Domino’s (DPZ): Assessing Valuation After Recent Share Price Momentum Rebuild

Domino's Pizza (DPZ) has quietly outperformed the broader market over the past month, with shares up about 6% even as the stock remains slightly negative year to date and over the past year.

See our latest analysis for Domino's Pizza.

That 5.97% 1 month share price return, despite a slightly negative year to date move and a 1 year total shareholder return of minus 5.3%, suggests momentum is starting to rebuild as investors warm to Domino's recent growth and margin improvements.

If Domino's rebound has you thinking about what else could surprise to the upside, this is a good moment to explore fast growing stocks with high insider ownership.

With shares still below their recent peak yet trading at a modest discount to analyst targets, the key question now is clear: Is Domino's undervalued after its stumble, or are markets already pricing in the next leg of growth?

Most Popular Narrative Narrative: 12.7% Undervalued

Compared with Domino's last close at $433.67, the most followed narrative sees fair value closer to $496.65, implying meaningful upside if its assumptions hold.

Ongoing enhancements to Domino's digital ordering platforms, including a new e-commerce site, and the rapid acceleration of loyalty program adoption are set to reinforce Domino's ability to capture a larger share of digital food spend as mobile commerce expands, positively impacting transaction growth and comp sales.

Want to see what kind of revenue and earnings arc could justify that valuation uplift, plus the punchy future earnings multiple it leans on? The narrative spells out a tight set of growth, margin and buyback assumptions that push Domino's toward a premium profile usually reserved for faster growing categories. Curious how those moving parts combine to back into this fair value target without looking unrealistic on paper?

Result: Fair Value of $496.65 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, if pizza category demand softens further or international unit growth continues to fall short of plans, Domino's could struggle to hit these optimistic earnings targets.

Find out about the key risks to this Domino's Pizza narrative.

Another View: Market Ratios Flash a Caution Signal

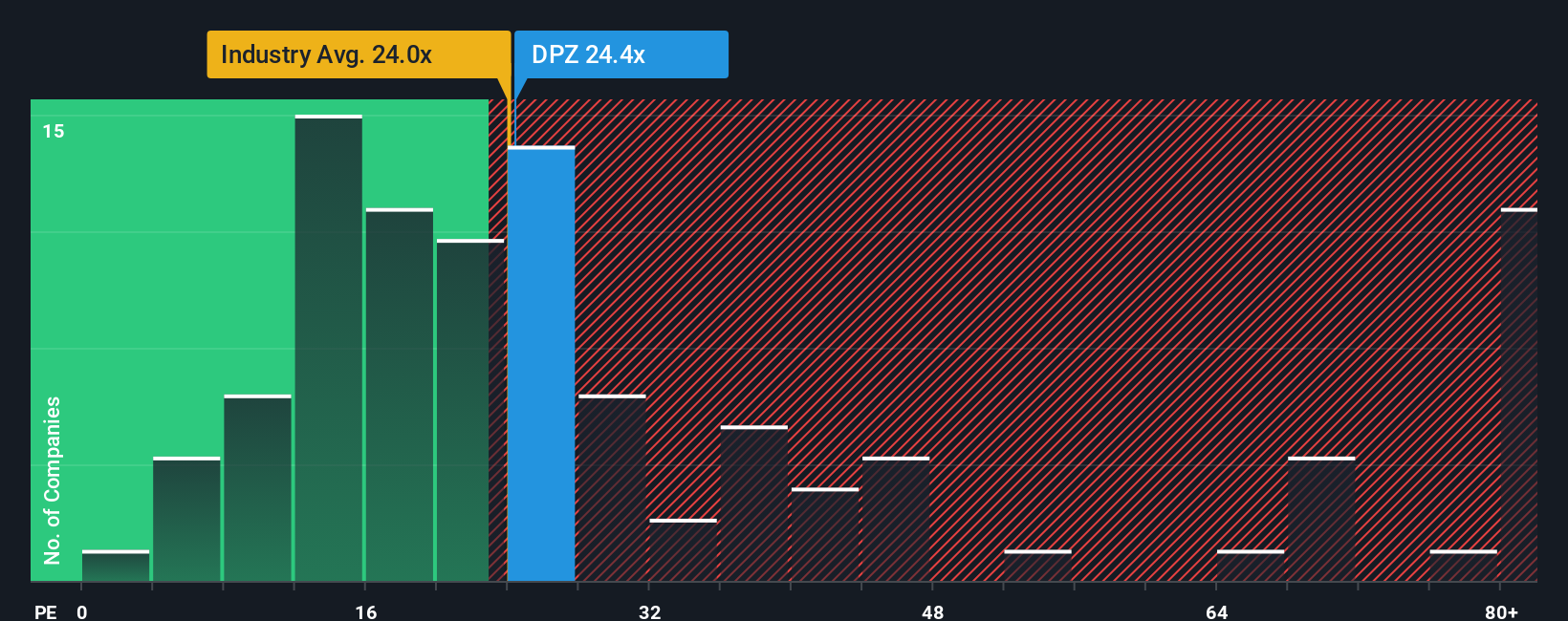

Our valuation based on earnings multiples paints a tougher picture. Domino's trades on a P/E of 24.9x, above both the Hospitality industry at 24.8x and peers at 23.4x, and well ahead of its 20.6x fair ratio. This suggests limited margin of safety if growth underwhelms.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Domino's Pizza Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a custom view in just minutes: Do it your way.

A great starting point for your Domino's Pizza research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, consider your next potential move by scanning targeted stock ideas on Simply Wall Street that could complement or provide an alternative to your Domino's thesis.

- Explore potential value opportunities by reviewing these 903 undervalued stocks based on cash flows that the market may be overlooking despite strong cash flow support.

- Consider structural growth themes by scanning these 30 healthcare AI stocks that are involved in transforming patient care, diagnostics, and medical decision making.

- Review your income strategy by focusing on these 12 dividend stocks with yields > 3% offering dividend yields supported by their underlying fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報