DXC Technology (DXC) Valuation Check After New AdvisoryX AI Consulting Push and Leadership Shift

DXC Technology (DXC) just doubled down on its AI ambitions, launching its AdvisoryX consulting group and naming a new Chief Digital Information Officer to steer its end to end digital and AI agenda.

See our latest analysis for DXC Technology.

Those moves land at an interesting moment, with the share price at $15.24 and a recent burst of momentum, including a double digit 1 month share price return, contrasting with a still weak multi year total shareholder return. This suggests sentiment is stabilizing rather than fully turning.

If DXC’s AI push has you rethinking where the real enterprise tech opportunities might be, this could be a good time to explore high growth tech and AI stocks for other potential winners.

With DXC trading well below some intrinsic value estimates and even below consensus analyst targets, is the market still fixated on past missteps, or quietly starting to price in a credible AI led turnaround and future growth?

Most Popular Narrative: 5.1% Overvalued

With DXC closing at $15.24 against a narrative fair value of $14.50, the story leans toward a modestly rich valuation built on specific long term assumptions.

The analysts have a consensus price target of $15.625 for DXC Technology based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $18.0, and the most bearish reporting a price target of just $14.0.

Want to see what kind of shrinking margins, pressured earnings and surprisingly firm valuation multiple still add up to upside in this narrative? The full story is in how these forecasts balance sliding fundamentals with a higher future earnings multiple usually reserved for stronger growers. Curious which specific assumptions make that trade off look reasonable on paper? Dive in to unpack the tension behind that fair value.

Result: Fair Value of $14.50 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent GIS declines and ongoing margin pressure could derail the AI-led turnaround story if new bookings fail to translate into durable revenue growth.

Find out about the key risks to this DXC Technology narrative.

Another View: Multiples Tell a Different Story

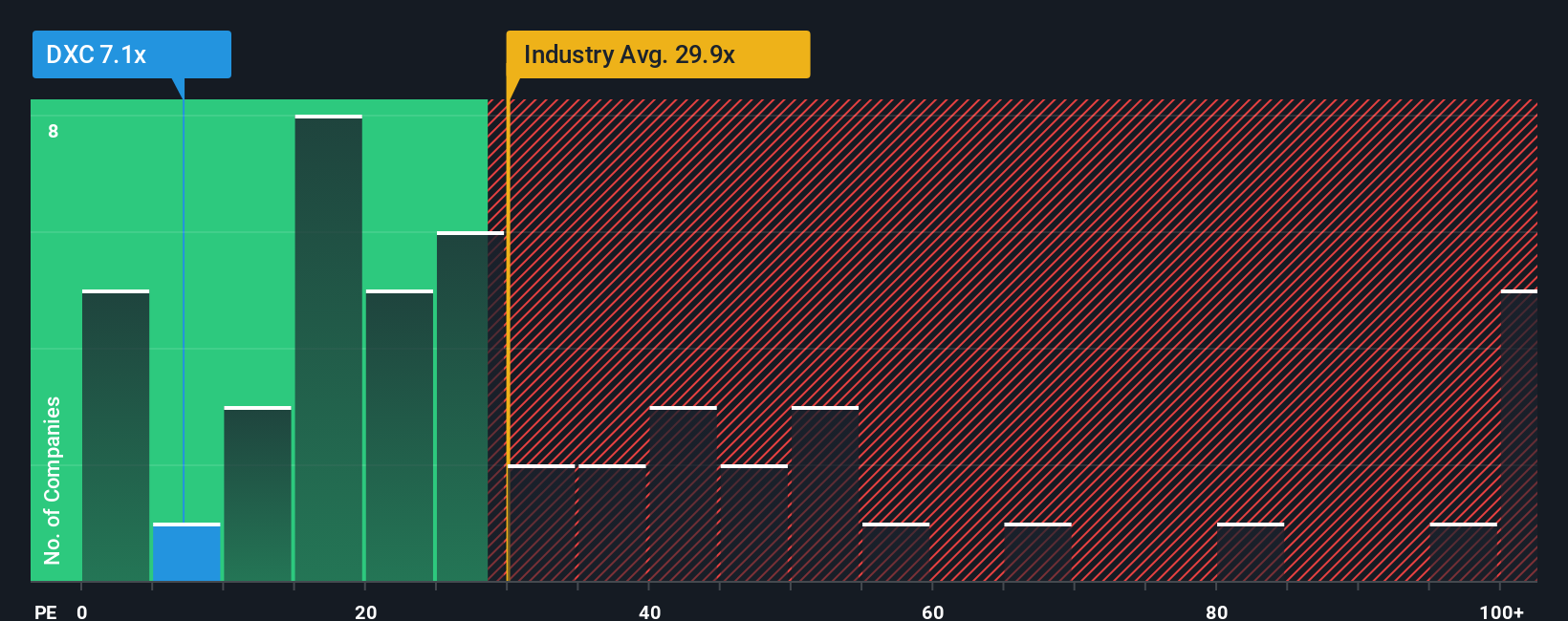

While the narrative fair value suggests DXC is 5.1% overvalued, its current P/E of 7.1x is far below the US IT industry at 31.1x, peers at 19x, and even our fair ratio of 18.7x. This raises a key question: Is the market overpricing the risks, or are the earnings at risk of slipping?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own DXC Technology Narrative

If you see the numbers differently, or simply want to stress test your own thesis directly against the data, you can build a custom view in just a few minutes, Do it your way.

A great starting point for your DXC Technology research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more high conviction ideas?

Before markets move on without you, use the Simply Wall St Screener to surface fresh, data driven stock ideas that match your strategy and risk profile.

- Capture asymmetric upside by targeting these 3605 penny stocks with strong financials that pair tiny share prices with solid underlying fundamentals and room for sentiment to re rate sharply.

- Position early in structural growth by focusing on these 25 AI penny stocks powering real world AI adoption across infrastructure, applications, and enabling technologies.

- Identify potential bargains by scanning these 903 undervalued stocks based on cash flows where cash flow strength and intrinsic value estimates may indicate the market has not fully recognized the underlying value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報