ANI Pharmaceuticals (ANIP): Assessing Valuation After a Strong Year and Recent Share Price Pullback

ANI Pharmaceuticals (ANIP) has quietly pulled back over the past few months, even after delivering solid revenue and earnings growth. With the stock still up sharply this year, investors are now asking what comes next.

See our latest analysis for ANI Pharmaceuticals.

That pullback looks more like a breather than a breakdown. The share price is still at $82.13 with a robust year to date share price return of 48.14 percent, while the three year total shareholder return of 109.3 percent shows longer term momentum has been strong, even if the last quarter’s 15.95 percent share price slide hints that enthusiasm is cooling at the margins.

If ANI’s run up has you rethinking your pharma exposure, it might be worth scanning other ideas in the space via our screener for pharma stocks with solid dividends.

With earnings still climbing and the shares trading at a steep discount to analyst targets, is ANI Pharmaceuticals quietly undervalued here, or has the market already priced in the company’s next leg of growth?

Most Popular Narrative: 25.3% Undervalued

With ANI Pharmaceuticals last closing at $82.13 against a narrative fair value of about $109.88, the valuation story hinges on ambitious growth and margin assumptions.

The company is seeing early stage expansion in underpenetrated specialties and with prescribers who were previously inexperienced with ACTH therapies (over 50% of new prescribers), indicating long runway for sustained future growth in market share and revenue.

Want to see what kind of revenue ramp, profit margin expansion, and future earnings multiple are baked into that upside case? The full narrative lays out a surprisingly aggressive earnings climb, a sharp margin turn, and a valuation profile more often associated with faster growing sectors. Curious which assumptions really drive that fair value gap, and how sensitive they are to execution? Dive in to unpack the numbers behind this optimistic pricing roadmap.

Result: Fair Value of $109.88 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this optimistic path could be derailed if payers tighten Cortrophin Gel access, or if exclusivity on key generics fades faster than expected.

Find out about the key risks to this ANI Pharmaceuticals narrative.

Another Lens on Valuation

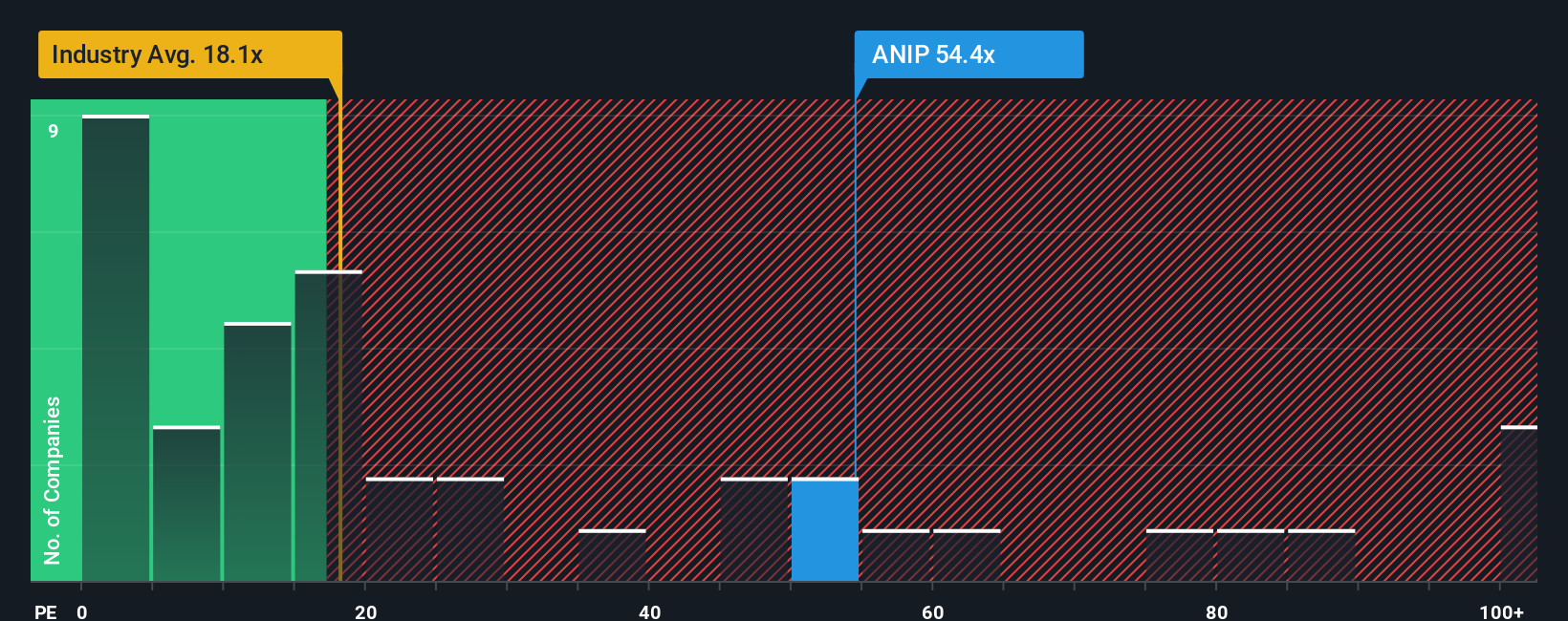

Look past the upbeat fair value and ANI starts to look pricey on earnings. Shares trade on a P E ratio of 50.3 times versus 19.7 times for the US pharma industry and a fair ratio of 20.6 times, leaving little room for disappointment if growth stumbles.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own ANI Pharmaceuticals Narrative

If this view does not quite fit your own, or you prefer digging into the numbers yourself, you can build a custom narrative in just a few minutes: Do it your way.

A great starting point for your ANI Pharmaceuticals research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Looking for your next standout opportunity?

Do not stop at a single stock when the market is full of candidates. Use the Simply Wall Street Screener to help pinpoint your next edge.

- Capture potential multi baggers early by scanning these 3609 penny stocks with strong financials that already show solid financial underpinnings and room to run.

- Focus on the structural shift toward automation and intelligent software by zeroing in on these 25 AI penny stocks that may benefit from growing AI adoption.

- Seek quality at a discount by targeting these 904 undervalued stocks based on cash flows that combine strong cash flows with attractive entry prices.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報