Broadridge Financial Solutions: Valuation Check After New Fintech Upgrades, Xceptor Partnership and Strategy Hire

Broadridge Financial Solutions (BR) has been quietly reshaping its fintech toolkit, from migrating its Shareholder Disclosure Hub to Amazon Web Services to partnering with Xceptor and naming a new head of strategy for its broker dealer arm.

See our latest analysis for Broadridge Financial Solutions.

The latest fintech upgrades and strategy hires come as Broadridge’s $231.5 share price reflects a mixed picture, with a modestly positive year to date share price return and a much stronger three year total shareholder return. This suggests long term momentum remains intact even as shorter term sentiment has cooled.

If you like the theme of fintech enablers shaping tomorrow’s markets, it could also be worth exploring high growth tech and AI stocks as potential next wave beneficiaries.

With revenue and earnings still growing and the shares trading at what looks like a healthy discount to analyst and intrinsic value estimates, is Broadridge an underappreciated fintech compounder, or are markets already pricing in its next leg of growth?

Most Popular Narrative: 14.1% Undervalued

With Broadridge shares closing at $231.50 versus a narrative fair value near $269, the valuation hinges on disciplined growth in revenue, margins, and earnings power.

Broadridge's leadership in secure, scalable, and innovative transaction processing (including blockchain/tokenization and AI-enabled platforms like OpsGPT and distributed ledger repo solutions) aligns with financial institutions' growing focus on security and the modernization of back-office operations, enabling new product launches, increasing switching costs, and supporting revenue growth and improved operating margins.

Want to see the math behind that premium platform story? The narrative leans on steady top line expansion, rising profitability, and a future earnings multiple usually reserved for market darlings. Curious which specific growth paths and margin gains are expected to support that price tag over the next few years? Dive in to unpack the assumptions driving this fair value call and see how bold they really are.

Result: Fair Value of $269.38 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, event driven revenues are expected to normalize, and longer sales cycles in key segments could sap momentum and challenge those upbeat growth assumptions.

Find out about the key risks to this Broadridge Financial Solutions narrative.

Another View: Rich on Earnings Metrics

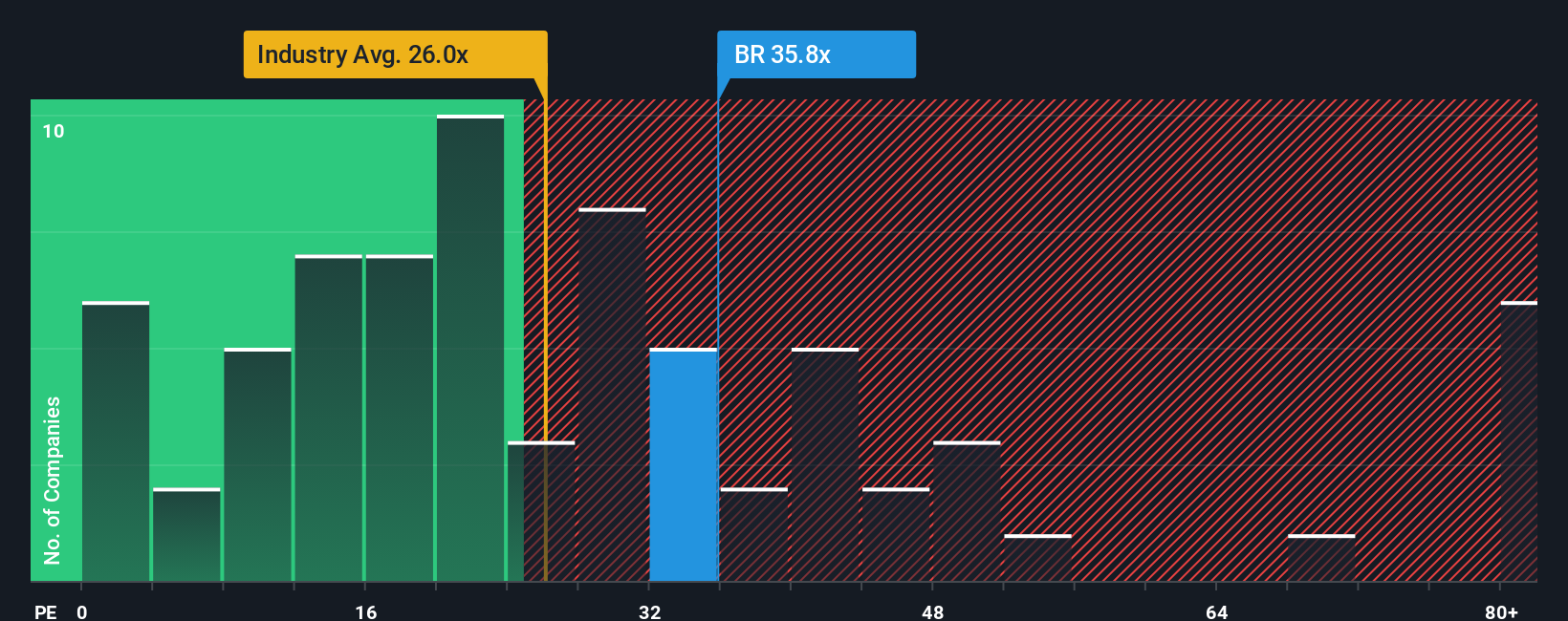

While the narrative fair value points to upside, the earnings lens looks less generous. Broadridge trades on a 29.2x price to earnings ratio, above both peers at 20.4x and the US Professional Services industry at 24.5x, and even above its 27.9x fair ratio. This hints at little room for error if growth slows.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Broadridge Financial Solutions Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a custom narrative in just a few minutes: Do it your way.

A great starting point for your Broadridge Financial Solutions research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next investing move?

Before markets move on without you, put Simply Wall Street’s Screener to work and build a shortlist of stocks that truly match your strategy.

- Look for potential mispriced opportunities by targeting companies trading below what their cash flows suggest they may be worth with these 904 undervalued stocks based on cash flows.

- Explore the momentum in cutting edge automation and machine learning by focusing on these 25 AI penny stocks.

- Assess your income stream by searching for companies with consistent payments using these 12 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報