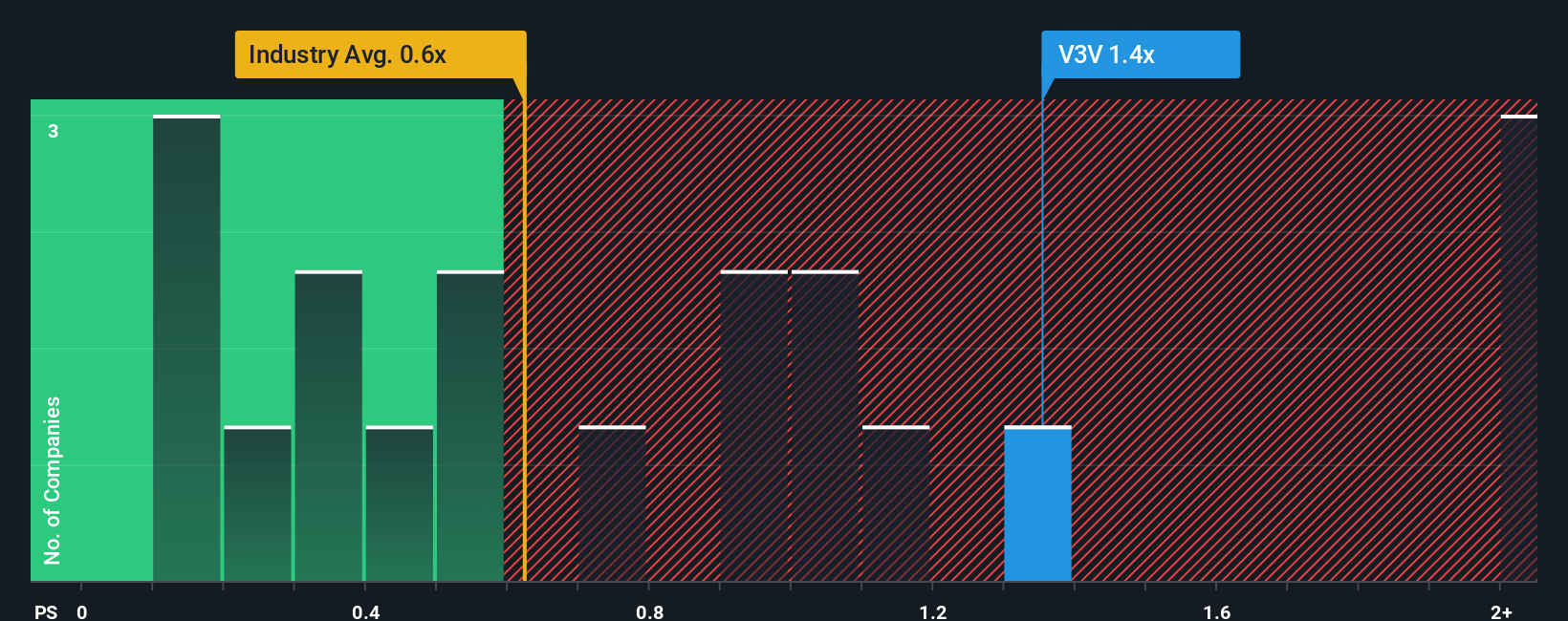

Since its price has surged higher, when almost half of the companies in Germany's Healthcare industry have price-to-sales ratios (or "P/S") below 0.6x, you may consider FamiCord as a stock probably not worth researching with its 1.4x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for FamiCord

How Has FamiCord Performed Recently?

Recent times have been advantageous for FamiCord as its revenues have been rising faster than most other companies. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on FamiCord will help you uncover what's on the horizon.Is There Enough Revenue Growth Forecasted For FamiCord?

The only time you'd be truly comfortable seeing a P/S as high as FamiCord's is when the company's growth is on track to outshine the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 9.5%. The latest three year period has also seen an excellent 40% overall rise in revenue, aided somewhat by its short-term performance. So we can start by confirming that the company has done a great job of growing revenues over that time.

Turning to the outlook, the next three years should generate growth of 3.7% per year as estimated by the only analyst watching the company. Meanwhile, the rest of the industry is forecast to expand by 4.5% each year, which is not materially different.

With this in consideration, we find it intriguing that FamiCord's P/S is higher than its industry peers. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for disappointment if the P/S falls to levels more in line with the growth outlook.

What Does FamiCord's P/S Mean For Investors?

The large bounce in FamiCord's shares has lifted the company's P/S handsomely. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Seeing as its revenues are forecast to grow in line with the wider industry, it would appear that FamiCord currently trades on a higher than expected P/S. The fact that the revenue figures aren't setting the world alight has us doubtful that the company's elevated P/S can be sustainable for the long term. Unless the company can jump ahead of the rest of the industry in the short-term, it'll be a challenge to maintain the share price at current levels.

The company's balance sheet is another key area for risk analysis. You can assess many of the main risks through our free balance sheet analysis for FamiCord with six simple checks.

If you're unsure about the strength of FamiCord's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Nasdaq

Nasdaq 華爾街日報

華爾街日報