Crinetics Pharmaceuticals (CRNX) Valuation Check After First-Patient Dosing in New SST2 Tumor Trial

Crinetics Pharmaceuticals (CRNX) just hit an important milestone, as it has dosed the first patient in its Phase 1/2 BRAVESST2 trial of CRN09682 for SST2 positive neuroendocrine tumors and other SST2 expressing solid tumors.

See our latest analysis for Crinetics Pharmaceuticals.

The BRAVESST2 milestone comes after a powerful run in the share price, with a roughly 45% 3 month share price return helping claw back some of the softer year to date move and setting up stronger long term momentum reflected in the more than tripling 3 year total shareholder return.

If this kind of pipeline driven story has your attention, it could be a good time to explore other specialist names in healthcare via healthcare stocks.

With shares still trading at a steep discount to analyst targets despite a blockbuster three year run, is Crinetics an underappreciated pipeline story offering upside, or is the market already pricing in the next leg of growth?

Price to Book of 4.4x: Is it justified?

Crinetics trades on a 4.4x price to book multiple, above the broader US pharmaceuticals average but below its more directly comparable peers.

Price to book compares the company’s market value with its net assets, a common yardstick for cash burning, research intensive drug developers where current earnings are not yet meaningful.

For Crinetics, a 4.4x multiple suggests investors are already paying a premium over the average pharma name for its pipeline and expected growth, even though the company remains loss making today and still has limited reported revenue.

Relative to the US pharmaceuticals industry average of 2.5x, the stock appears materially more expensive. However, when measured against a closer peer set on 6.8x it screens as more moderately valued and could still rerate if its late stage programs deliver, especially given our model also sees the shares trading 57.3% below an estimated fair value.

See what the numbers say about this price — find out in our valuation breakdown.

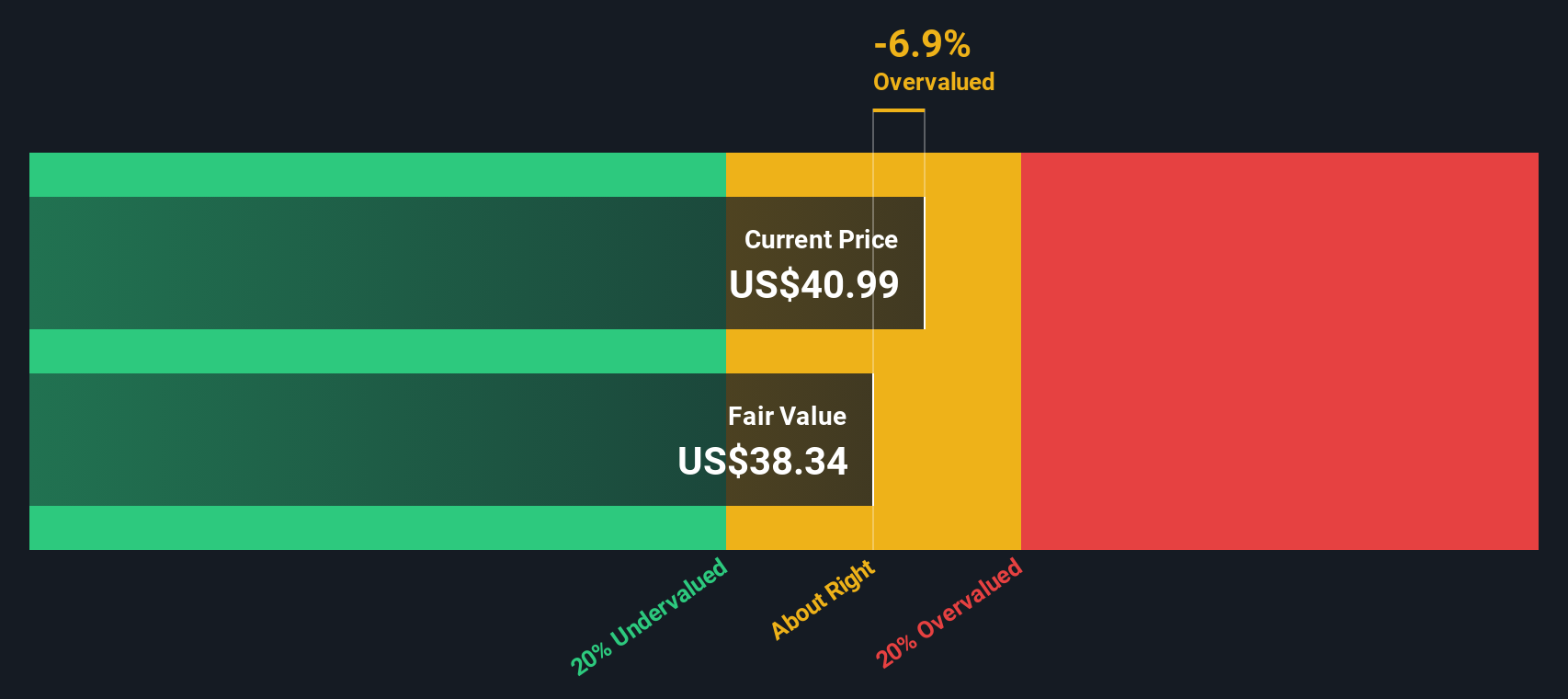

Result: Price to Book of 4.4x (ABOUT RIGHT)

However, clinical setbacks in late stage trials or dilution from additional capital raises could quickly undermine confidence in the long term, pipeline-driven story.

Find out about the key risks to this Crinetics Pharmaceuticals narrative.

Another View: What Our DCF Says

While the 4.4x price to book looks about right versus peers, our DCF model presents a very different picture. It suggests fair value closer to $115.51 versus a $49.31 share price, or roughly 57% upside. Is the market underestimating the pipeline, or simply discounting the risks too heavily?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Crinetics Pharmaceuticals for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 904 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Crinetics Pharmaceuticals Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a personalized view in just minutes: Do it your way.

A great starting point for your Crinetics Pharmaceuticals research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more investment ideas?

Before you move on, consider your next round of opportunities with focused stock ideas on Simply Wall St that you might regret overlooking later.

- Explore potential mispricing by targeting companies trading below their intrinsic value through these 904 undervalued stocks based on cash flows and position yourself for any future change in market perception.

- Explore cutting edge innovation by focusing on these 25 AI penny stocks, where developments in automation and intelligent systems may influence market trends.

- Refine your income strategy by identifying dividend-paying companies through these 12 dividend stocks with yields > 3%, aiming to balance growth potential with consistent payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報