Investors Still Aren't Entirely Convinced By Guanajuato Silver Company Ltd.'s (CVE:GSVR) Revenues Despite 53% Price Jump

Guanajuato Silver Company Ltd. (CVE:GSVR) shareholders would be excited to see that the share price has had a great month, posting a 53% gain and recovering from prior weakness. The annual gain comes to 205% following the latest surge, making investors sit up and take notice.

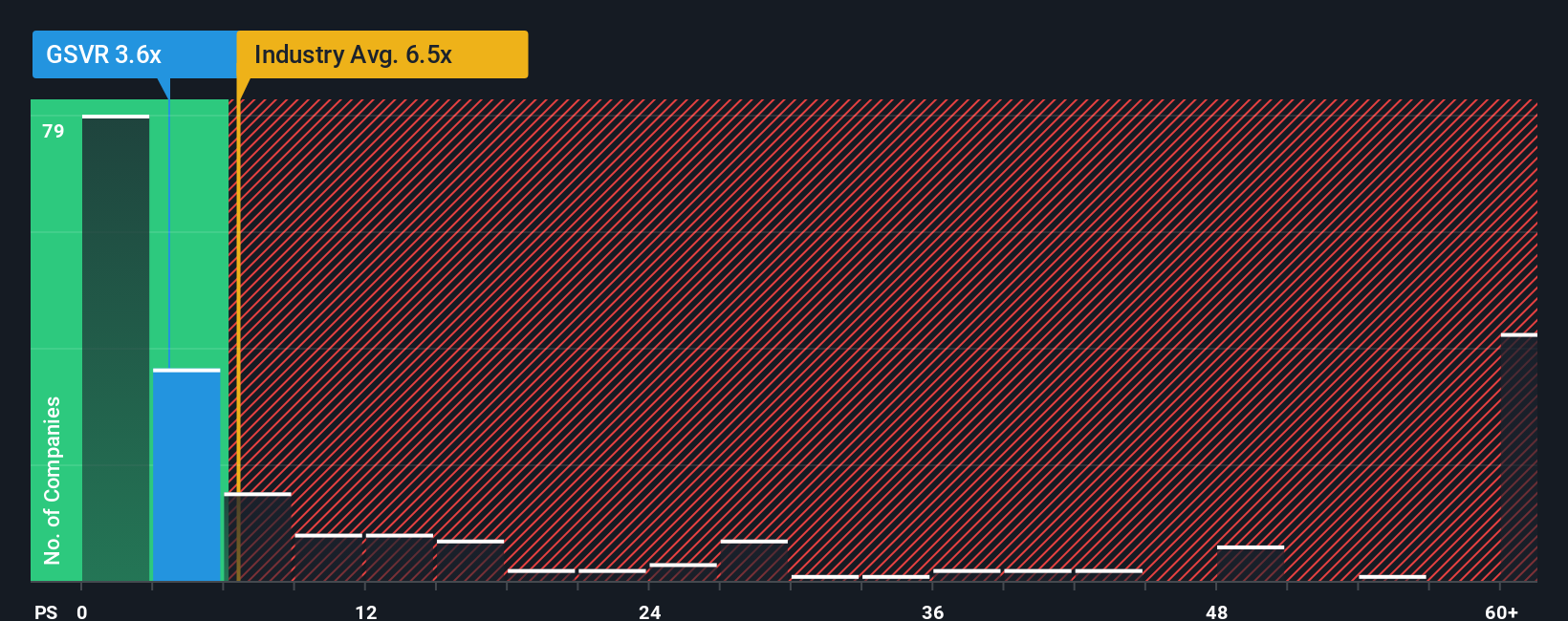

Even after such a large jump in price, Guanajuato Silver may still be sending buy signals at present with its price-to-sales (or "P/S") ratio of 3.6x, considering almost half of all companies in the Metals and Mining industry in Canada have P/S ratios greater than 6.5x and even P/S higher than 43x aren't out of the ordinary. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Guanajuato Silver

What Does Guanajuato Silver's Recent Performance Look Like?

Recent times haven't been great for Guanajuato Silver as its revenue has been rising slower than most other companies. Perhaps the market is expecting the current trend of poor revenue growth to continue, which has kept the P/S suppressed. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Guanajuato Silver.Do Revenue Forecasts Match The Low P/S Ratio?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Guanajuato Silver's to be considered reasonable.

Taking a look back first, we see that the company managed to grow revenues by a handy 2.6% last year. This was backed up an excellent period prior to see revenue up by 194% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenues over that time.

Looking ahead now, revenue is anticipated to climb by 89% during the coming year according to the lone analyst following the company. With the industry only predicted to deliver 52%, the company is positioned for a stronger revenue result.

With this information, we find it odd that Guanajuato Silver is trading at a P/S lower than the industry. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

What Does Guanajuato Silver's P/S Mean For Investors?

The latest share price surge wasn't enough to lift Guanajuato Silver's P/S close to the industry median. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Guanajuato Silver's analyst forecasts revealed that its superior revenue outlook isn't contributing to its P/S anywhere near as much as we would have predicted. There could be some major risk factors that are placing downward pressure on the P/S ratio. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

Before you take the next step, you should know about the 1 warning sign for Guanajuato Silver that we have uncovered.

If you're unsure about the strength of Guanajuato Silver's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Nasdaq

Nasdaq 華爾街日報

華爾街日報