Caterpillar (CAT): Assessing Valuation After Backlog Growth and AI-Driven Infrastructure Momentum in 2025

Caterpillar (CAT) has quietly turned into one of 2025’s standout Dow names, and the catalyst is not just more bulldozers. Its stock run is being powered by old school infrastructure and new AI infrastructure demand.

See our latest analysis for Caterpillar.

That surge is showing up clearly in the chart, with a roughly 10% 1 month share price return and a powerful year to date share price return of about 74 percent adding to an impressive 5 year total shareholder return near 284 percent. At the same time, recent dividend affirmations and ESOP related shelf closures reinforce the picture of a mature but still momentum driven industrial heavyweight.

If Caterpillar’s mix of old economy strength and new infrastructure demand has your attention, this is a good moment to explore aerospace and defense stocks as another way to find capital goods names riding similar spending trends.

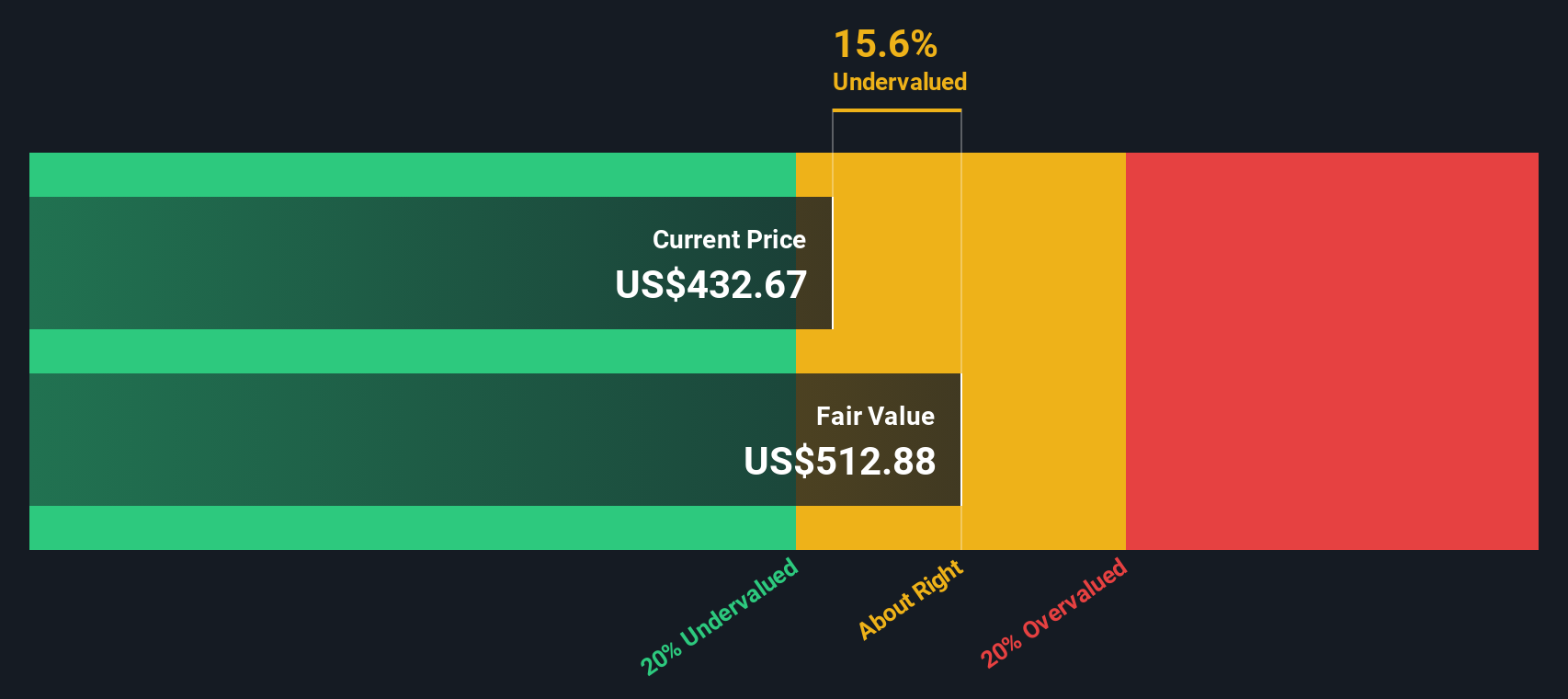

With the stock near record highs, trading at a premium to analyst targets and historical valuation, the key question now is whether Caterpillar is simply expensive momentum or if the market is still underestimating its future earnings power.

Most Popular Narrative Narrative: 6.5% Overvalued

With Caterpillar closing at $625.61 against a narrative fair value near $588, the pricing gap reflects elevated expectations for power demand and margins.

Record backlog growth across all three primary segments, driven by strong global infrastructure demand (particularly in North America, Africa, and the Middle East), positions Caterpillar for above-trend sales growth in late 2025 and into 2026, supporting top-line revenue expansion.

Want to see what kind of revenue runway and margin reset could justify that premium price tag? The narrative focuses on compounding earnings and a future profit multiple more often reserved for market darlings. Curious which specific growth and buyback assumptions would need to align closely to support that fair value? Click through to unpack the full story behind those numbers.

Result: Fair Value of $588 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent tariff uncertainty and softer equipment demand in key regions could erode margins and challenge the upbeat earnings path that is embedded in today’s premium valuation.

Find out about the key risks to this Caterpillar narrative.

Another Angle on Valuation

Our DCF model also points to caution, with Caterpillar trading above an estimated fair value of $554.59. When both narrative based targets and discounted cash flows lean toward overvaluation, it raises a simple question: how much future growth are you really paying for today?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Caterpillar Narrative

If you are not fully aligned with this outlook or want to dig into the numbers yourself, you can build a custom view in just a few minutes, Do it your way.

A great starting point for your Caterpillar research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more high conviction opportunities?

Do not stop at a single stock when smart, data backed ideas are just a click away. Use the Simply Wall Street Screener to stay ahead.

- Capture income potential by targeting reliable payers through these 12 dividend stocks with yields > 3% and build a portfolio that works harder every quarter.

- Position yourself early in transformative technology trends by screening for companies shaping the future with these 27 quantum computing stocks before the crowd catches on.

- Strengthen your watchlist with quality ideas by filtering for these 904 undervalued stocks based on cash flows and avoid overpaying when markets get exuberant.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報