Nagase (TSE:8012) Share Buyback Sparks Fresh Look at Valuation Under ACE 2.0 Plan

Nagase (TSE:8012) just put real money behind its shareholder return story by launching a buyback of over 1.3 million shares via the Tokyo Stock Exchange’s off auction system under its ACE 2.0 plan.

See our latest analysis for Nagase.

The buyback lands after a strong run, with the share price at ¥3,767 and a roughly 19% year to date share price return. The five year total shareholder return of about 189% suggests longer term momentum has been robust rather than fading.

If this kind of capital allocation story interests you, it might be worth seeing what other industrial names are doing too, starting with auto manufacturers.

With earnings still growing, a 30 percent gap to analyst targets and a bolder buyback framework, investors now face a key question: Is Nagase still mispriced, or is the market already baking in the next leg of growth?

Price-to-Earnings of 16x: Is it justified?

Nagase last closed at ¥3,767, and on a price to earnings basis of 16x it screens as more expensive than many trade distributor peers.

The price to earnings multiple shows how much investors are paying today for each unit of current earnings, which matters for an established, profitable trading and industrial group like Nagase. At 16x earnings, the market is effectively assuming a solid trajectory for profits rather than a no growth scenario.

However, that 16x multiple stands well above both the Japan Trade Distributors industry average of 9.9x and the peer group average of 10.1x, suggesting investors are paying a sizeable premium for Nagase's earnings stream. Set against this, it is close to the estimated fair price to earnings ratio of 16.6x. This implies the stock is roughly aligned with where the market could ultimately re rate it as fundamentals play out.

Explore the SWS fair ratio for Nagase

Result: Price-to-Earnings of 16x (OVERVALUED)

However, investors still need to watch for a cyclical slowdown in key end markets, as well as any stumble in executing Nagase's ambitious ACE 2.0 growth plan.

Find out about the key risks to this Nagase narrative.

Another View on Value

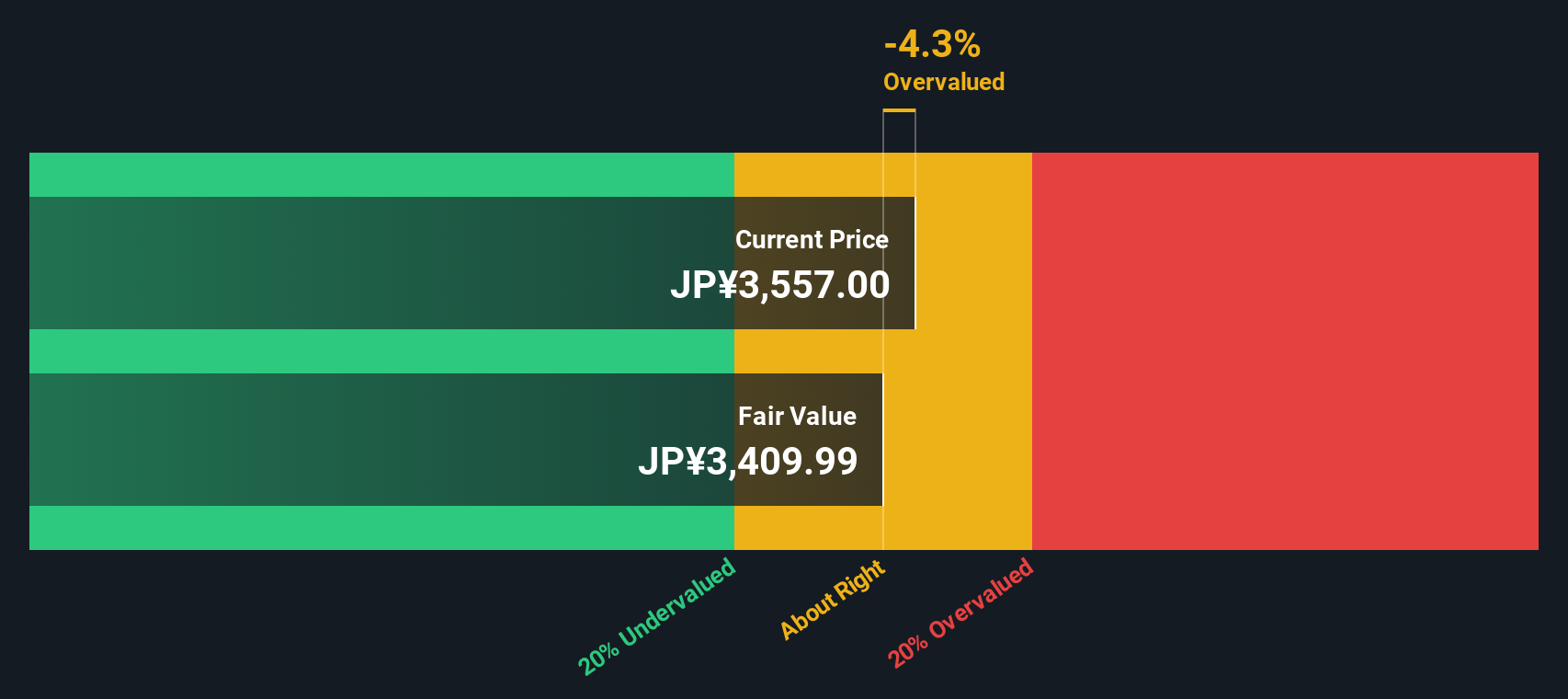

Our DCF model paints a cooler picture, suggesting Nagase is overvalued with a fair value around ¥3,060 compared with today’s ¥3,767. If cash flows do not grow as strongly as hoped, could the share price drift back toward that lower anchor?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Nagase for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 903 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Nagase Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a fresh view in just minutes: Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Nagase.

Looking for more investment ideas?

Before you move on, make sure you are not leaving potential winners on the table. The Simply Wall St Screener can surface ideas aligned with your strategy.

- Capture growth potential by scanning these 25 AI penny stocks that are reshaping entire industries with intelligent automation and data driven products.

- Lock in resilient income streams by reviewing these 12 dividend stocks with yields > 3% that may help support your portfolio through different market cycles.

- Position yourself early in emerging themes by assessing these 80 cryptocurrency and blockchain stocks riding the adoption of digital assets and blockchain infrastructure.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報