Is It Too Late to Consider Alnylam Pharmaceuticals After Its Huge 2025 Share Price Surge?

- Wondering if Alnylam Pharmaceuticals at around $412 a share is still a smart buy after its huge run, or if the upside has already been priced in.

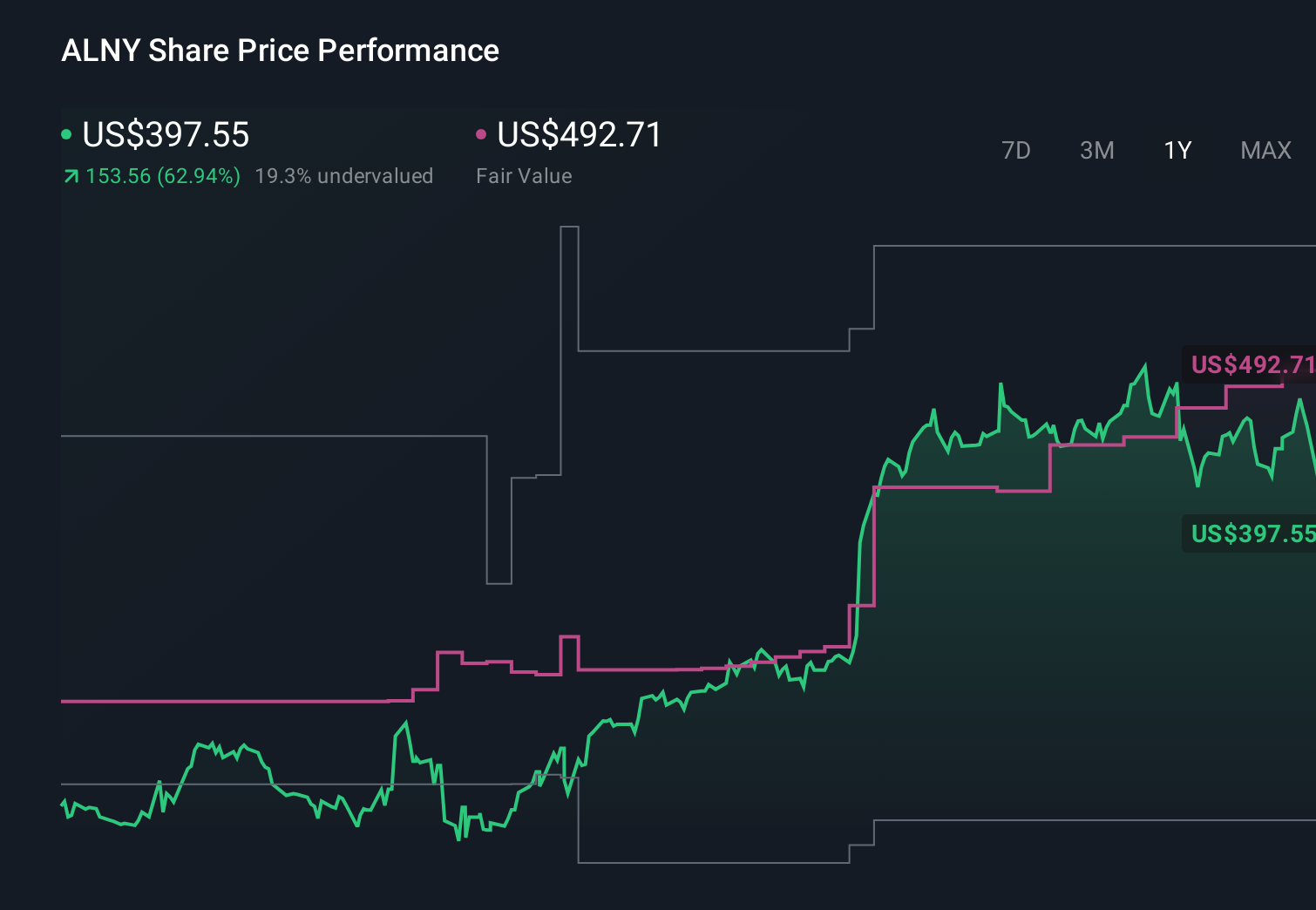

- The stock is down 11.3% over the last week and 8.7% over the past month, but even after that pullback it is still up 76.6% year to date and 68.2% over the last 12 months.

- Those moves have come as investors refocus on Alnylam's RNAi drug pipeline, major partnerships with big pharma, and the growing commercial traction of its approved therapies. The market is essentially re-rating the company around its long term revenue potential and strategic positioning in rare diseases and genetic medicine.

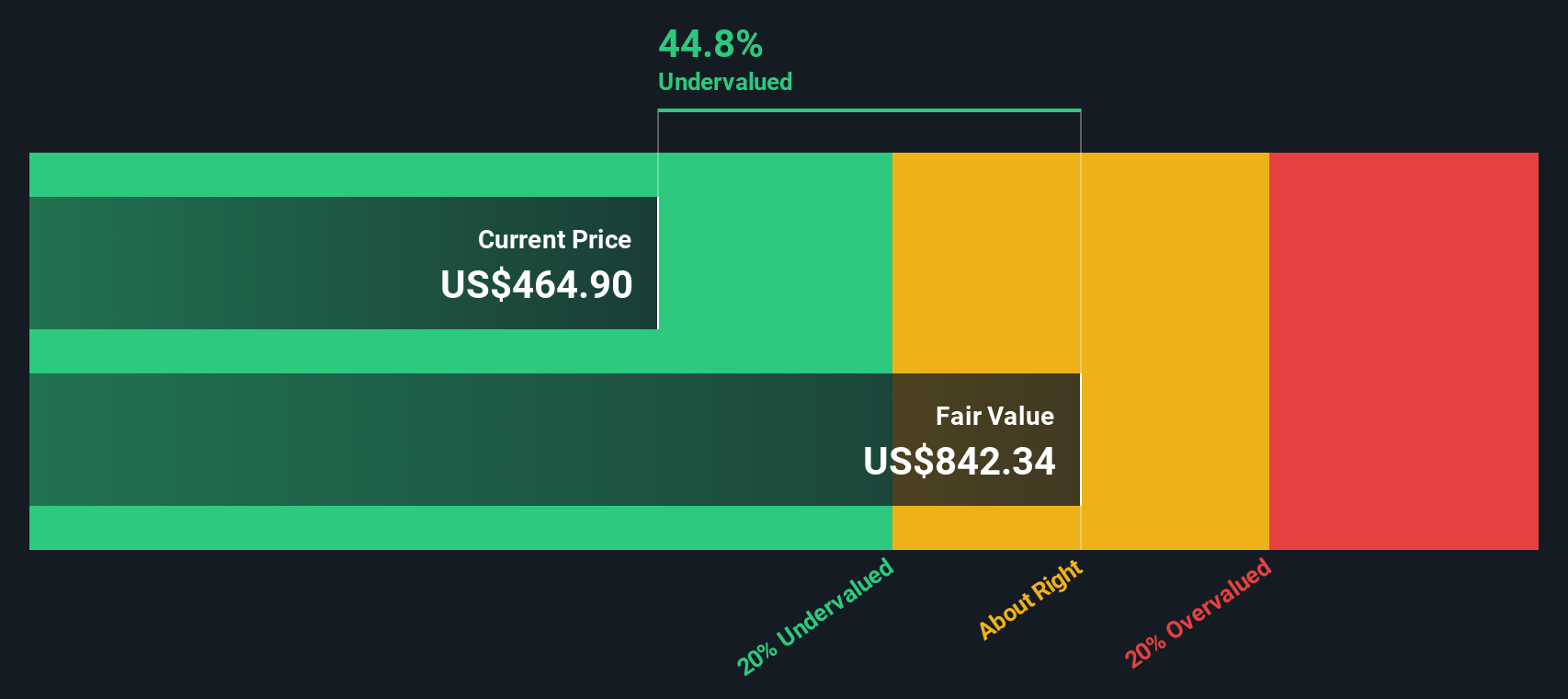

- Despite the optimism, our valuation framework only gives Alnylam a 2/6 value score, which suggests the market may already be baking in a lot of good news. Next, we will walk through the main valuation methods investors are using today, and then finish with a more holistic way to think about what the stock is really worth.

Alnylam Pharmaceuticals scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Alnylam Pharmaceuticals Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a company is worth by projecting the cash it can generate in the future and then discounting those cash flows back to today in dollar terms. For Alnylam, the 2 Stage Free Cash Flow to Equity model starts from last twelve month free cash flow of about $195.7 million and builds up to analyst forecasts and longer term projections.

Analysts in this model see free cash flow climbing into the low billions over the coming years, with Simply Wall St extrapolating this path to around $4.3 billion in 2035 as the RNAi portfolio scales. Each of these future cash flows is discounted back to a present value, reflecting risk and the time value of money.

When all discounted cash flows are summed, the model arrives at an intrinsic value of roughly $595.4 per share. Versus a recent share price near $412, the DCF implies Alnylam is about 30.7% undervalued on cash flow fundamentals according to this analysis.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Alnylam Pharmaceuticals is undervalued by 30.7%. Track this in your watchlist or portfolio, or discover 904 more undervalued stocks based on cash flows.

Approach 2: Alnylam Pharmaceuticals Price vs Sales

For a company like Alnylam that is still transitioning toward sustained profitability, the price to sales multiple is often a more useful yardstick than earnings based metrics. It focuses on how much investors are paying for each dollar of current revenue, which tends to be more stable than near term earnings for high growth biotechs.

In general, faster revenue growth and lower risk justify a higher price to sales ratio, while slower growth, thinner margins, or elevated risk should pull that multiple down. Alnylam currently trades on a price to sales ratio of about 16.98x, a sizeable premium to the broader Biotechs industry average of around 12.26x and above the peer group average of roughly 9.31x.

Simply Wall St also calculates a Fair Ratio of 15.42x, its proprietary view of what Alnylam’s price to sales multiple should be after accounting for factors such as growth prospects, profitability trajectory, risk profile, industry positioning and market cap. Because it blends these fundamentals into a single benchmark, the Fair Ratio gives a more tailored reference point than a blunt comparison with sector averages or individual peers. With the actual multiple sitting above this Fair Ratio, the shares screen as somewhat expensive on a sales basis.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1446 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Alnylam Pharmaceuticals Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives, a simple way to connect your view of Alnylam’s story to specific forecasts for its future revenue, earnings and margins, and then to a clear fair value that you can compare with today’s share price. A Narrative on Simply Wall St’s Community page lets you spell out why you think, for example, Alnylam’s cardiomyopathy launch and RNAi pipeline will justify something closer to the bullish fair value near $583, or why competitive and pricing risks mean a more cautious view around $236 is more appropriate. The platform will translate that story into numbers, show whether the stock looks undervalued or overvalued versus your fair value, and then keep that view up to date automatically as new news, earnings and guidance come in. This way, your decision is always anchored to the latest information and your own clearly defined assumptions.

Do you think there's more to the story for Alnylam Pharmaceuticals? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報