Global Growth Companies Insiders Favor With Up To 49% Earnings Growth

As global markets navigate the anticipation of potential interest rate cuts and mixed economic signals, investors are keenly observing sectors that promise growth amidst uncertainty. In this context, stocks with high insider ownership often attract attention as they can indicate confidence from those closely connected to the company's operations.

Top 10 Growth Companies With High Insider Ownership Globally

| Name | Insider Ownership | Earnings Growth |

| UTI (KOSDAQ:A179900) | 25% | 120.7% |

| Streamax Technology (SZSE:002970) | 32.5% | 33.1% |

| Seers Technology (KOSDAQ:A458870) | 33.9% | 78.8% |

| Rasan Information Technology (SASE:8313) | 31.1% | 21% |

| Novoray (SHSE:688300) | 23.6% | 31.4% |

| Loadstar Capital K.K (TSE:3482) | 31% | 23.6% |

| Laopu Gold (SEHK:6181) | 34.8% | 34.3% |

| KebNi (OM:KEBNI B) | 36.3% | 61.2% |

| J&V Energy Technology (TWSE:6869) | 17.5% | 31.6% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 37.2% |

Below we spotlight a couple of our favorites from our exclusive screener.

Grupo Aeroportuario del Sureste S. A. B. de C. V (BMV:ASUR B)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Grupo Aeroportuario del Sureste, S. A. B. operates airports and related services in Mexico, with a market cap of MX$167.90 billion.

Operations: The company's revenue segments include operations in Colombia (MX$3.79 billion), Mexico - Cancun (MX$20.37 billion), Mexico - Merida (MX$1.75 billion), Mexico - Villahermosa (MX$661.60 million), other airports in Mexico (MX$3.33 billion), and San Juan, Puerto Rico, US (MX$5.39 billion).

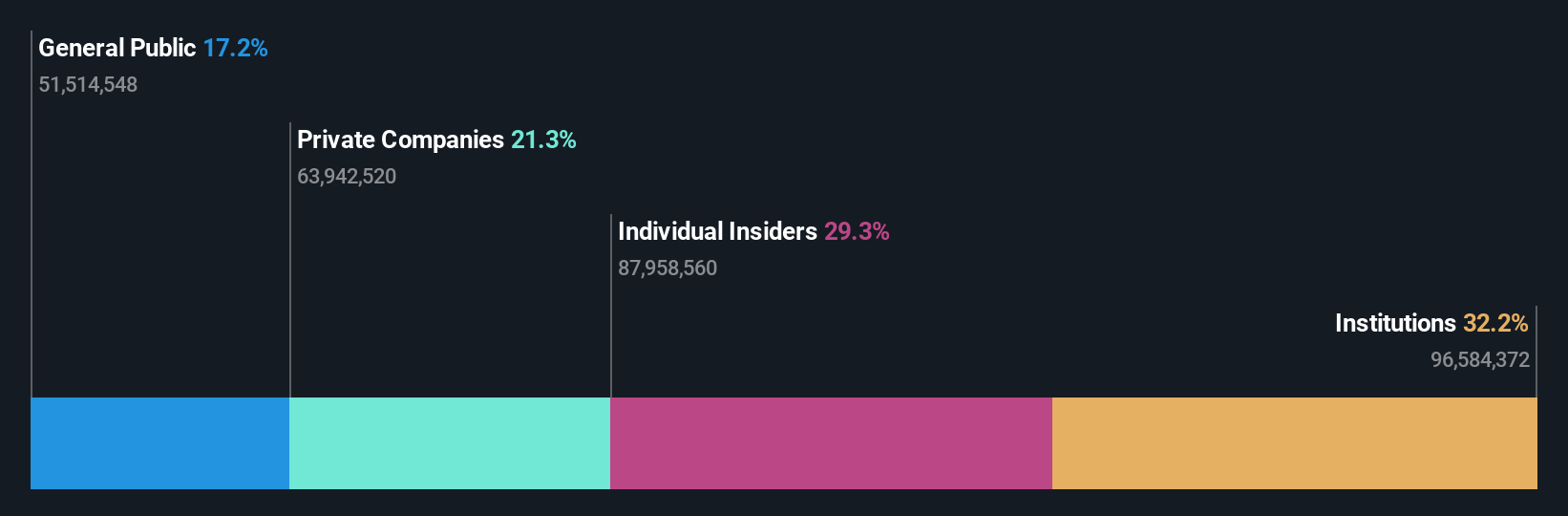

Insider Ownership: 29.3%

Earnings Growth Forecast: 12.5% p.a.

Grupo Aeroportuario del Sureste S. A. B. de C. V.'s earnings are forecast to grow at 12.5% annually, outpacing the MX market's 11.4%. Despite trading at 31.9% below its estimated fair value, recent results show mixed performance with increased sales but declining net income and earnings per share year-on-year for Q3 2025. Passenger traffic has seen modest growth over the past year, indicating steady operational activity without significant insider trading activity recently reported.

- Get an in-depth perspective on Grupo Aeroportuario del Sureste S. A. B. de C. V's performance by reading our analyst estimates report here.

- Our expertly prepared valuation report Grupo Aeroportuario del Sureste S. A. B. de C. V implies its share price may be lower than expected.

SICC (SHSE:688234)

Simply Wall St Growth Rating: ★★★★★☆

Overview: SICC Co., Ltd. operates in the research, development, production, and sale of silicon carbide substrate materials both in China and internationally, with a market cap of CN¥37.60 billion.

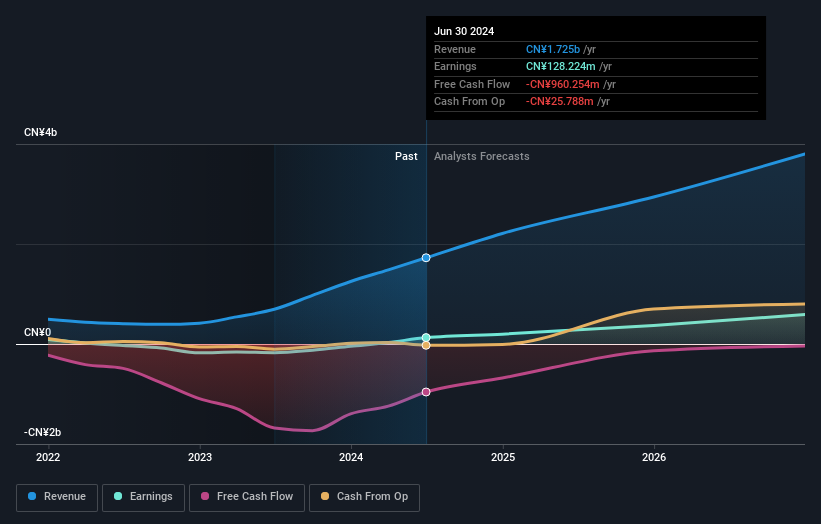

Operations: The company generates revenue primarily from its Semiconductor Material segment, which accounted for CN¥1.60 billion.

Insider Ownership: 26.8%

Earnings Growth Forecast: 49.8% p.a.

SICC Co., Ltd. anticipates significant earnings growth of 49.8% annually, surpassing the CN market's 27.3%. Revenue is also expected to grow robustly at 22.8% per year, although recent results showed a decline in sales and net income compared to last year. Despite these challenges, insider ownership remains stable with no substantial trading activity reported recently. Executive changes include Mr. Wang Junguo's resignation as an executive director and subsequent appointment as an employee representative director.

- Delve into the full analysis future growth report here for a deeper understanding of SICC.

- Our valuation report here indicates SICC may be overvalued.

Intsig Information (SHSE:688615)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Intsig Information Co., Ltd. focuses on researching and developing text recognition and commercial big data core technologies in China, with a market cap of CN¥27.31 billion.

Operations: Intsig Information generates revenue through its research and development of text recognition and commercial big data technologies in China.

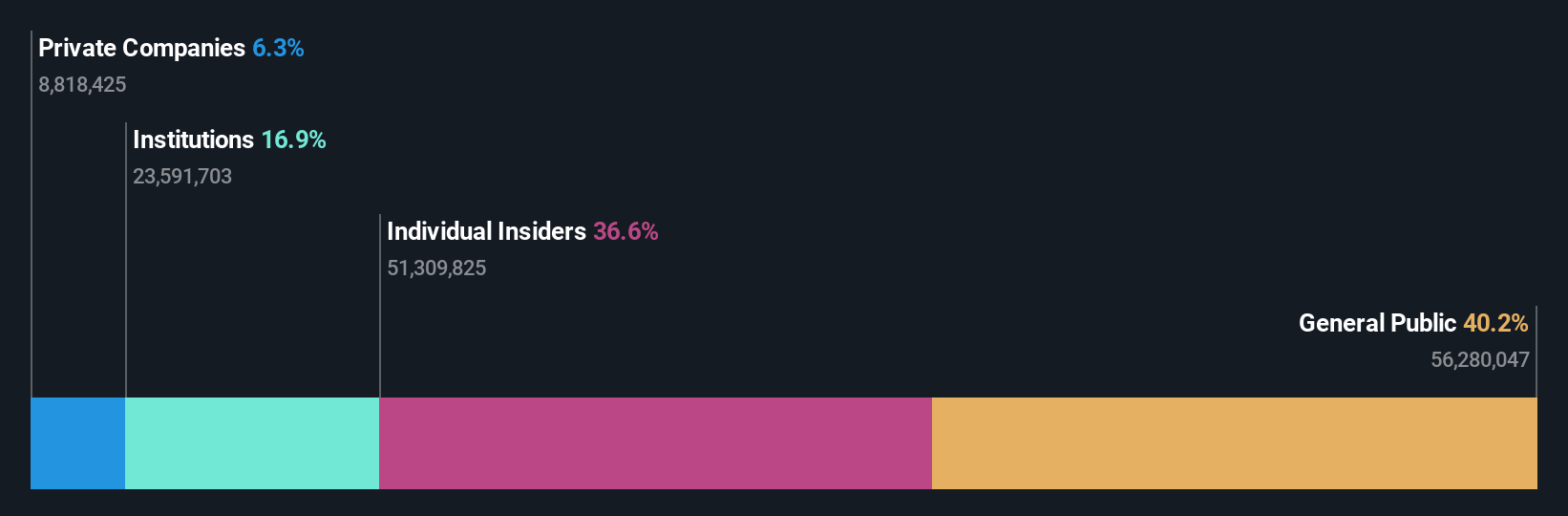

Insider Ownership: 36.6%

Earnings Growth Forecast: 22.1% p.a.

Intsig Information is positioned for growth with revenue expected to increase by 20.5% annually, outpacing the CN market's 14.6%. Despite a volatile share price recently, the company reported sales of CNY 1.30 billion for the first nine months of 2025, up from CNY 1.05 billion last year. Earnings grew by 25.9% over the past year but are forecasted to grow at a slower pace than the broader market in coming years, with no recent insider trading activity noted.

- Click here to discover the nuances of Intsig Information with our detailed analytical future growth report.

- Our valuation report unveils the possibility Intsig Information's shares may be trading at a premium.

Summing It All Up

- Take a closer look at our Fast Growing Global Companies With High Insider Ownership list of 858 companies by clicking here.

- Looking For Alternative Opportunities? The end of cancer? These 29 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報