Is Pfizer Shifting From Defensive Stock To Value Opportunity After Post Pandemic Restructuring?

- If you are wondering whether Pfizer is quietly setting up to be a value play rather than just a defensive healthcare name, you are not alone, and the recent numbers give us plenty to unpack.

- Despite a tough few years, with the stock still down about 42.8% over three years and 13.4% over five, it has started to stabilize. It has posted a modest 0.4% gain over the last week, 1.1% over the last month, and a 9.1% rise over the past year, even though it remains down 3.0% year to date.

- Recent news has centered on Pfizer reshaping its post pandemic identity. The company has been investing heavily in its non COVID pipeline and pursuing strategic deals and partnerships to diversify future revenue. At the same time, investors are weighing ongoing debates around patent cliffs, drug pricing reforms, and the long runway needed for new therapies to replace maturing blockbusters.

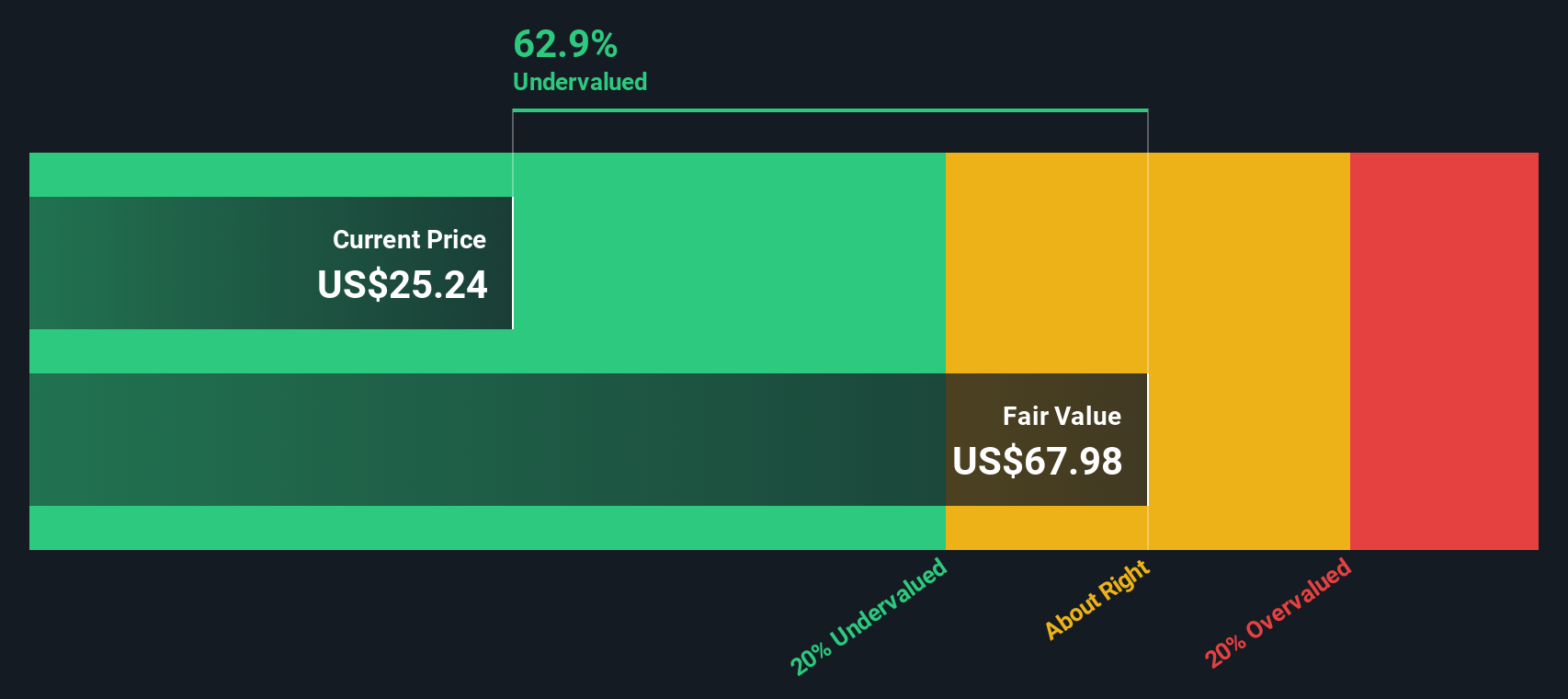

- On our valuation framework, Pfizer scores a 5/6 on undervaluation checks, giving it a solid valuation score of 5 that suggests the market may still be underestimating parts of the story. Next, we will unpack the standard valuation approaches before finishing with a more nuanced way to think about what this stock is really worth.

Find out why Pfizer's 9.1% return over the last year is lagging behind its peers.

Approach 1: Pfizer Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates what a company is worth today by projecting future cash flows and discounting them back to the present. For Pfizer, the model starts with last twelve month Free Cash Flow of about $9.9 billion, then layers in analyst forecasts and longer term extrapolations for the next decade.

Analysts expect Pfizer to lift Free Cash Flow into the mid teens over the coming years, with projections around $19.3 billion in 2026 and tapering toward roughly $16.5 billion by 2035 as growth normalizes. Simply Wall St uses a 2 Stage Free Cash Flow to Equity framework, where the first stage relies on analyst estimates and the second stage assumes more modest, slowing growth.

When those future cash flows are discounted back, the model arrives at an intrinsic value of about $62.40 per share. Compared with the current market price, this implies roughly a 58.7% discount, indicating that the market price is significantly below this model’s estimate of Pfizer’s cash generation potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Pfizer is undervalued by 58.7%. Track this in your watchlist or portfolio, or discover 904 more undervalued stocks based on cash flows.

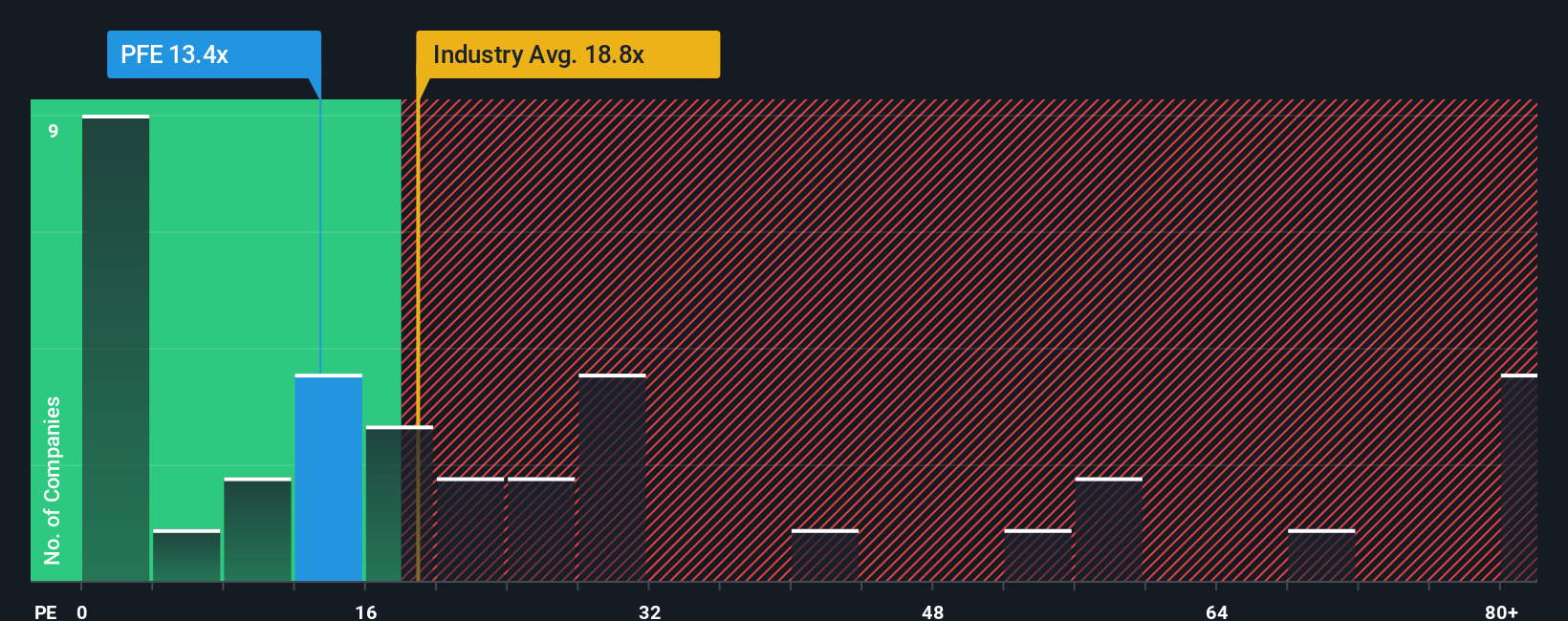

Approach 2: Pfizer Price vs Earnings

For a mature, profitable business like Pfizer, the Price to Earnings, or PE, ratio is a practical way to gauge whether investors are paying a reasonable price for each dollar of earnings. In general, companies with stronger growth prospects and lower perceived risk tend to justify a higher PE, while slower growth or higher uncertainty usually points to a lower, more conservative multiple.

Pfizer currently trades on a PE of about 15.0x, which sits below the broader Pharmaceuticals industry average of roughly 19.9x and also below the peer group average of about 17.5x. On the surface, that discount suggests the market is still cautious about Pfizer’s earnings trajectory and post pandemic reset.

Simply Wall St’s Fair Ratio framework goes a step further by estimating what PE Pfizer should trade on, given its earnings growth outlook, profit margins, size, industry profile, and risk factors. For Pfizer, that Fair Ratio is a much higher 26.2x, which indicates that, once these fundamentals are accounted for, the shares appear to warrant a richer multiple than both peers and the sector overall. Comparing the Fair Ratio with the current 15.0x PE highlights a stock that looks undervalued on this basis.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1447 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Pfizer Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to connect your view of Pfizer’s future to concrete numbers like revenue, earnings, margins, and a fair value estimate. A Narrative is the story behind your assumptions, turning ideas about pipelines, patent cliffs, or cost cuts into a structured forecast, and then into a fair value that you can directly compare to today’s share price to inform a decision on whether to buy, hold, or sell. Narratives on Simply Wall St, available to millions of investors through the Community page, are designed to be easy to use, and they update dynamically as new data, news, and earnings are released so your story stays in sync with reality. For example, one Pfizer Narrative might assume a fair value of about $35.77 per share based on stronger margins and a successful obesity and oncology expansion, while a more cautious Narrative might see fair value closer to $24.00, reflecting tougher pricing, slower growth, and execution risks.

For Pfizer however we will make it really easy for you with previews of two leading Pfizer Narratives:

Fair value in this bullish Narrative is estimated at $29.08 per share.

At the last close of $25.80, this implies Pfizer is trading at roughly 11.3% below that fair value.

Revenue growth in this scenario is modeled at approximately -2.9% a year.

- Assumes obesity, oncology, and other late stage innovative therapies support a rerating of Pfizer and underpin long term earnings resilience despite patent expirations.

- Leans on digitalization, emerging market expansion, and targeted deals to drive margin improvement and diversify away from COVID era volatility.

- Aligns broadly with bullish analysts who see sector wide easing of U.S. pricing fears and pipeline execution as catalysts for multiple expansion.

Fair value in this more cautious Narrative is set at $24.00 per share.

With the stock at $25.80, that implies Pfizer is trading about 7.5% above this bearish fair value.

Revenue growth in this scenario is modeled at around -4.2% a year.

- Emphasizes global drug price pressure, U.S. policy reforms, and patent cliffs on key products as headwinds that could erode revenue and compress margins.

- Questions whether new R&D assets and acquisitions can arrive fast enough, and at sufficient scale, to offset erosion from aging blockbusters.

- Views today’s share price as close to fairly valued or slightly rich, with limited upside if pricing reforms and competitive pressures play out at the pessimistic end of expectations.

Do you think there's more to the story for Pfizer? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報