BridgeBio Pharma (BBIO): Assessing Valuation After Strong Attruby Quarter and Upbeat Analyst Outlook

BridgeBio Pharma (BBIO) just delivered a quarter where revenue topped expectations, thanks largely to strong U.S. demand for its heart drug Attruby, even as the company remained in the red.

See our latest analysis for BridgeBio Pharma.

Those upbeat Attruby numbers and the recent insider share sale have landed as the stock keeps grinding higher, with a roughly 11 percent 1 month share price return feeding into a powerful 1 year total shareholder return above 160 percent. This is a sign that bullish momentum around BridgeBio's growth story is still very much intact even if valuation risk is creeping higher.

If BridgeBio's run has you thinking about what else could surprise to the upside in biotech, this is a good moment to explore healthcare stocks for more potential candidates.

With shares already near analyst targets after a blistering multiyear run, but intrinsic models still hinting at upside, is BridgeBio a late stage momentum trade or a genuine buying opportunity before future growth is fully priced in?

Most Popular Narrative: 12.5% Undervalued

BridgeBio's most followed narrative pegs fair value near $84.65 per share, noticeably ahead of the recent $74.07 close, framing upside through 2026 pipeline execution and margin expansion.

The company's late-stage pipeline, with three Phase III readouts imminent across high unmet need rare disease indications, positions BridgeBio to leverage advancements in biotechnology for potential first-to-market and best-in-class therapies. This creates the opportunity for multiple revenue inflection points and margin improvement as the portfolio diversifies.

Curious how steep revenue ramps, profit margin flip, and a richer future multiple combine into that fair value view? The core assumptions might surprise you.

Result: Fair Value of $84.65 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained Attruby dependence and potential late stage trial setbacks mean that any safety signal or regulatory delay could quickly challenge the bullish valuation case.

Find out about the key risks to this BridgeBio Pharma narrative.

Another View: Multiples Flash a Very Different Signal

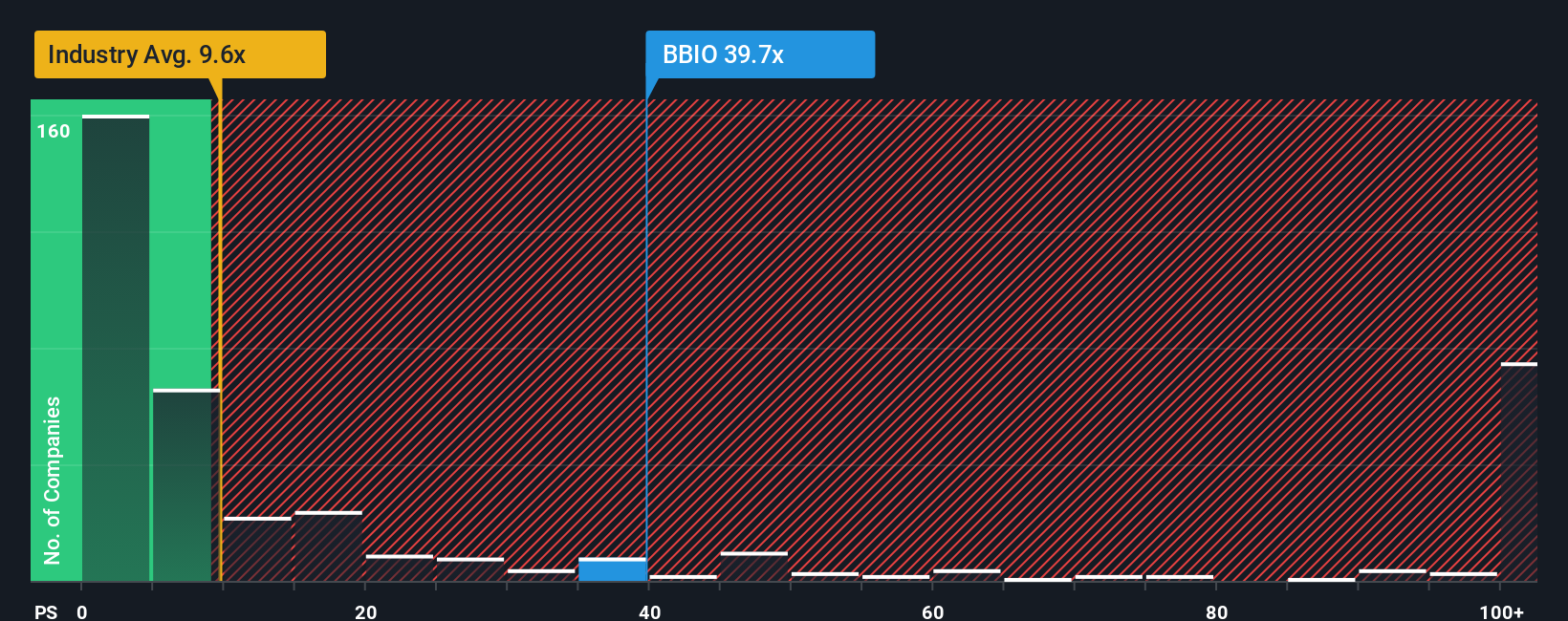

Step away from narratives and our DCF style fair value and the simple price to sales check tells a starkly different story. At about 40.3 times sales versus a fair ratio of 25.6 and an industry average near 11.8, BridgeBio screens as richly priced. Are investors stretching too far for growth here?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own BridgeBio Pharma Narrative

If this perspective does not quite line up with your own, dive into the numbers yourself and craft a personalized view in minutes: Do it your way.

A great starting point for your BridgeBio Pharma research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, consider using the Simply Wall Street Screener to identify potential opportunities that others may be overlooking.

- Explore early stage potential by screening for these 3605 penny stocks with strong financials that already show robust balance sheets and healthier fundamentals than typical micro caps.

- Consider the next productivity wave by targeting these 25 AI penny stocks positioned at the intersection of machine learning developments and real world commercial adoption.

- Refine your value strategy by focusing on these 904 undervalued stocks based on cash flows that trade below their cash flow potential yet still maintain solid long term growth prospects.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報