Equinox Gold (TSX:EQX): Assessing Valuation After a Powerful Share Price Rerating

Equinox Gold (TSX:EQX) has quietly turned into one of the stronger gold names on the TSX, with the stock climbing about 16% over the past month and roughly 38% in the past 3 months.

See our latest analysis for Equinox Gold.

That surge sits on top of a powerful backdrop, with the share price now at $20.24 and a year to date share price return of about 164 percent, alongside a three year total shareholder return of more than 320 percent. This performance signals that investors are steadily repricing Equinox Gold for higher growth and lower perceived risk.

If Equinox Gold’s run has you thinking bigger about the sector, this is a good moment to explore fast growing stocks with high insider ownership as potential next wave opportunities.

After such a powerful rerating and sharp earnings momentum, investors now face a key question: is Equinox Gold still trading below its true value, or has the market already priced in most of the future growth?

Most Popular Narrative: 8.2% Undervalued

Compared to the last close at CA$20.24, the most widely followed narrative points to a modest upside, anchored in rising scale and cash generation.

Successful ramp-up of Greenstone and Valentine mines, combined with the recent merger, positions Equinox Gold for significantly higher output and scale, supporting meaningful revenue and cash flow growth in the coming quarters as new production fully contributes.

Curious how aggressive growth, expanding margins, and a future earnings multiple usually reserved for larger producers all fit into one price tag? The key drivers behind this fair value hinge on a dramatic shift in profitability, accelerating revenue, and a surprisingly restrained valuation multiple on those future earnings. Want to see exactly how those assumptions stack up over the next few years? Read on to unpack the full narrative.

Result: Fair Value of $22.05 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upside depends on smooth execution, with ore grade underperformance at Greenstone or prolonged community disruptions at Los Filos both capable of derailing the current growth story.

Find out about the key risks to this Equinox Gold narrative.

Another Angle on Valuation

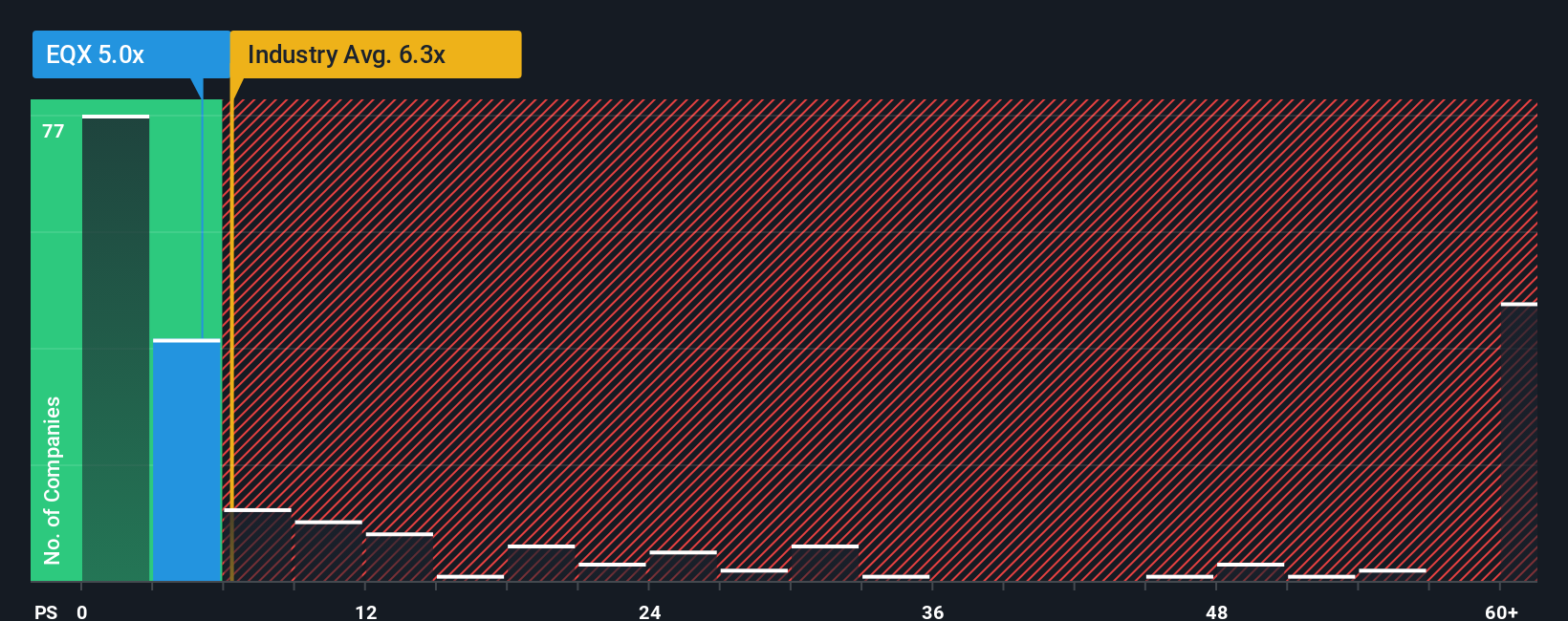

Our fair ratio analysis paints a more cautious picture. Equinox Gold trades on a price to sales ratio of 5 times, above its fair ratio of 4.5 times, even though it still looks cheaper than the Canadian Metals and Mining industry at 6.5 times and peers around 9.5 times. Is the market now paying a premium for momentum?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Equinox Gold Narrative

If you see things differently or want to dig into the numbers yourself, you can quickly build a personalized view in just minutes: Do it your way.

A great starting point for your Equinox Gold research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Ready for your next investing move?

Put your momentum from Equinox Gold to work and look for the next standout opportunity using targeted screeners on Simply Wall St before others catch on.

- Identify potential mispricing by scanning these 904 undervalued stocks based on cash flows that show strong cash flow support for their current market price.

- Explore innovation-focused opportunities by using these 25 AI penny stocks positioned to benefit from advances in artificial intelligence.

- Reinforce your income strategy with these 12 dividend stocks with yields > 3% that combine attractive yields with a focus on long term total returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報