How Investors Are Reacting To Trane Technologies (TT) After Amazon Expands BrainBox AI Energy-Saving Rollout

- In late 2025, Trane Technologies and Amazon reported that AI-powered BrainBox AI, running on AWS infrastructure, cut energy use by nearly 15% at three Amazon Grocery fulfillment centers, leading Amazon to plan rollouts across more than 30 U.S. grocery fulfillment and distribution sites and future pilots in stores.

- The results highlight how Trane’s acquisition of BrainBox AI positions it at the intersection of HVAC, artificial intelligence, and large-scale building decarbonization for blue-chip customers.

- Next, we’ll examine how Amazon’s broader rollout of BrainBox AI across its grocery network could reshape Trane Technologies’ investment narrative.

This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

Trane Technologies Investment Narrative Recap

To own Trane Technologies, you need to believe that demand for high efficiency HVAC and building decarbonization will keep growing, and that Trane can convert that demand into profitable, recurring software and services revenue. The Amazon BrainBox AI rollout reinforces Trane’s commercial HVAC growth catalyst in data rich, mission critical facilities, while near term risks still sit in cyclical transport markets and any slowdown in key nonresidential verticals.

Among recent company updates, Trane’s steady share repurchases under its multi billion dollar authorization stand out alongside the Amazon news, because both speak to how management is leaning into its core thesis of HVAC led growth and high returns on capital. While the BrainBox AI deployment showcases Trane’s role in AI enabled efficiency, the ongoing buybacks highlight a capital allocation approach that supports earnings per share growth during both strong commercial cycles and pockets of transport weakness.

Yet, against that backdrop, investors should still watch how exposed Trane is to any cooling in data center and healthcare HVAC demand...

Read the full narrative on Trane Technologies (it's free!)

Trane Technologies' narrative projects $25.4 billion revenue and $3.7 billion earnings by 2028. This requires 6.9% yearly revenue growth and about a $0.8 billion earnings increase from $2.9 billion today.

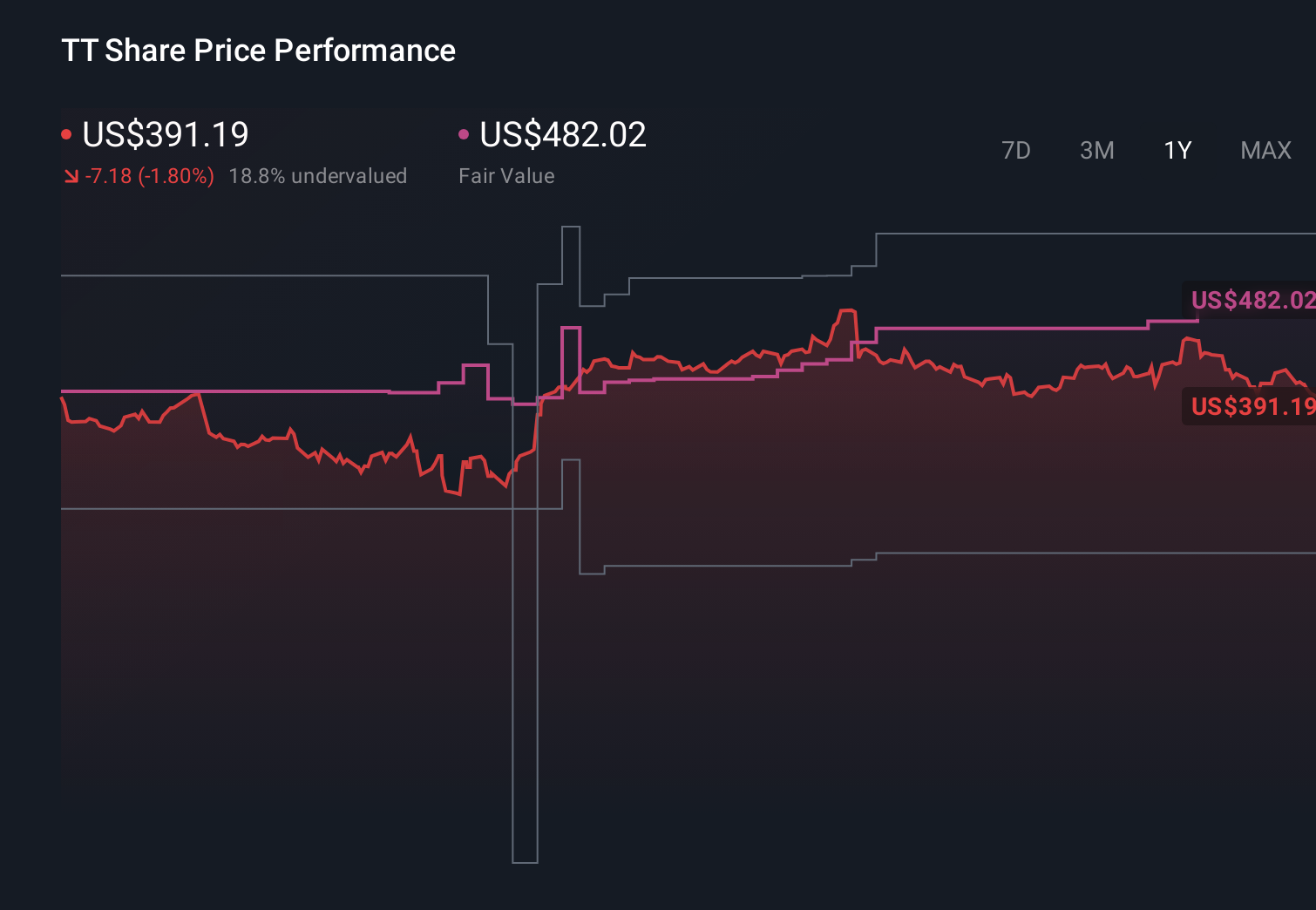

Uncover how Trane Technologies' forecasts yield a $482.02 fair value, a 19% upside to its current price.

Exploring Other Perspectives

Three Simply Wall St Community fair value estimates for Trane range from US$307.91 to US$482.02, underscoring how far apart individual views can be. When you set those opinions against Trane’s dependence on continued commercial HVAC strength in data center and healthcare projects, it becomes clear why checking several perspectives on future performance really matters.

Explore 3 other fair value estimates on Trane Technologies - why the stock might be worth as much as 19% more than the current price!

Build Your Own Trane Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Trane Technologies research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Trane Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Trane Technologies' overall financial health at a glance.

No Opportunity In Trane Technologies?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- We've found 12 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- These 9 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報