Exploring Global Markets With 3 Undervalued Small Caps And Insider Activity

As global markets navigate the anticipation of an interest rate cut from the Federal Reserve, small-cap stocks have shown resilience, with the Russell 2000 Index advancing amid a backdrop of mixed economic indicators. In this environment, identifying promising small-cap companies often involves looking at those with strong fundamentals and potential growth drivers that align well with current market conditions.

Top 10 Undervalued Small Caps With Insider Buying Globally

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Norcros | 13.5x | 0.7x | 41.98% | ★★★★★☆ |

| Speedy Hire | NA | 0.3x | 40.46% | ★★★★★☆ |

| Morguard North American Residential Real Estate Investment Trust | 4.7x | 1.6x | 29.86% | ★★★★★☆ |

| Senior | 24.1x | 0.8x | 29.03% | ★★★★★☆ |

| Centurion | 3.6x | 3.0x | -52.82% | ★★★★☆☆ |

| PSC | 9.4x | 0.4x | 22.46% | ★★★★☆☆ |

| Chinasoft International | 21.1x | 0.7x | -1179.69% | ★★★★☆☆ |

| Hung Hing Printing Group | NA | 0.4x | 44.49% | ★★★★☆☆ |

| Kendrion | 28.8x | 0.7x | 42.57% | ★★★☆☆☆ |

| Ever Sunshine Services Group | 6.1x | 0.4x | -394.63% | ★★★☆☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

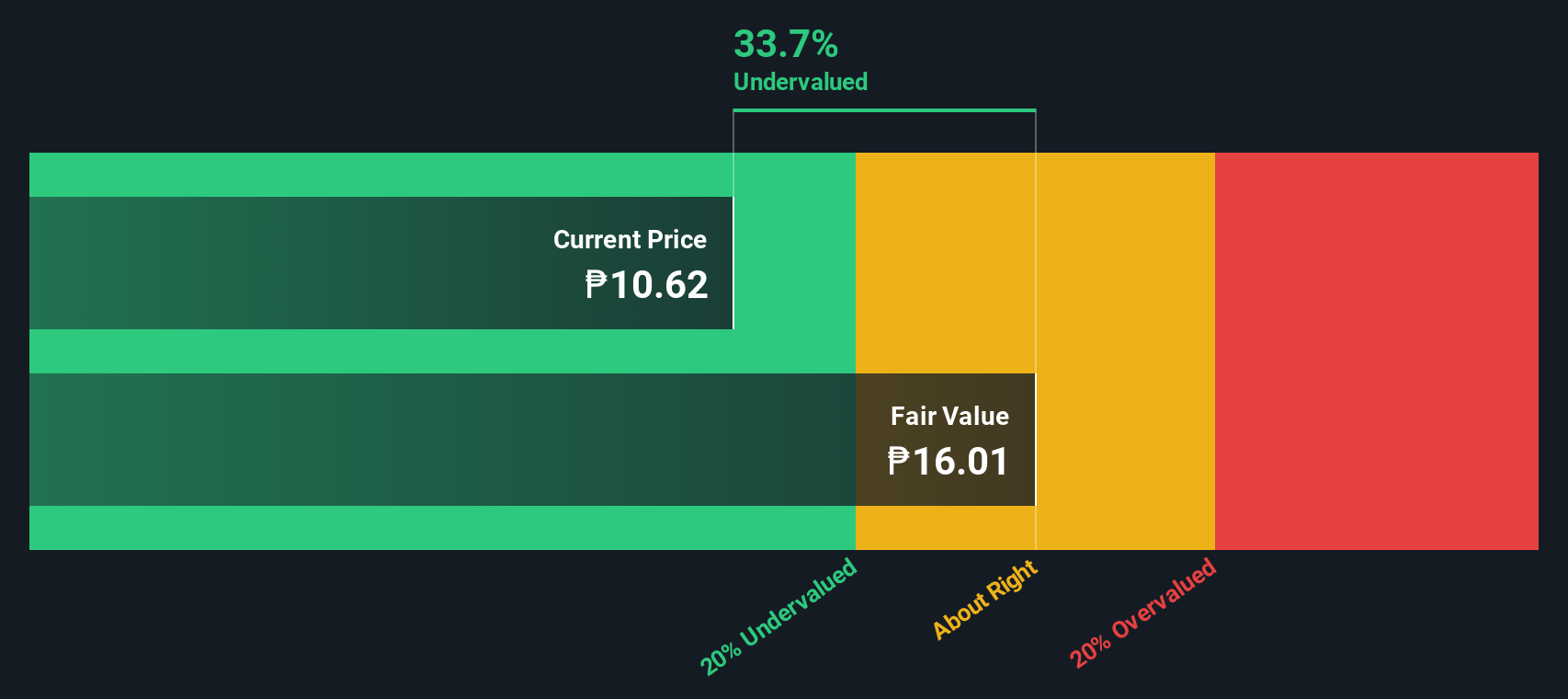

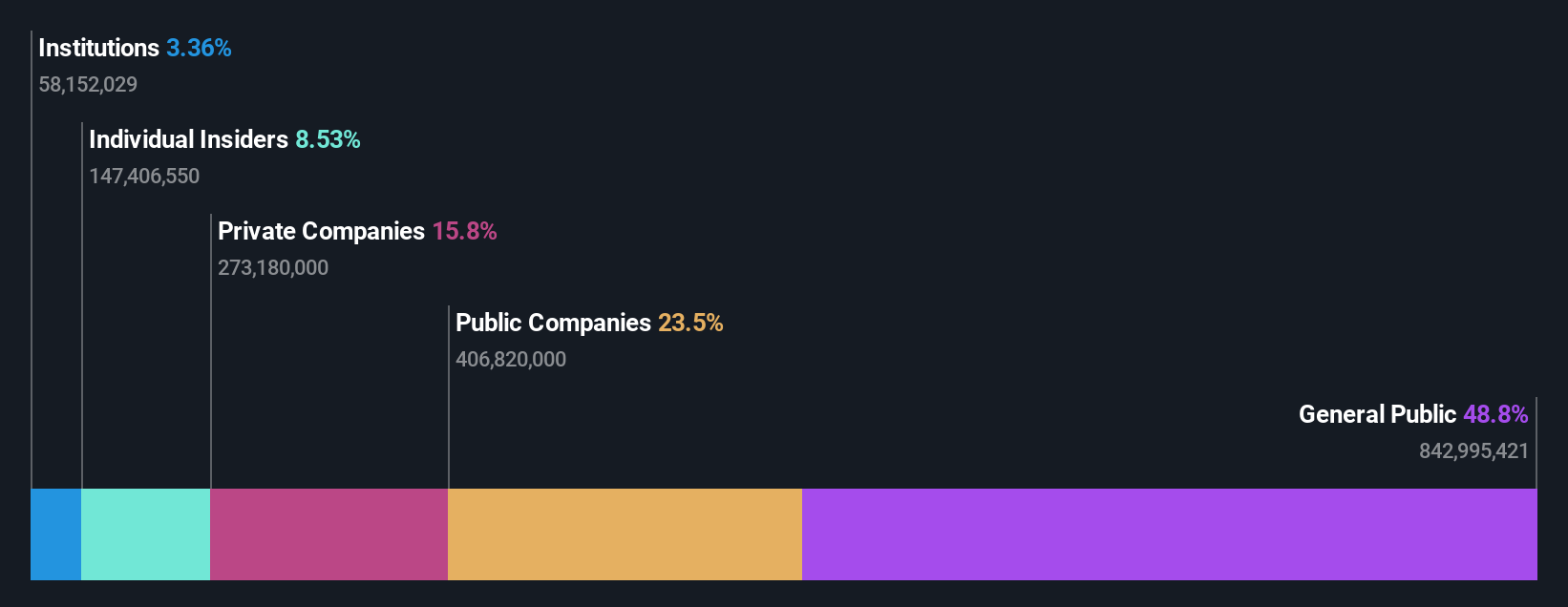

East West Banking (PSE:EW)

Simply Wall St Value Rating: ★★★★★☆

Overview: East West Banking operates as a financial institution offering retail, consumer, and corporate banking services with a market capitalization of ₱40.71 billion.

Operations: The company generates significant revenue from its Retail and Consumer Banking segments, with Corporate Banking also contributing. Operating expenses, including General & Administrative and Sales & Marketing costs, are substantial components of the cost structure. Notably, the net income margin has shown variations over time, reaching 23.77% in recent periods.

PE: 3.1x

East West Banking, a smaller player in the financial sector, recently reported a rise in net interest income to PHP 10.5 billion for Q3 2025 from PHP 8.5 billion the previous year, with net income also increasing to PHP 2.48 billion. Insider confidence is evident as they have shown interest through share purchases this year. However, the bank maintains a low allowance for bad loans at 66%, while non-performing loans are notably high at 4.4%. Earnings are projected to grow annually by around 12%.

Ever Sunshine Services Group (SEHK:1995)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Ever Sunshine Services Group operates primarily in the property management sector, providing a range of services, and has a market capitalization of approximately CN¥7.61 billion.

Operations: The company generates revenue primarily from property management services, with a notable gross profit margin of 19.43% as of June 30, 2025. Cost of goods sold (COGS) accounts for a significant portion of expenses, totaling CN¥5.65 billion in the same period. Operating expenses are also substantial at CN¥603.63 million, impacting profitability alongside non-operating expenses which reached CN¥246.98 million during this timeframe.

PE: 6.1x

Ever Sunshine Services Group, a smaller company in its sector, recently saw insider confidence with Zhubo Lin purchasing 300,000 shares for approximately HK$543,000. Although the company has not repurchased shares this year, it completed a buyback of 4.5 million shares last year. With earnings projected to grow by 7.89% annually and an ongoing restructuring involving CIFI Holdings' stake sale to LMR Partners for HK$280 million, Ever Sunshine is navigating complex financial landscapes while maintaining growth potential despite relying solely on external borrowing.

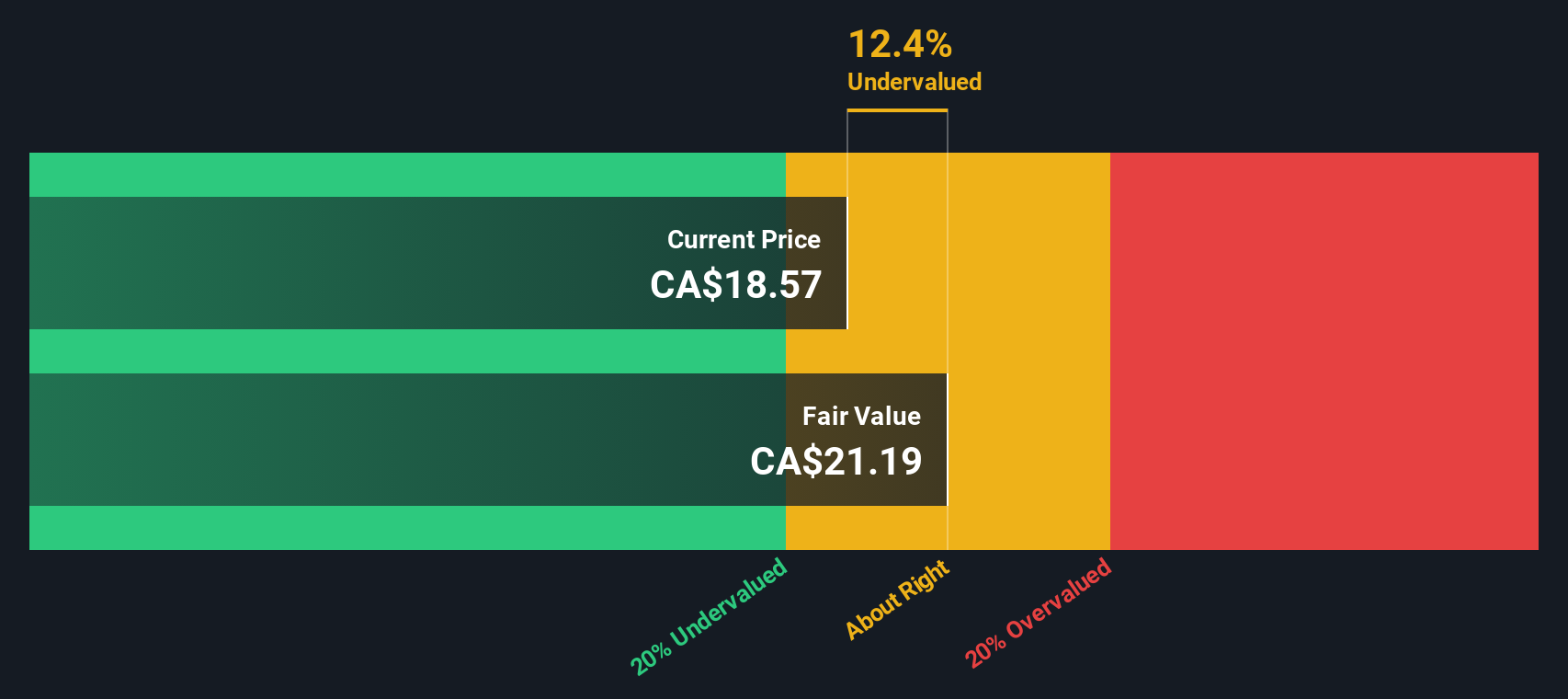

Morguard North American Residential Real Estate Investment Trust (TSX:MRG.UN)

Simply Wall St Value Rating: ★★★★★☆

Overview: Morguard North American Residential Real Estate Investment Trust operates in the multi-suite residential real estate sector, focusing on the acquisition and management of residential properties across North America, with a market cap of CA$1.83 billion.

Operations: The primary revenue stream is derived from its multi-suite residential real estate segment, with the latest reported revenue at CA$359.44 million. Over recent periods, the gross profit margin has shown fluctuations, reaching 54.14% in the most recent quarter. Operating expenses have consistently been a significant component of costs, impacting net income margins which have varied considerably across different periods.

PE: 4.7x

Morguard North American Residential REIT, a smaller player in the real estate sector, has seen insider confidence with recent share repurchases totaling 728,717 shares for CAD 12.72 million by September 2025. Despite earnings declining by an average of 16.1% annually over five years, Q3 2025 showed improvement with net income at CAD 7.85 million compared to a loss the previous year. Leadership changes bring Angela Sahi as CEO, potentially guiding future strategies amidst its external borrowing challenges and consistent monthly dividends around CAD 0.065 per unit.

Next Steps

- Unlock more gems! Our Undervalued Global Small Caps With Insider Buying screener has unearthed 132 more companies for you to explore.Click here to unveil our expertly curated list of 135 Undervalued Global Small Caps With Insider Buying.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報