A Look at Wabtec’s (WAB) Valuation After Its Multi-Year Share Price Rally

Westinghouse Air Brake Technologies (WAB) has quietly rewarded patient shareholders, with the stock climbing about 15% over the past 3 months and more than doubling over five years, outpacing many industrial peers.

See our latest analysis for Westinghouse Air Brake Technologies.

With the share price now around $217.77 and a roughly mid-teens year to date share price return, momentum still looks constructive. The triple digit multi year total shareholder returns point to investors steadily re rating Wabtec as growth and execution risks ease.

If Wabtec’s steady climb has you rethinking your watchlist, this could be a good moment to see what else is moving across aerospace and defense stocks.

Yet with shares near record highs, modest upside to analyst targets and solid double digit earnings growth, investors now face a key question: is Westinghouse Air Brake Technologies still a buy or is future growth already priced in?

Most Popular Narrative Narrative: 6.9% Undervalued

With Westinghouse Air Brake Technologies last closing at $217.77 versus a narrative fair value of about $233.82, the story leans toward upside potential driven by structural rail trends.

Structural rail industry shifts, such as the competitive modal advantage of rail in reducing emissions, winning freight share from road transport, and growing regulatory support for automation and safety innovation, are expected to further increase demand for Wabtec's core offerings, underpinning a multi-year growth runway for revenue and earnings.

Curious what kind of revenue trajectory, margin lift, and future earnings multiple it takes to back this richer valuation? The narrative spells out a surprisingly ambitious profit roadmap and a premium pricing assumption that looks more like a growth franchise than a mature industrial. Want to see exactly how those moving parts stack up in the model?

Result: Fair Value of $233.82 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, softer North American railcar demand and more uneven freight backlog conversion could challenge the upbeat growth and valuation assumptions underpinning the current narrative.

Find out about the key risks to this Westinghouse Air Brake Technologies narrative.

Another Lens on Value

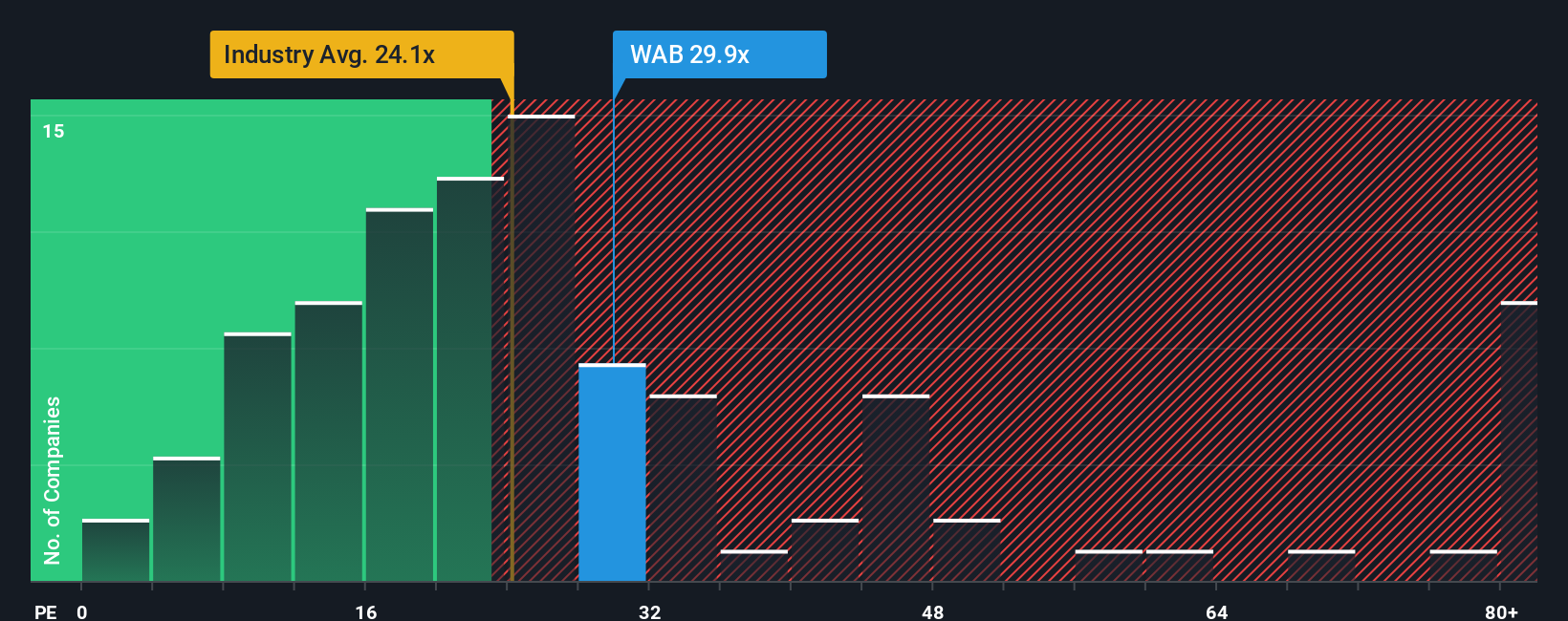

On simple earnings comparisons, Westinghouse Air Brake Technologies looks fully priced. Its P/E of 31.7x sits above the US Machinery industry at 25.7x, peers at 18.4x, and even its own fair ratio of 30.7x. This suggests there may be limited margin for error if growth stumbles.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Westinghouse Air Brake Technologies Narrative

If you see the outlook differently or would rather test your own assumptions against the numbers, you can build a custom narrative in minutes, Do it your way.

A great starting point for your Westinghouse Air Brake Technologies research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, consider running smart screens on Simply Wall Street so you are not chasing the market later.

- Capture early stage potential with these 3609 penny stocks with strong financials that already show relatively stronger balance sheets and cleaner financials than many similarly small names in the market.

- Explore long-term structural themes using these 25 AI penny stocks to identify companies that are focusing on artificial intelligence and automation trends.

- Look for potentially mispriced quality with these 904 undervalued stocks based on cash flows, combining solid fundamentals with valuations that may appear attractive relative to discounted cash flow estimates.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報