Danaher (DHR): Valuation Check After Goldman Sachs Buy Rating and Improving Bioprocessing Outlook

Danaher (DHR) just picked up a fresh Buy rating from Goldman Sachs, and the timing lines up with improving sentiment in life sciences tools, especially bioprocessing equipment where demand signals are finally turning.

See our latest analysis for Danaher.

The stock has quietly put together a solid run, with a 90 day share price return of 22.27 percent and a 30 day gain of 7.68 percent. The 5 year total shareholder return of 19.30 percent shows long term compounding even though the 1 year total shareholder return is still slightly negative, suggesting momentum is rebuilding as investors respond to Danaher’s stated growth outlook and recent dividend affirmation.

If Danaher’s momentum has your attention, it could be worth seeing what else is setting up in healthcare right now through healthcare stocks.

With the shares already up double digits over three months and trading only modestly below consensus targets, the key question now is whether Danaher still offers upside from here or if the market is already pricing in the next leg of growth.

Most Popular Narrative Narrative: 9.1% Undervalued

With Danaher last closing at $232.37 against a narrative fair value near $255.67, the story leans toward upside and sets the stage for a potential catalyst.

The sustained advancement of precision medicine and personalized therapies, including new AI assisted diagnostic solutions and groundbreaking launches in genomics (like support for in vivo CRISPR therapies), positions Danaher's technology portfolio to capture higher margin growth and drive long term EBITDA expansion.

Want to see what powers that optimism? The narrative focuses on accelerating earnings, expanding margins, and a rich future multiple. Curious how those pieces fit together?

Result: Fair Value of $255.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent uncertainty in China and prolonged weakness in early stage biotech funding could derail recovery expectations and pressure Danaher’s premium valuation narrative.

Find out about the key risks to this Danaher narrative.

Another Angle on Valuation

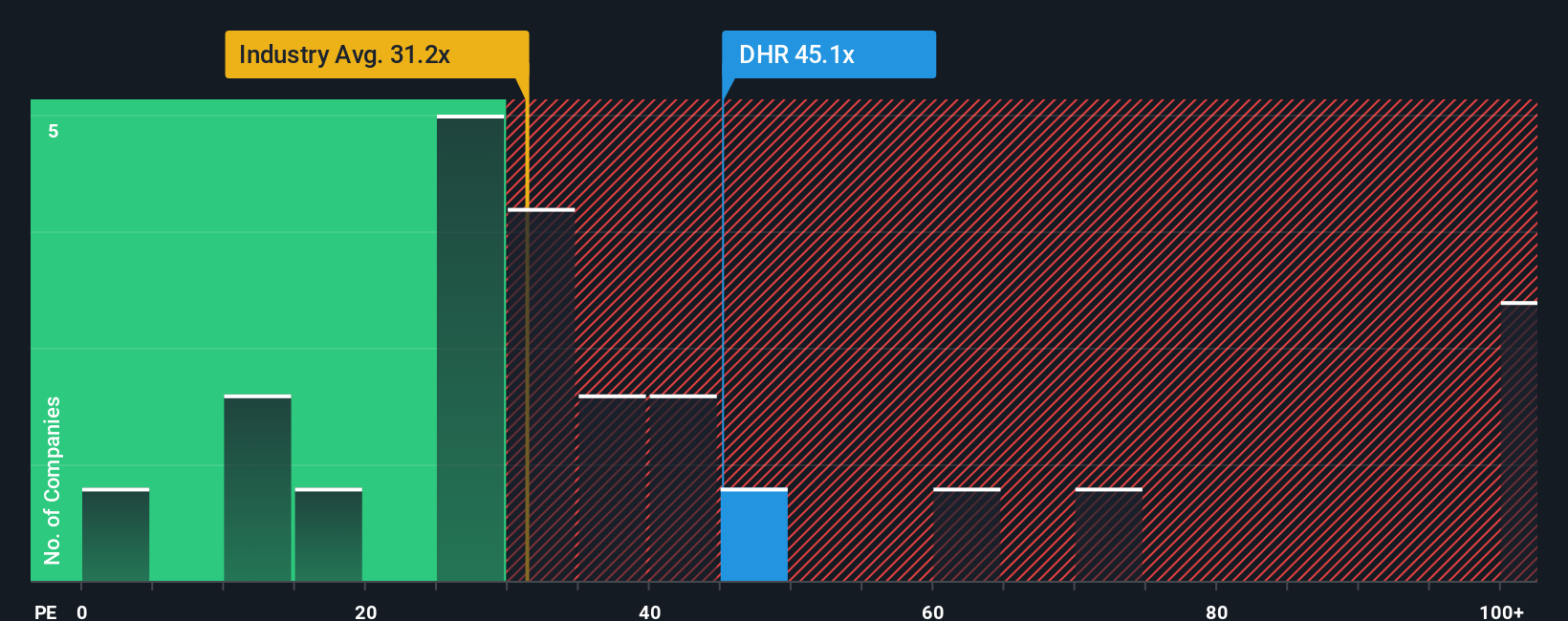

While the narrative fair value suggests upside, the earnings based view looks harsher. Danaher trades on a 46.9 times price to earnings ratio versus 35.8 times for the North American Life Sciences industry and a 32.2 times fair ratio, implying investors are paying a steep premium that could compress if sentiment cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Danaher Narrative

If you see the story differently or prefer hands on research, you can quickly assemble your own view in just a few minutes: Do it your way.

A great starting point for your Danaher research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Ready for more investment ideas?

Before you move on, lock in your next potential opportunity by scanning a few focused stock lists on Simply Wall St that match your style and strategy.

- Accelerate your search for strong potential returns by targeting these 904 undervalued stocks based on cash flows that the market has not fully appreciated yet.

- Capitalize on the next wave of innovation by zeroing in on these 25 AI penny stocks positioned to benefit from advances in artificial intelligence.

- Strengthen your portfolio’s income engine by reviewing these 12 dividend stocks with yields > 3% that can support reliable cash flows over the long term.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報