Enova International (ENVA): Reassessing Valuation After a Sharp Share Price Surge

Enova International (ENVA) has been on a tear lately, with the stock up roughly 16% over the past week and about 24% this month. That kind of move naturally raises valuation questions.

See our latest analysis for Enova International.

Zooming out, this latest jump comes on top of a powerful trend, with a roughly 64% year to date share price return and a three year total shareholder return above 300%. This suggests momentum is still firmly building as investors reassess Enova’s growth and risk profile.

If Enova’s surge has you rethinking where growth and conviction overlap, it might be a good time to explore fast growing stocks with high insider ownership as potential next candidates for your watchlist.

But after such a sharp re-rating and with the share price now sitting above analyst targets, is Enova still trading below its true value, or is the market already baking in the next leg of growth?

Most Popular Narrative: 12.3% Overvalued

With Enova International’s fair value in the leading narrative sitting below the recent 157.92 close, the story hinges on powerful growth, shrinking margins, and a re-rated earnings multiple.

The scaling efficiencies of Enova's digital customer base, disciplined cost controls, and continued optimization of marketing effectiveness are driving operating leverage, leading to declining operating expenses as a percent of revenue and contributing to accelerating adjusted EPS growth and improving operating margins.

Want to see what kind of revenue surge, margin reset, and future earnings multiple are baked into that price tag? The narrative spells out a bold growth trajectory, surprising profitability trade offs, and a valuation anchor that could reshape how you view this lender’s upside.

Result: Fair Value of $140.63 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heightened regulatory scrutiny and any macro shock that drives up losses for nonprime borrowers could quickly challenge the growth and valuation assumptions behind this story.

Find out about the key risks to this Enova International narrative.

Another View: Multiples Still Look Supportive

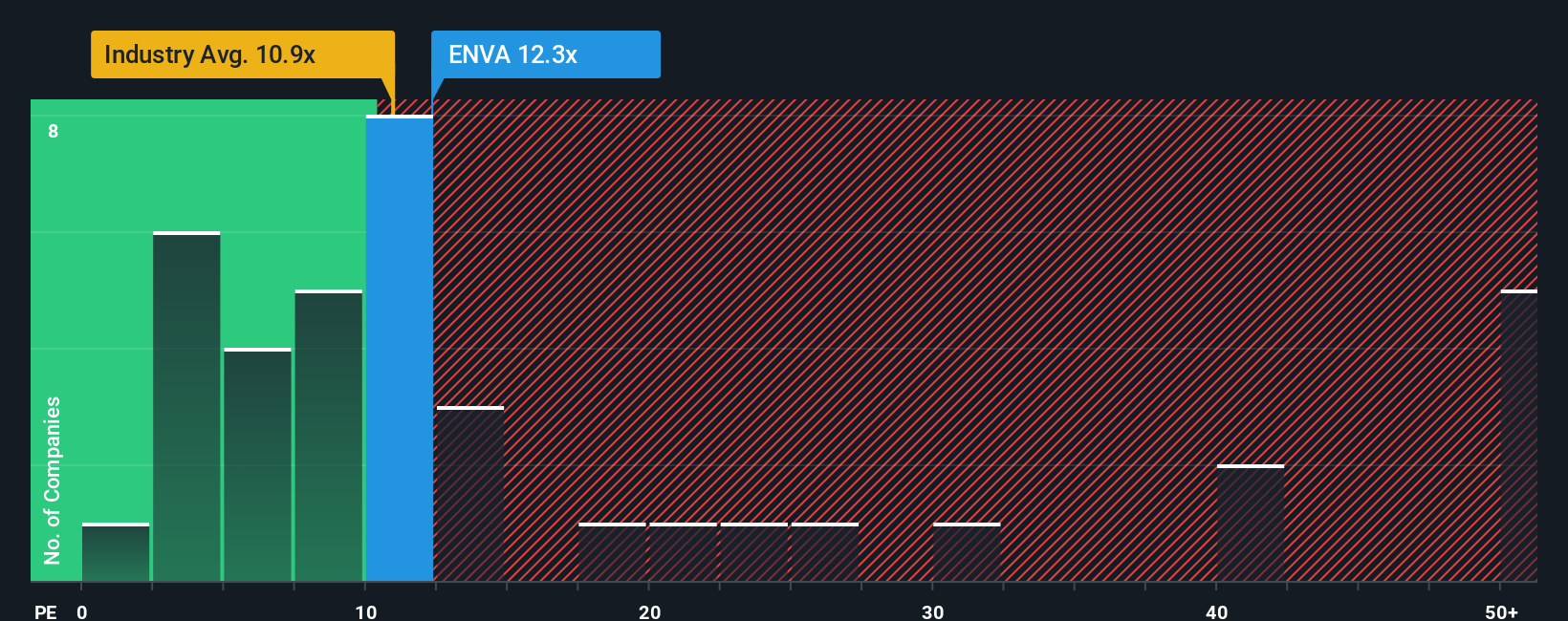

While the leading narrative says Enova looks about 12% overvalued, the market’s own yardsticks tell a more forgiving story. At 13.4 times earnings, the stock trades below the US market’s 18.9 times and under a 16 times fair ratio, suggesting the market could still re rate higher if growth holds.

Against that, Enova does look expensive versus the Consumer Finance industry at 9.2 times, which hints at less room for error if credit costs spike or growth cools. Are investors being sensibly selective about a proven compounder, or overpaying for momentum in a risky corner of lending?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Enova International Narrative

If you see the story unfolding differently or want to dig into the numbers yourself, you can build a personalized view in just a few minutes: Do it your way.

A great starting point for your Enova International research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, consider your next opportunities by tapping into curated stock ideas that match different return goals, risk levels, and themes.

- Capture potential value upside by targeting companies the market may be overlooking, starting with these 904 undervalued stocks based on cash flows.

- Tap into cutting edge innovation and growth by filtering for companies leading breakthroughs in automation and machine learning with these 25 AI penny stocks.

- Strengthen your income strategy by focusing on reliable payers through these 12 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報