BioMarin (BMRN): Has the Market Overreacted to This Year’s Pullback in a Profitable Rare-Disease Leader?

BioMarin Pharmaceutical (BMRN) has quietly slid about 20% this year, even as revenue and net income keep growing. That disconnect is exactly what has value focused biotech investors taking a closer look.

See our latest analysis for BioMarin Pharmaceutical.

At around $52.99 per share, BioMarin’s roughly 20% year to date share price decline and steep three and five year total shareholder return drawdown suggest sentiment has cooled. At the same time, steady revenue and profit growth hint that investors might be reassessing risk rather than the long term story.

If this shift in mood has you comparing opportunities across the sector, it could be worth exploring other potential ideas among healthcare stocks.

With shares down sharply despite double digit profit growth and a sizable discount to analyst targets, investors face a key question: Is BioMarin mispriced for its rare disease pipeline, or is the market already bracing for slower future growth?

Most Popular Narrative Narrative: 40.7% Undervalued

With BioMarin closing at $52.99 against a widely followed fair value estimate near $89, the dominant narrative leans firmly toward a discounted opportunity.

The analysts have a consensus price target of $96.593 for BioMarin Pharmaceutical based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $122.0, and the most bearish reporting a price target of just $60.0.

Curious what kind of revenue climb, margin expansion, and future earnings power could justify that gap between today’s price and the narrative’s target? Explore the full story to see which growth and profitability assumptions are doing the heavy lifting behind this fair value view.

Result: Fair Value of $89.36 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, margin pressure from rising R&D and SG&A, along with intensifying competition for core rare disease therapies, could quickly undermine this undervaluation narrative.

Find out about the key risks to this BioMarin Pharmaceutical narrative.

Another Lens On Valuation

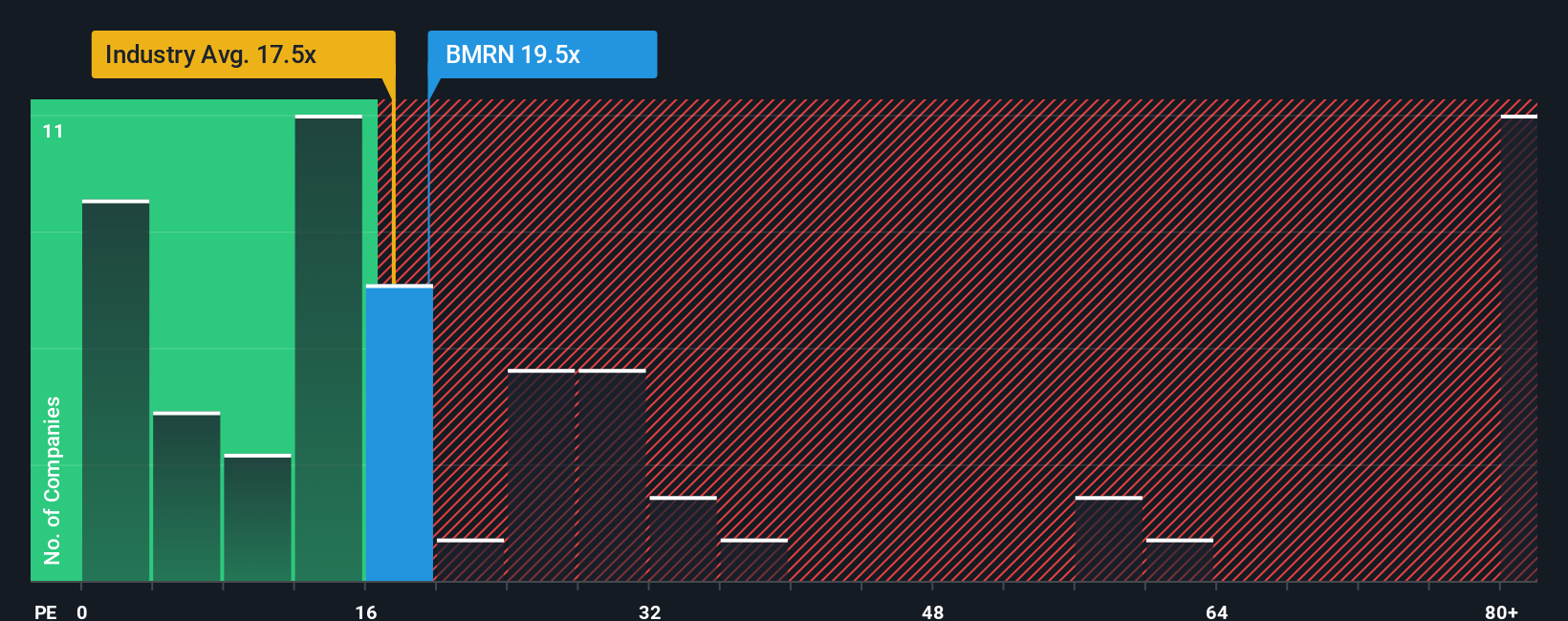

On earnings, BioMarin looks more middle of the road. The stock trades at about 19.6 times profit, slightly richer than the US biotech average of 19.2 times but below a fair ratio of 23.8 times, which hints at potential upside without suggesting it is a major bargain.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own BioMarin Pharmaceutical Narrative

If you see the numbers differently or want to test your own assumptions, you can quickly build a personalised view in minutes with Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding BioMarin Pharmaceutical.

Ready for your next investing move?

Do not stop at one opportunity when you can scan the market like a pro, use targeted screeners, and spot ideas before most investors even notice them.

- Capture potential mispricings early by checking out these 904 undervalued stocks based on cash flows that stand out on discounted cash flows and solid fundamentals.

- Ride powerful secular trends by reviewing these 25 AI penny stocks positioned to benefit from rapid advances in artificial intelligence.

- Strengthen your income game by focusing on these 12 dividend stocks with yields > 3% that can help support reliable cash returns in your portfolio.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報