Want Want China (SEHK:151) EPS Decline Tests Bullish Stability Narrative in H1 2026

Want Want China Holdings (SEHK:151) has posted steady H1 2026 numbers, reporting revenue of about CNY 11.1 billion and basic EPS of CNY 0.146 alongside net income of CNY 1.7 billion, setting a measured tone for the new fiscal year. The company’s revenue edged up from roughly CNY 10.9 billion in H1 2025 to CNY 11.1 billion in H1 2026, while net income softened from CNY 1.9 billion to CNY 1.7 billion and EPS eased from CNY 0.158 to CNY 0.146. This frames a picture of resilient scale but slightly tighter profitability that investors will be watching through the lens of margins.

See our full analysis for Want Want China Holdings.With the headline results on the table, the next step is to see how these earnings and margin trends line up with the prevailing narratives investors follow around Want Want China Holdings.

Curious how numbers become stories that shape markets? Explore Community Narratives

TTM net income holds near CNY 4.2b

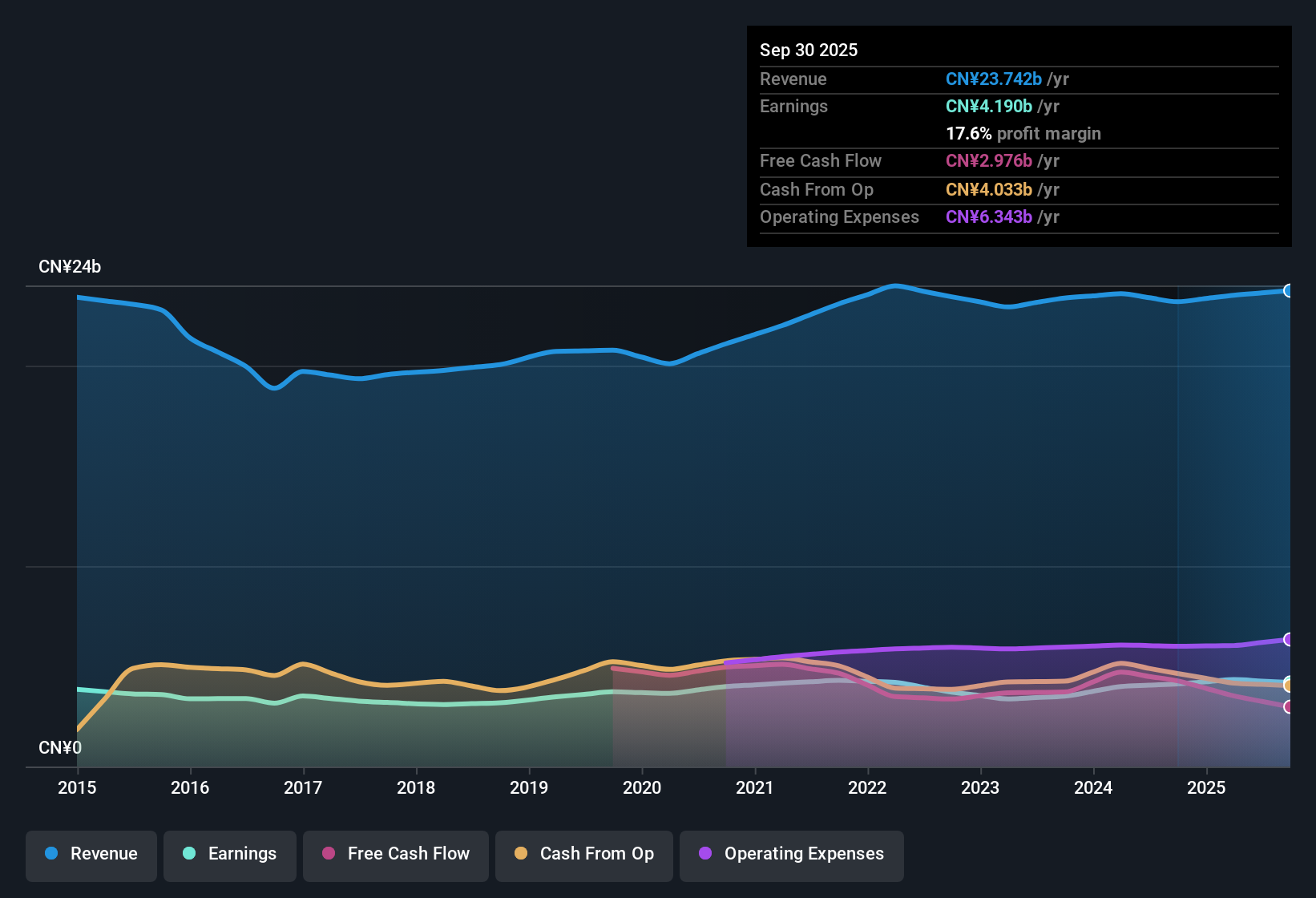

- Over the last twelve months, net income excluding extra items was about CNY 4,189.6 million on CNY 23,741.9 million of revenue, versus CNY 4,335.6 million on CNY 23,510.7 million of revenue in the prior trailing period. This points to broadly steady scale with only a small step down in profits.

- What stands out for a bullish angle is that one year earnings growth of 1.7 percent and five year growth of 0.2 percent per year sit alongside this roughly CNY 4.2 billion profit base. Optimistic investors may see this as a case where even low single digit growth can add up when it is being applied to a large, established earnings pool.

- Supporters can also note that trailing net profit margin of 17.6 percent is only slightly below last year’s 17.8 percent. This fits a story of resilient profitability rather than a sharp deterioration.

- On the flip side, those same figures show how gradual the progress has been, so any bullish thesis has to be built on stability and brand strength rather than rapid acceleration in reported earnings.

Margins steady in high teens

- The latest trailing net profit margin is 17.6 percent compared with 17.8 percent a year earlier. This narrow move indicates the company is still converting a similar share of revenue into profit even as H1 2026 net income dipped from CNY 1,863.4 million in H1 2025 to CNY 1,717.4 million.

- From a more cautious, bearish perspective, critics highlight that modest revenue growth of 2.8 percent per year and only 4.07 percent forecast annual earnings growth leave little room for error if margins were to slip further from the high teens level.

- This concern leans on the fact that H1 2026 EPS of roughly CNY 0.146 is lower than both H1 2025 EPS of about CNY 0.158 and H2 2025 EPS of about CNY 0.209, so the semiannual trend is not moving in one clear upward line.

- Bears also point to the unstable dividend track record flagged in the data, arguing that without consistent payouts, the appeal of steady but slow margin performance is not strong enough on its own to justify a richer valuation.

Value gap versus DCF fair value

- At a share price of HK$4.85 and a trailing P E of 12.4 times, the stock trades slightly cheaper than the Hong Kong food industry average of 13 times and peer average of 12.5 times. It also trades well below the stated DCF fair value of about HK$11.18, implying a discount of roughly 56.6 percent to that model.

- What is interesting for investors weighing a generally optimistic narrative is how this valuation picture sits beside only modest fundamentals. Forecasts of about 4.07 percent annual earnings growth and trailing revenue growth of 2.8 percent per year suggest that any rerating toward the DCF fair value would rest more on the market recognizing stability and cash generation than on a sudden surge in reported growth.

- Supporters of a bullish view may argue that the combination of a slightly below peer P E multiple and high teens net margin provides a reasonable margin of safety if the business can simply maintain its current scale and profitability.

- More skeptical investors, however, may look at the same 56.6 percent DCF discount and see it as the market baking in the slow growth profile and dividend instability, rather than a straightforward mispricing that will automatically close over time.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Want Want China Holdings's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Want Want China Holdings is wrestling with slow revenue and earnings growth, softer EPS, and an unstable dividend record that weakens its income appeal.

If that inconsistency worries you, use our these 1908 dividend stocks with yields > 3% to quickly focus on companies offering stronger, more reliable income streams that can better underpin long term returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報