European Market Insights: Fountain And 2 Other Promising Penny Stocks

As the European markets experience mixed returns, with Germany's DAX posting gains and France's CAC 40 Index seeing a modest decline, investors are eyeing opportunities amid hopes for interest rate cuts in the U.S. and UK. In this context, penny stocks—often smaller or newer companies—continue to draw attention for their potential value, despite being an outdated term. By focusing on those with robust financials and clear growth prospects, investors can uncover promising opportunities within these often-overlooked segments of the market.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Orthex Oyj (HLSE:ORTHEX) | €4.69 | €83.29M | ✅ 4 ⚠️ 1 View Analysis > |

| Lucisano Media Group (BIT:LMG) | €1.02 | €15.15M | ✅ 4 ⚠️ 5 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (DB:0QM) | €0.37 | €219.71M | ✅ 3 ⚠️ 3 View Analysis > |

| Libertas 7 (BME:LIB) | €3.02 | €64.06M | ✅ 3 ⚠️ 3 View Analysis > |

| Hultstrom Group (OM:HULT B) | SEK3.28 | SEK199.55M | ✅ 2 ⚠️ 2 View Analysis > |

| ForFarmers (ENXTAM:FFARM) | €4.35 | €384.47M | ✅ 4 ⚠️ 1 View Analysis > |

| Nurminen Logistics Oyj (HLSE:NLG1V) | €0.922 | €74.4M | ✅ 2 ⚠️ 4 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.265 | €313.07M | ✅ 3 ⚠️ 1 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.794 | €26.59M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 281 stocks from our European Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Fountain (ENXTBR:FOU)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Fountain S.A. operates in the sale, rental, and provision of machines for cold and hot drinks made from freeze-dried or grain products across France, Belgium, the Netherlands, and other European countries with a market cap of €9.50 million.

Operations: The company's revenue is primarily generated from the corporate beverage market, amounting to €30.04 million.

Market Cap: €9.5M

Fountain S.A. has shown significant financial improvement, with net income rising to €0.617 million for the half-year ending June 2025, up from €0.418 million a year earlier. The company has reduced its debt to equity ratio from 117.3% to 82.4% over five years, though its net debt remains high at 67.9%. Despite short-term liabilities exceeding assets, operating cash flow effectively covers debt obligations (88.9%). Fountain's earnings have grown by 32.2% in the past year and maintain a high return on equity of 45.4%. The management and board are experienced, contributing to stable operations and growth prospects within the commercial services industry.

- Jump into the full analysis health report here for a deeper understanding of Fountain.

- Review our historical performance report to gain insights into Fountain's track record.

FIPP (ENXTPA:FIPP)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: FIPP S.A. operates in the real estate sector both in Paris and internationally, with a market cap of €13.84 million.

Operations: The company's revenue is derived from its Shops segment, which contributes €0.06 million, and its Housing segment, generating €0.27 million.

Market Cap: €13.84M

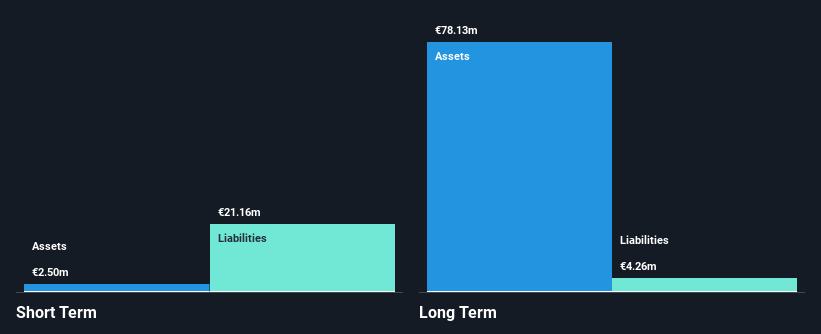

FIPP S.A., operating within the real estate sector, is pre-revenue with sales of €0.382 million for the first half of 2025, down from €0.955 million a year earlier. Despite being unprofitable and experiencing increased losses over five years, FIPP benefits from a debt-free status and has sufficient cash runway for more than three years due to positive free cash flow growth. However, its short-term liabilities exceed assets by a significant margin (€22.7M vs €11.7M). The company exhibits high share price volatility and lacks detailed management tenure data but has an experienced board averaging 8.5 years in tenure.

- Navigate through the intricacies of FIPP with our comprehensive balance sheet health report here.

- Assess FIPP's previous results with our detailed historical performance reports.

Polytec Holding (WBAG:PYT)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Polytec Holding AG, with a market cap of €73.47 million, develops, manufactures, and sells plastic solutions for passenger cars and light commercial vehicles, commercial vehicles, and smart plastic and industrial applications.

Operations: Polytec Holding AG's revenue from plastics processing amounts to €686.73 million.

Market Cap: €73.47M

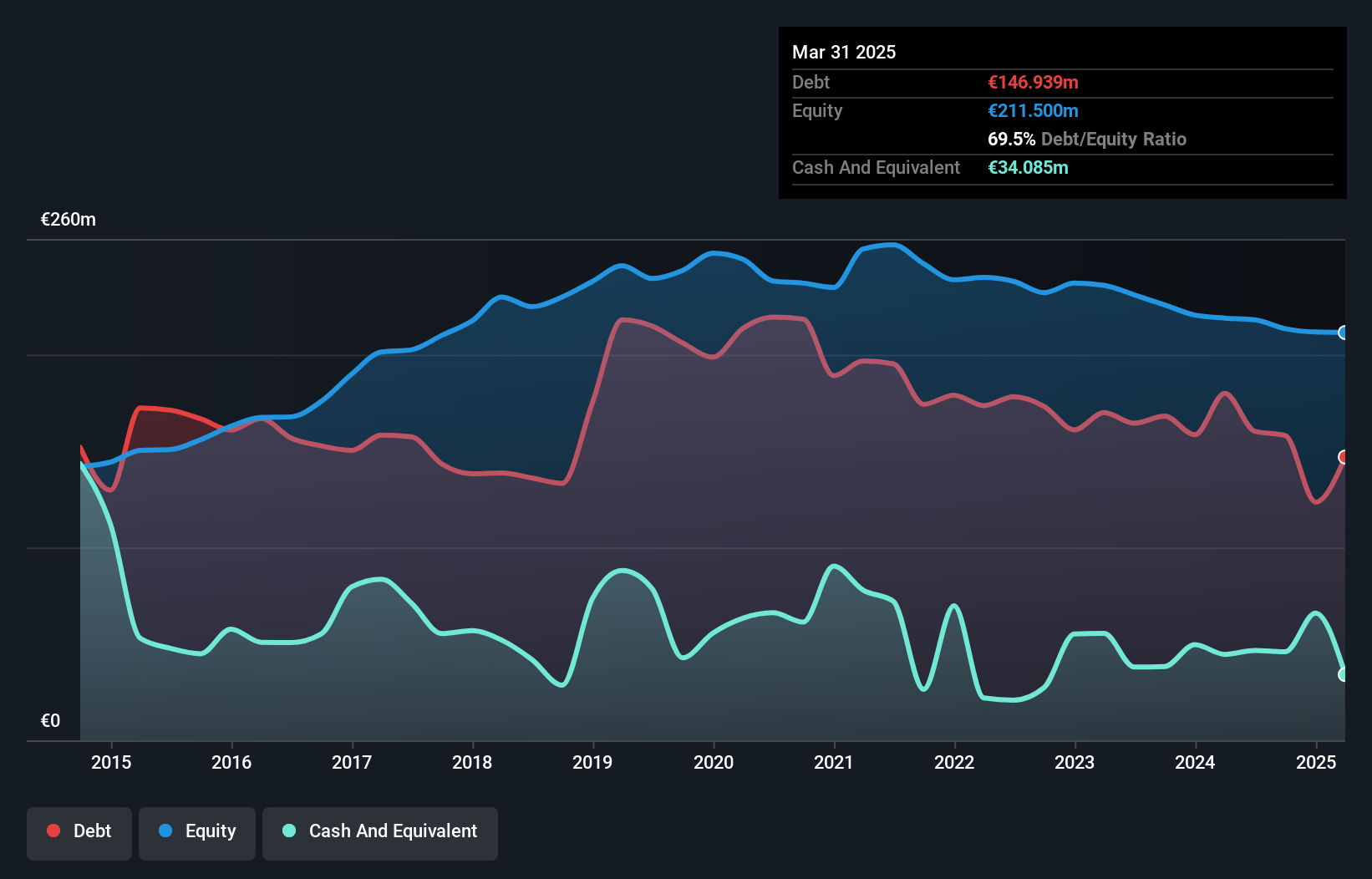

Polytec Holding AG, with a market cap of €73.47 million, has shown improved financial performance by becoming profitable over the past year, reporting a net income of €0.938 million for Q3 2025 compared to a loss in the previous year. The company's revenue from plastics processing reached €686.73 million, with short-term assets exceeding both short and long-term liabilities significantly. Despite its profitability and reduced debt-to-equity ratio over five years, Polytec faces challenges such as low interest coverage by EBIT and high net debt to equity ratio (43.8%). Earnings are forecasted to grow substantially at 63.71% annually.

- Take a closer look at Polytec Holding's potential here in our financial health report.

- Gain insights into Polytec Holding's outlook and expected performance with our report on the company's earnings estimates.

Key Takeaways

- Access the full spectrum of 281 European Penny Stocks by clicking on this link.

- Want To Explore Some Alternatives? The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報