Bayer (XTRA:BAYN): Assessing Valuation After Fresh Pipeline Progress and Regulatory Milestones

Bayer (XTRA:BAYN) has packed several clinical and regulatory milestones into just a few days, and the stock is now trading in the context of a much busier innovation story than markets saw earlier this year.

See our latest analysis for Bayer.

That flurry of trial starts and regulatory filings seems to be resonating with investors, with Bayer’s 1 month share price return of 32.45% feeding into an 87.38% year to date share price gain, even though the 3 year total shareholder return of negative 24.36% shows longer term holders are still waiting for a full turnaround.

If Bayer’s renewed pipeline has your attention, this could be a good moment to scan other healthcare names and see how they stack up using healthcare stocks.

Yet with the shares up more than 80 percent over the past year, while still trading at a steep discount to some intrinsic value models, investors face a familiar dilemma: is Bayer a late cycle momentum play or a genuine mispriced growth story?

Most Popular Narrative: 8.7% Overvalued

With Bayer last closing at €36.33 against a narrative fair value of about €33.42, the current price is running ahead of these assumptions, setting up a debate over how much optimism is already priced in.

Progress on litigation containment, including large case settlements at low average cost, strategic provision management, and an articulated multi-pronged legal strategy with a target to largely resolve legacy glyphosate and PCB exposures by end-2026, has the potential to remove a major overhang on earnings and valuation, signaling a medium-term inflection in net margin, earnings quality, and investor sentiment.

Curious how modest revenue growth, sharply improving margins, and a richer future earnings multiple can still justify a lower fair value than today’s price? The full narrative unpacks the tension between those upgraded forecasts, a reduced discount rate, and the claim that Bayer is already priced for that roadmap.

Result: Fair Value of €33.42 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent litigation overhangs and tightening regulatory scrutiny on key crop protection products could quickly undermine the improving earnings and valuation narrative.

Find out about the key risks to this Bayer narrative.

Another View: Multiples Paint a Different Picture

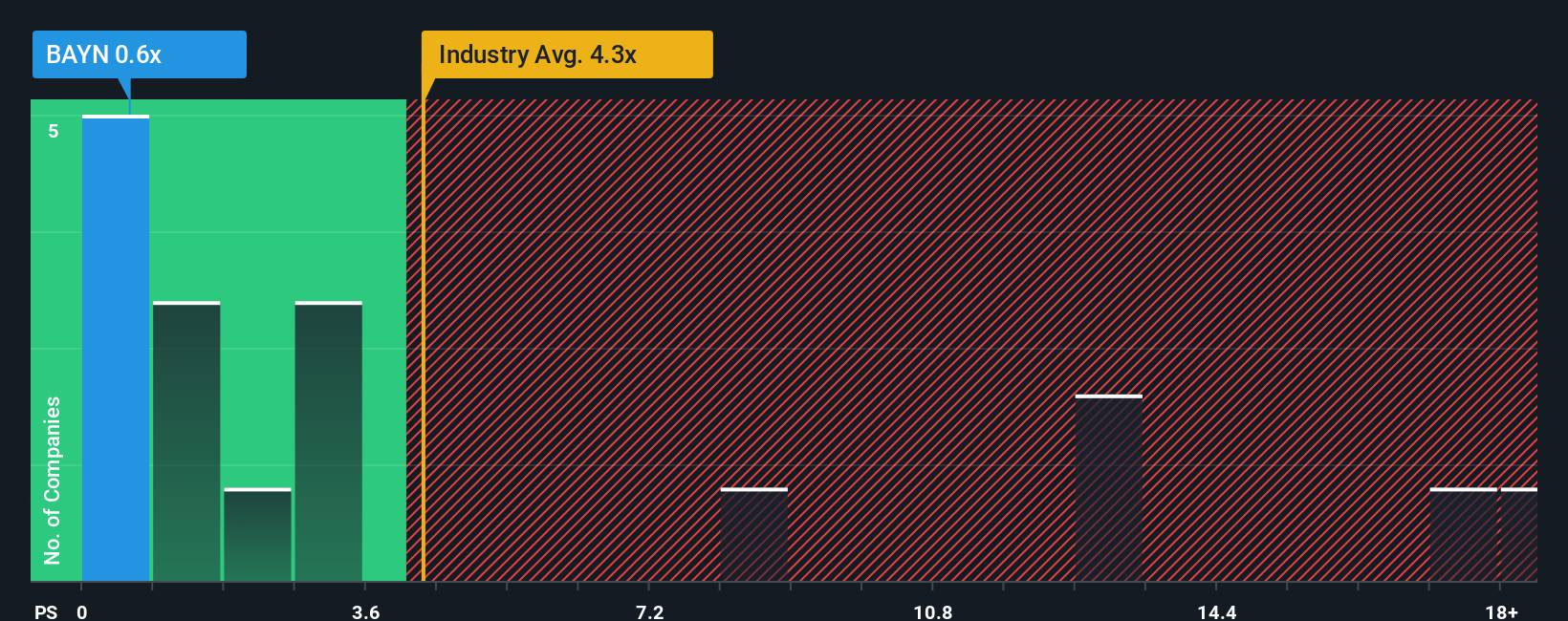

While the narrative fair value suggests Bayer is 8.7 percent overvalued, its current price to sales ratio of 0.8 times looks strikingly cheap versus the European pharma average of 3.5 times, peers at 2.1 times, and a fair ratio of 1.8 times. This raises the question of whether sentiment is still too pessimistic.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Bayer Narrative

If you see the story differently or want to test your own assumptions against the numbers, you can build a custom narrative in minutes: Do it your way.

A great starting point for your Bayer research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next investing move?

Do not stop with one idea. Use the Simply Wall Street Screener to quickly pinpoint fresh, data driven opportunities that match your strategy before others act.

- Capture potential high growth rebounds by scanning these 3605 penny stocks with strong financials that pair smaller market caps with strengthening financial foundations and improving business momentum.

- Position yourself at the frontier of innovation by targeting these 25 AI penny stocks powering breakthroughs in automation, data intelligence, and real world AI adoption.

- Explore income focused opportunities by reviewing these 12 dividend stocks with yields > 3% that combine solid yields with balance sheets built to support consistent payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報