Will Jyske Bank's (CPSE:JYSK) DKK 2.25 Billion Buyback Shift Its Capital Return Narrative?

- Earlier in 2025, Jyske Bank launched a share repurchase programme running from 26 February 2025 to 30 January 2026, targeting up to DKK 2.25 billion of stock, leaving it with 2,836,419 treasury shares or 4.61% of its share capital after recent purchases.

- The programme underlines management’s willingness to return excess capital to shareholders while potentially enhancing earnings per share through a lower share count.

- We’ll now explore how this sizeable buyback plan could reshape Jyske Bank’s investment narrative, particularly around capital returns and future earnings.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

Jyske Bank Investment Narrative Recap

To own Jyske Bank today, you need to believe in its ability to keep converting solid customer franchises and efficiency gains into resilient earnings while managing stricter capital and regulatory demands. The new DKK 2.25 billion buyback supports the existing capital return story but does not materially change the key near term catalyst of earnings delivery or the main risk around potential shifts in regulatory capital requirements.

The most relevant recent announcement alongside the buyback is the October 2025 upgrade to full year net profit guidance to DKK 4.9 billion to 5.3 billion (EPS DKK 77 to 84). When viewed together, the higher earnings guidance and ongoing repurchases focus attention on how sustainably Jyske Bank can balance shareholder distributions with maintaining its strong CET1 ratio if regulation or credit conditions become less favourable.

Yet behind this supportive capital return story, there is a risk investors should be aware of around...

Read the full narrative on Jyske Bank (it's free!)

Jyske Bank's narrative projects DKK12.3 billion in revenue and DKK4.3 billion in earnings by 2028.

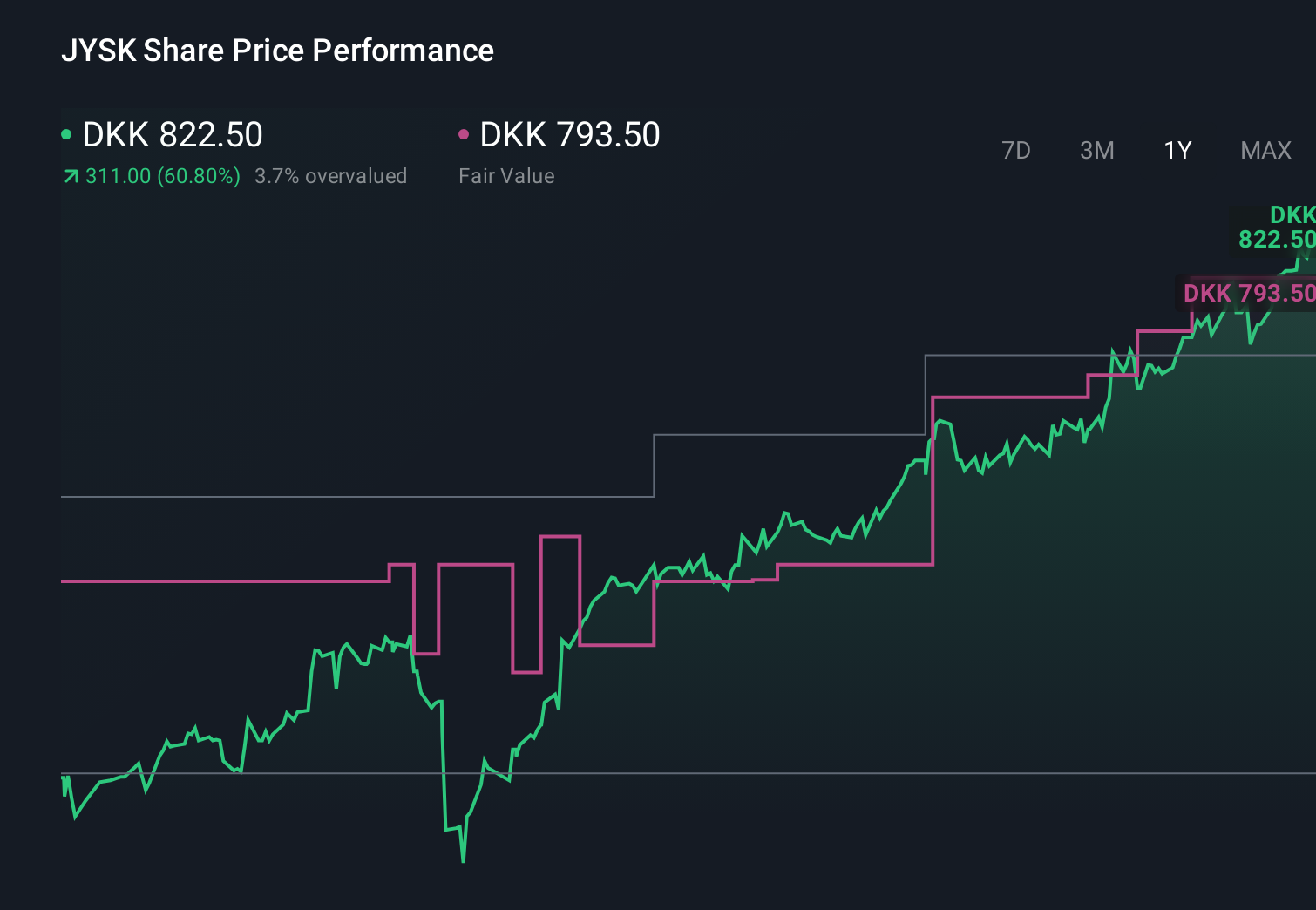

Uncover how Jyske Bank's forecasts yield a DKK793.50 fair value, a 3% downside to its current price.

Exploring Other Perspectives

Three fair value estimates from the Simply Wall St Community span about DKK 750 to DKK 1,557.98, underlining how far apart individual views on Jyske Bank can be. Against this wide range, the key risk around tighter capital requirements and potentially constrained buybacks could be crucial for how you think about the bank’s ability to support future returns.

Explore 3 other fair value estimates on Jyske Bank - why the stock might be worth as much as 90% more than the current price!

Build Your Own Jyske Bank Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Jyske Bank research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Jyske Bank research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Jyske Bank's overall financial health at a glance.

Interested In Other Possibilities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報