Assessing Bureau Veritas After Recent ESG Expansion and Share Price Weakness in 2025

- Wondering if Bureau Veritas is quietly turning into a value opportunity, or if the recent share price drift is a warning sign? This article will walk you through what the numbers really say.

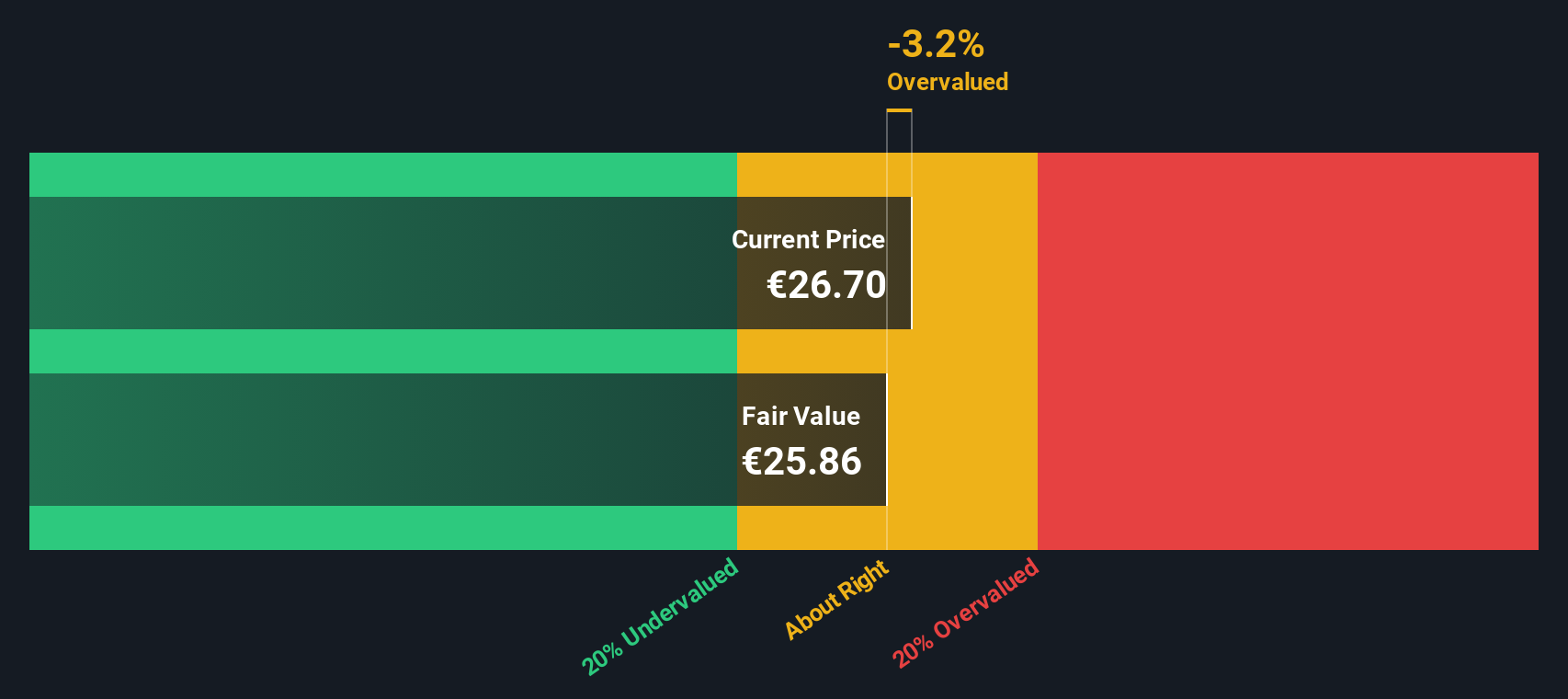

- The stock has slipped recently, down about 3.0% over the last week, 8.3% over the last month, and 10.6% year to date, but longer term holders are still sitting on gains of 15.4% over three years and 30.8% over five years.

- Recent headlines have focused on Bureau Veritas expanding its role in sustainability and ESG related assurance, as demand for independent verification grows across industries. The company has also been in the news for strengthening its presence in high growth regions and sectors such as renewable energy and advanced manufacturing. This helps explain why investors are reassessing both its risks and its long term potential.

- On our valuation framework, Bureau Veritas scores a 4 out of 6 for being undervalued. This means several checks point to upside while a couple still flash caution. Next we will break down the main valuation methods and, toward the end, explore an even better way to make sense of what the current price really implies.

Approach 1: Bureau Veritas Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a company is worth today by projecting the cash it can generate in the future and then discounting those amounts back to their value in the present.

For Bureau Veritas, the model starts from last twelve month free cash flow of about €846 million and then applies a two stage Free Cash Flow to Equity approach. Analyst forecasts drive the first few years, with free cash flow expected to stay in the €700 million range by 2028, before Simply Wall St extrapolates more modest growth for the years beyond.

Adding up these discounted cash flows gives an estimated intrinsic value of roughly €30.53 per share. Compared with the current share price, this implies the stock is about 14.8% undervalued on a DCF basis. This suggests the market is not fully pricing in the company’s future cash generation potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Bureau Veritas is undervalued by 14.8%. Track this in your watchlist or portfolio, or discover 904 more undervalued stocks based on cash flows.

Approach 2: Bureau Veritas Price vs Earnings

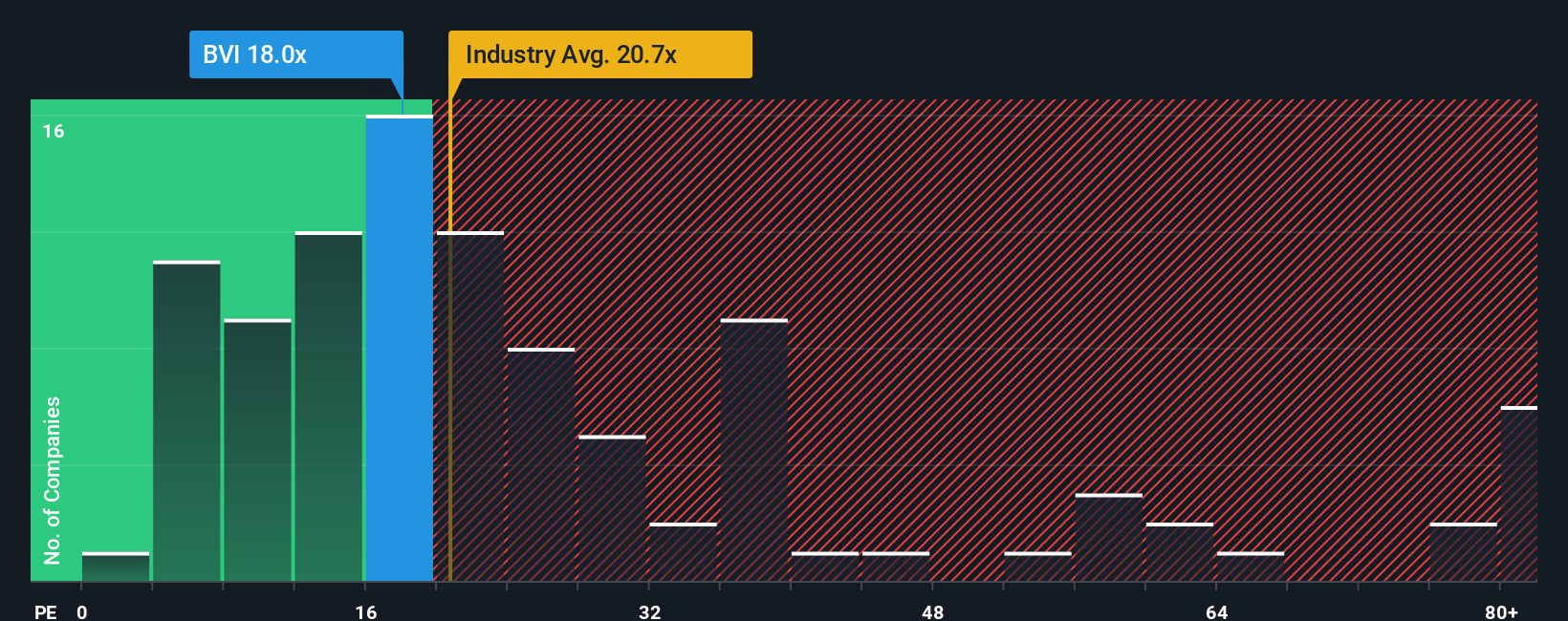

For profitable companies like Bureau Veritas, the price to earnings ratio, or PE, is a useful way to gauge whether investors are paying a reasonable price for each euro of current earnings. In general, faster growth and lower risk can justify a higher PE ratio, while slower growth or higher uncertainty usually call for a lower multiple.

Bureau Veritas currently trades on a PE of about 17.5x, which is very close to the Professional Services industry average of around 17.4x, but at a notable discount to its broader peer group, which sits near 35.4x. On the surface, that suggests the market is valuing Bureau Veritas more conservatively than some comparable companies.

Simply Wall St’s Fair Ratio framework goes a step further by estimating what PE multiple would be appropriate given Bureau Veritas earnings growth profile, profitability, industry, market cap and risk factors. On this basis, the stock’s Fair Ratio comes out at roughly 16.9x. Because this tailored benchmark directly incorporates company specific fundamentals, it provides a more precise yardstick than simply lining the stock up against industry or peer averages. With the current PE only slightly above the Fair Ratio, Bureau Veritas appears broadly fairly valued on an earnings multiple basis.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1447 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Bureau Veritas Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple framework that lets you attach a clear story about Bureau Veritas to the numbers you believe in, such as its fair value, future revenue, earnings and margins. It then connects that story to a financial forecast and, ultimately, to a fair value estimate you can compare with today’s share price to inform your decision to buy, hold or sell.

On Simply Wall St’s Community page, millions of investors use Narratives as an easy, interactive tool that automatically refreshes when new information such as earnings, guidance or major news arrives. This helps your thesis evolve in real time instead of going stale.

For example, one Bureau Veritas Narrative might lean into accelerating regulation, digitalization and ESG demand to justify a higher fair value near €40. A more cautious Narrative might focus on M&A integration risks, currency headwinds and regulatory changes to land closer to €28.5. By choosing the story that best fits your view, you immediately see how your expectations translate into a data driven fair value you can track against the current price.

Do you think there's more to the story for Bureau Veritas? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報