Reassessing Braze (BRZE) Valuation After a 22% One-Month Share Price Rebound

Market context for Braze after recent share moves

Braze (BRZE) has quietly staged a double digit rebound over the past month, even as its share price remains down sharply year to date. That divergence between recent momentum and longer term underperformance is where the story gets interesting for investors.

See our latest analysis for Braze.

That recent 22.26% 1 month share price return looks more like investors recalibrating growth expectations than a random bounce. This is especially the case given the share price is still down 19.50% year to date and the three year total shareholder return sits at 23.69%. Together, these figures suggest momentum is rebuilding from a lower base rather than peaking late in the cycle.

If Braze has you rethinking what durable software growth can look like, it may be worth scanning other high growth tech and AI opportunities through high growth tech and AI stocks for fresh ideas.

With the stock still trading at a sizeable discount to Wall Street targets but facing slowing growth and ongoing losses, is Braze now an underappreciated reopening of the story, or are investors already banking on a sharp reacceleration in earnings?

Most Popular Narrative: 25.8% Undervalued

With Braze last closing at 34.93 dollars against a narrative fair value of 47.06 dollars, the implied upside rests on ambitious AI led expansion.

The analysts have a consensus price target of 43.722 dollars for Braze based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of 68.0 dollars, and the most bearish reporting a price target of just 35.0 dollars.

Want to see what kind of revenue surge, margin reset, and future profit multiple are baked into that upside case? The full narrative lays out the bold math.

Result: Fair Value of $47.06 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, integrating OfferFit and navigating shifting data sovereignty rules could raise costs and delay AI monetization, challenging the upbeat long term valuation story.

Find out about the key risks to this Braze narrative.

Another View on Valuation

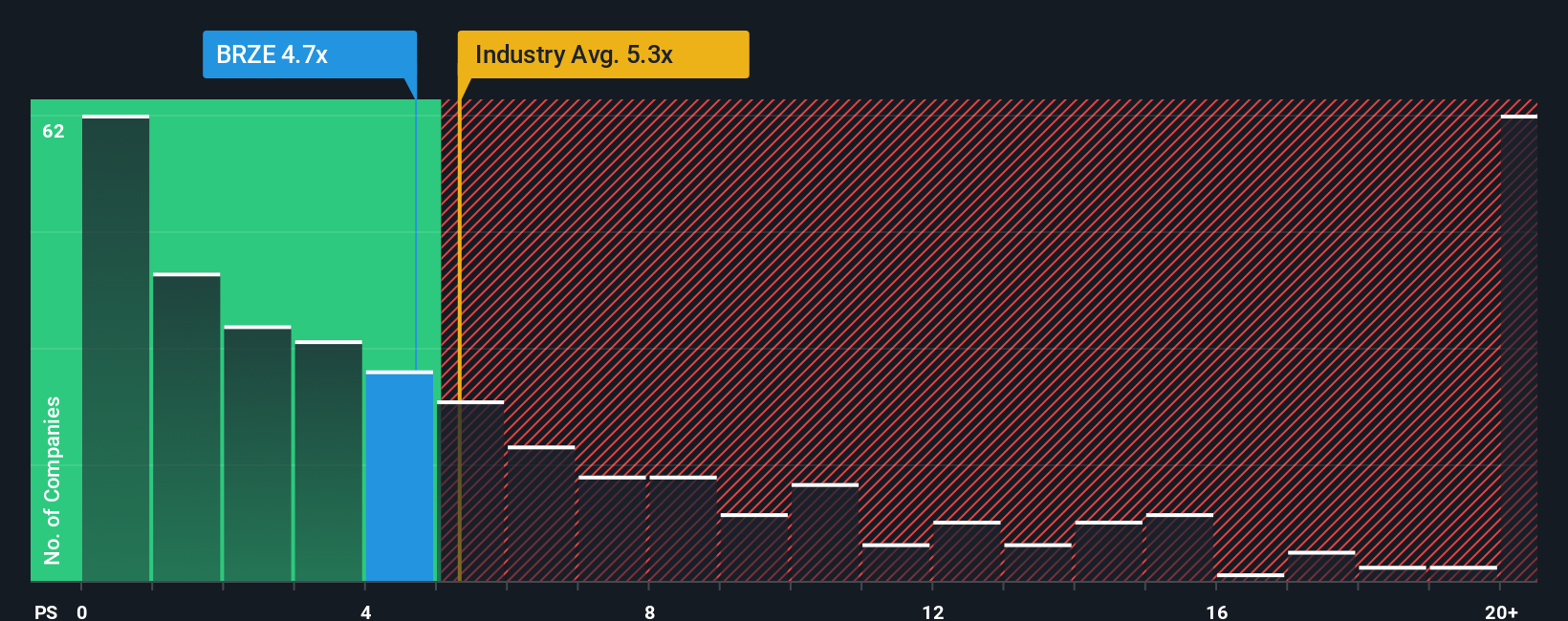

While the narrative fair value suggests Braze is comfortably undervalued, the market’s revenue multiple tells a tougher story. At 5.7 times sales, the stock looks pricey versus the US software average of 5.1 times and a fair ratio of 5.1 times, even though it screens cheaper than peers at 6.8 times. Is this a premium worth paying for Gen AI promise?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Braze Narrative

If you see the story differently or simply prefer hands on research, you can build a personalized Braze narrative in minutes, Do it your way.

A great starting point for your Braze research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for your next investing edge?

Before you move on, lock in fresh ideas with our screener. The right shortlist now could be the opportunity you will not get twice.

- Target potential multi baggers early by tracking quality opportunities across these 3605 penny stocks with strong financials that already show stronger fundamentals than their tiny valuations suggest.

- Ride powerful automation trends by zeroing in on companies at the heart of AI disruption, using these 25 AI penny stocks to focus on those reshaping entire industries.

- Strengthen your portfolio’s cash flow engine by scanning these 12 dividend stocks with yields > 3% that offer meaningful income potential without ignoring balance sheet resilience.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報