Krystal Biotech And 2 Other Growth Stocks Insiders Are Betting On

As the U.S. stock market experiences a surge following the Federal Reserve's decision to cut interest rates, investors are closely watching growth companies with high insider ownership. In this environment, stocks like Krystal Biotech and others where insiders have significant stakes can be particularly attractive, as they often signal confidence in the company's potential amidst evolving economic conditions.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Super Micro Computer (SMCI) | 13.9% | 50.7% |

| StubHub Holdings (STUB) | 14.2% | 73.5% |

| SES AI (SES) | 12% | 68.9% |

| Niu Technologies (NIU) | 37.2% | 93.7% |

| Credo Technology Group Holding (CRDO) | 10.4% | 30.7% |

| Cloudflare (NET) | 10.2% | 43.5% |

| Bitdeer Technologies Group (BTDR) | 33.4% | 131.7% |

| Atour Lifestyle Holdings (ATAT) | 18% | 24.4% |

| Astera Labs (ALAB) | 11.7% | 29.0% |

| AppLovin (APP) | 27.5% | 27.3% |

Let's uncover some gems from our specialized screener.

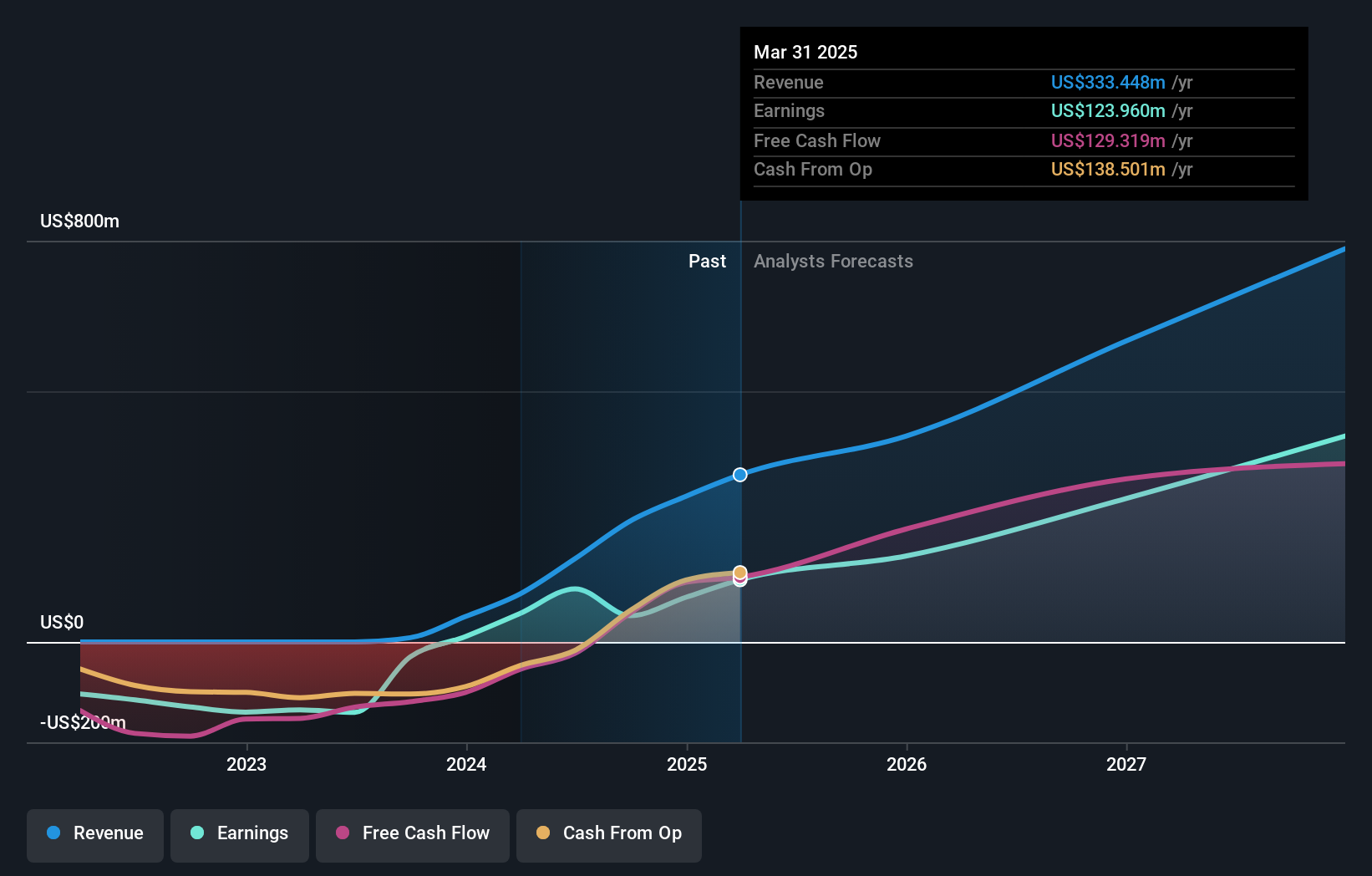

Krystal Biotech (KRYS)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Krystal Biotech, Inc. is a commercial-stage biotechnology company focused on discovering, developing, manufacturing, and commercializing genetic medicines for diseases with high unmet medical needs in the United States, with a market cap of $6.95 billion.

Operations: The company generates revenue of $373.16 million from its segment focused on genetic medicines addressing diseases with significant unmet medical needs in the United States.

Insider Ownership: 10.3%

Earnings Growth Forecast: 28.3% p.a.

Krystal Biotech has demonstrated significant growth, with earnings increasing to US$79.37 million in Q3 2025 from US$27.18 million a year ago. The company is advancing its genetic medicines pipeline across various fields, supported by the FDA's platform technology designation for its KB801 eye drop therapy. Despite trading below estimated fair value, Krystal's revenue and earnings are expected to grow faster than the market average, although insider ownership details over recent months are unavailable.

- Get an in-depth perspective on Krystal Biotech's performance by reading our analyst estimates report here.

- Our expertly prepared valuation report Krystal Biotech implies its share price may be lower than expected.

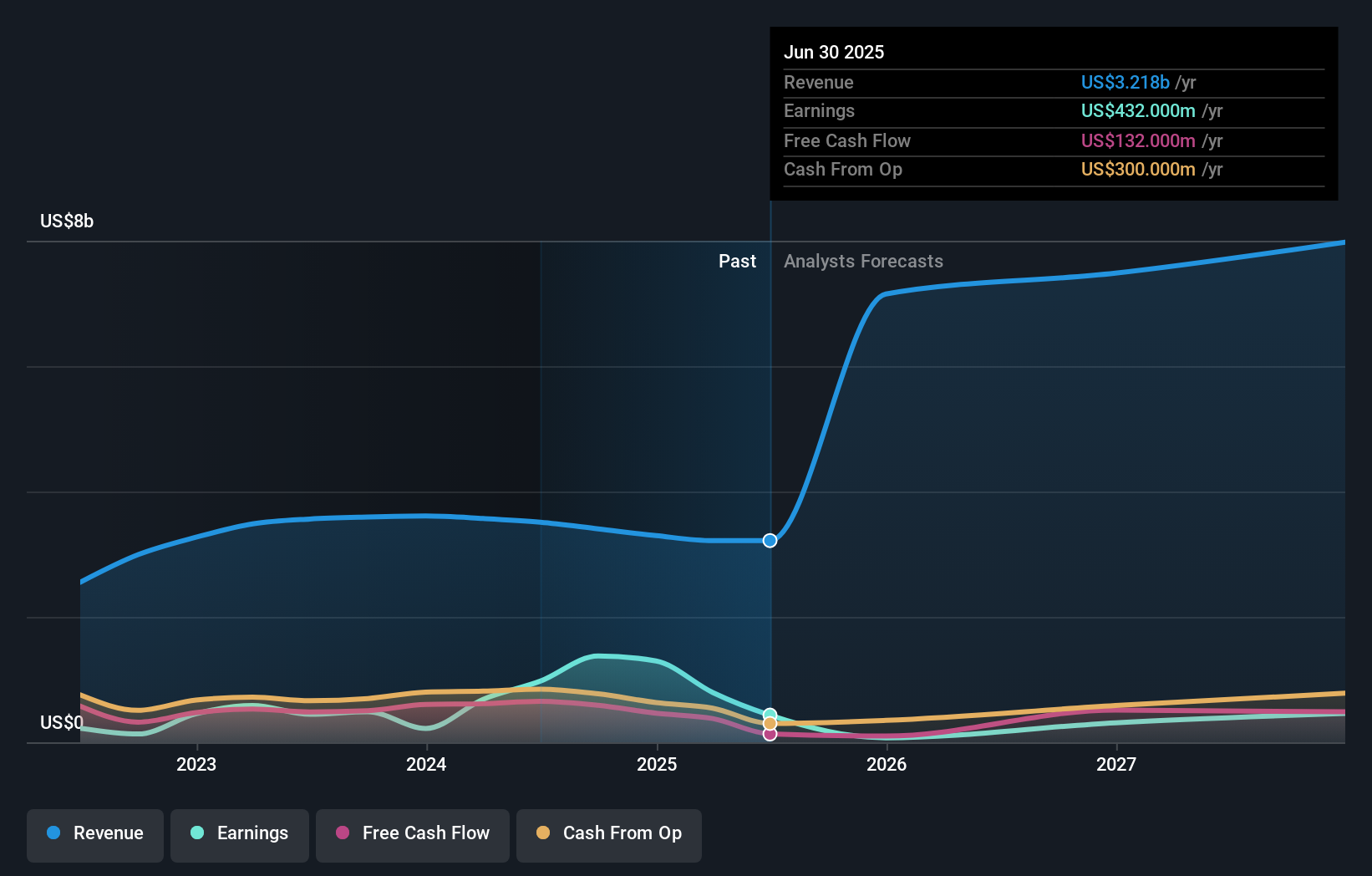

Hyatt Hotels (H)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Hyatt Hotels Corporation operates as a hospitality company both in the United States and internationally, with a market cap of approximately $14.69 billion.

Operations: Hyatt's revenue primarily comes from its Owned and Leased segment at $1.24 billion, followed by Management and Franchising at $1.19 billion, and Distribution contributing $974 million.

Insider Ownership: 11.2%

Earnings Growth Forecast: 57.5% p.a.

Hyatt Hotels Corporation is poised for growth, with revenue expected to increase by 17.8% annually, surpassing the US market average. Despite recent insider selling, the company benefits from strong insider ownership and strategic expansions like Hyatt Place Cancun Airport. Its financial position includes a $1.5 billion revolving credit facility and a recent $399.83 million bond issuance at 5.4%. Although currently unprofitable, earnings are projected to grow significantly over the next three years.

- Dive into the specifics of Hyatt Hotels here with our thorough growth forecast report.

- Our valuation report here indicates Hyatt Hotels may be overvalued.

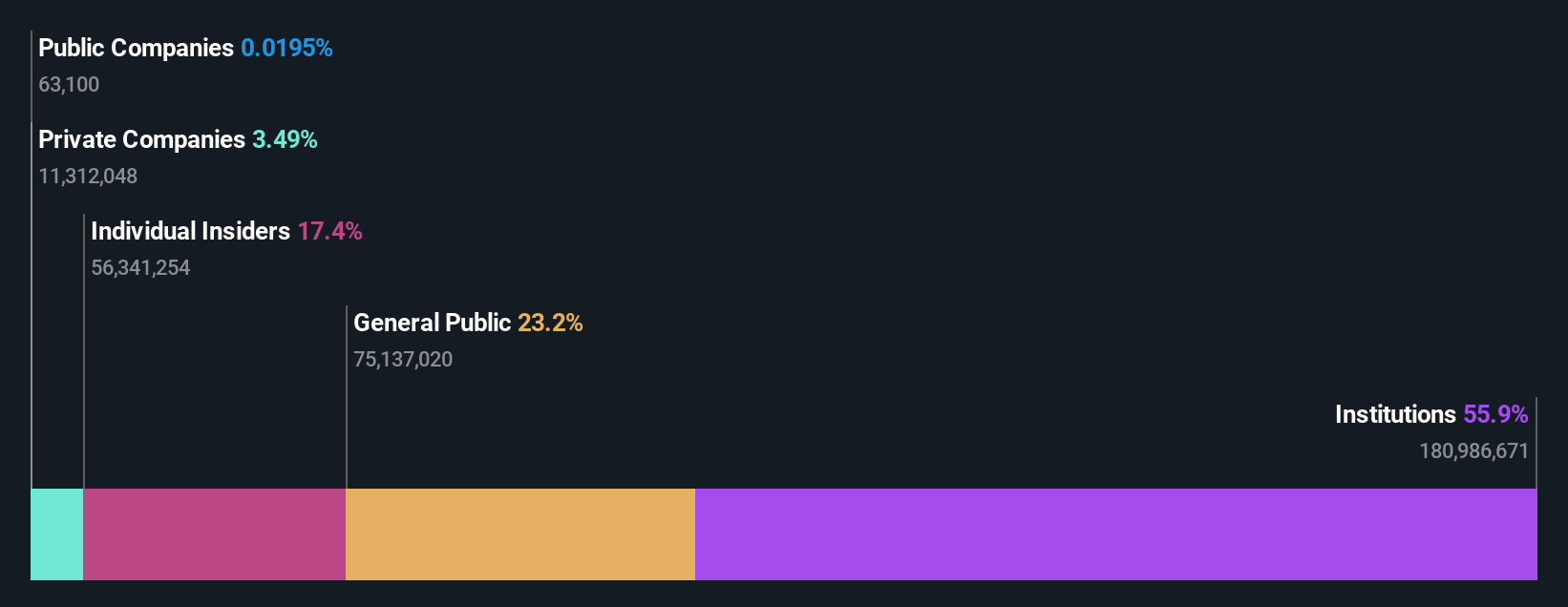

On Holding (ONON)

Simply Wall St Growth Rating: ★★★★★☆

Overview: On Holding AG develops and distributes sports products globally, with a market cap of approximately $16.25 billion.

Operations: The company generates revenue primarily from its Athletic Footwear segment, which amounts to CHF 2.88 billion.

Insider Ownership: 26.3%

Earnings Growth Forecast: 30.1% p.a.

On Holding is experiencing robust growth, with earnings expected to increase by 30.1% annually, outpacing the US market. The company recently reported strong Q3 results, with sales rising to CHF 794.4 million from CHF 635.8 million year-over-year and net income significantly improved at CHF 118.9 million compared to CHF 30.5 million previously. While insider trading activity remains unclear over the past three months, On Holding's strategic financial maneuvers include a shelf registration filing for future securities offerings.

- Click to explore a detailed breakdown of our findings in On Holding's earnings growth report.

- According our valuation report, there's an indication that On Holding's share price might be on the expensive side.

Turning Ideas Into Actions

- Explore the 203 names from our Fast Growing US Companies With High Insider Ownership screener here.

- Curious About Other Options? AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報