ITOCHU (TSE:8001) Valuation Check After New E‑Methane Partnership for Japan’s Carbon‑Neutral Gas Goals

ITOCHU (TSE:8001) is back in focus after teaming up with TotalEnergies, TES, Osaka Gas, and Toho Gas on the Live Oak e methane project in Nebraska, a long dated bet on Japan’s carbon neutral gas ambitions.

See our latest analysis for ITOCHU.

The market seems to like that direction, with ITOCHU’s 1 year total shareholder return near 30% and a strong 3 year total shareholder return above 140%. In addition, the year to date share price return above 25% suggests momentum is still building.

If this kind of energy transition story interests you, it could be a good moment to explore aerospace and defense stocks as another way to find infrastructure linked plays with long runway potential.

Yet with solid returns, modest earnings growth, and only a small discount to analyst targets, investors now face a key question: is ITOCHU still attractive for future upside, or has the market already priced in that growth?

Most Popular Narrative: 10% Overvalued

With ITOCHU last closing at ¥9,783 versus a narrative fair value of ¥9,770, the story leans slightly rich and leans heavily on future execution.

Progress on asset replacement and active portfolio management, along with robust share buyback activity, is likely to drive EPS growth and support shareholder returns, which may not be fully reflected in the current valuation.

Curious how modest growth, steady margins, and shrinking share count can still justify a premium earnings multiple above sector norms? The narrative spells out the full playbook behind that valuation pivot.

Result: Fair Value of ¥9,770 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent reliance on resource driven earnings and softer demand in key markets like China could quickly challenge the upbeat growth and valuation setup.

Find out about the key risks to this ITOCHU narrative.

Another Angle on Valuation

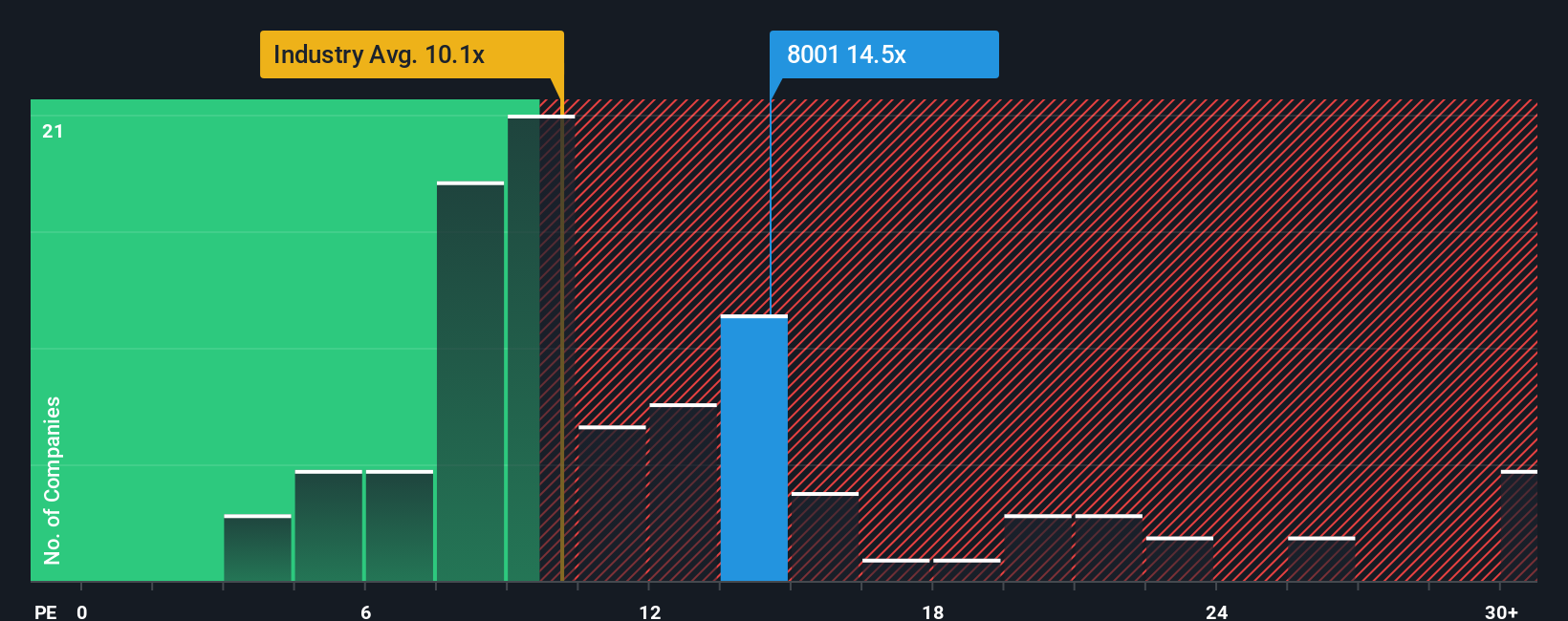

On earnings ratios, ITOCHU looks more stretched, trading at 14.6x versus 9.9x for the Trade Distributors industry, roughly in line with peers at 14.7x, yet well below a 23.2x fair ratio. Is this a measured premium, or room for expectations to deflate?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own ITOCHU Narrative

If you see the numbers differently or want to dig into the assumptions yourself, you can build a custom view in minutes: Do it your way.

A great starting point for your ITOCHU research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next investing move?

Before the next opportunity runs away from you, use the Simply Wall Street Screener to uncover fresh ideas that match your strategy and keep your edge sharp.

- Capture overlooked value by targeting companies trading below their cash flow potential with these 904 undervalued stocks based on cash flows tailored to long term compounding.

- Identify structural trends in technology by focusing on breakthrough innovators through these 25 AI penny stocks related to digital transformation.

- Strengthen your income stream by focusing on reliable cash generators via these 12 dividend stocks with yields > 3% that aim to keep paying you even when markets turn choppy.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報