More than 60 billion dollars were separated from the main business, and China Metallurgical (01618) was mistakenly killed by the market

The separation of over 60 billion yuan focused on the main business but was not favored by the market. China Metallurgical (01618) announced that its stock price plummeted 21%, and the market value shrunk by more than 10 billion Hong Kong dollars.

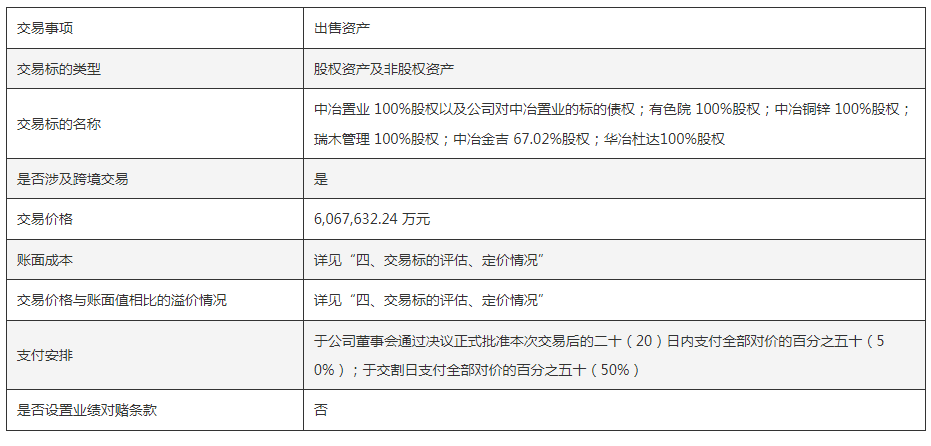

The Zhitong Finance App learned that China Metallurgical recently announced that it plans to sell all of China Metallurgical Real Estate's shares and transfer related claims to Minmetals Real Estate Holdings for about 3.124 billion yuan, and that it plans to sell all of the shares of Nonferrous Metals, Huaye, China Metallurgical Copper and Zinc, and Ruimu Management's respective shares and 67.02% of China Metallurgical Jinji's shares to the controlling shareholder China Minmetals for about 2,944 billion yuan. The total consideration for this sale was RMB 60.676 billion.

There is a very high premium in consideration of the underlying net assets in this transaction, which will result in a significant increase in net assets after the sale is completed. According to the disclosure, this divestment of non-core assets optimizes the allocation of resources, which is conducive to optimizing the company's business structure, focusing on core business, and enhancing core competitiveness. In the future, it will focus on fields such as metallurgical engineering, non-ferrous and mining engineering construction and operation, high-end infrastructure, industrial construction and emerging industries to promote high-quality business development.

However, the market did not buy it. As soon as the announcement came out, the market value of Hong Kong stocks plummeted by more than 20% the next day. After opening sharply lower, A-shares quickly fell to a standstill, and continued to fall on the second day. So, what impact will this large-scale separation of non-core assets have on the company's fundamentals, and will it affect sustainable management?

High value-added rates separate non-main businesses, net asset value or significant growth

The Zhitong Finance App learned that there are three main categories of revenue sources for China Metallurgical. One is engineering contracting business, including metallurgical construction, housing construction, and municipal engineering; the second is characteristic businesses, including mineral resources, engineering services, new materials, high-end equipment and energy and environmental protection; and third, comprehensive real estate, which is mainly the operation of China Metallurgical Real Estate. The company's main business is engineering contracting. According to the financial report for the first half of 2025, the revenue shares of its three major businesses were 90.3%, 7.62% and 2%, respectively.

The total revenue of the six companies sold this time (January-July) was 12.208 billion yuan, accounting for only 5.1% of total revenue (based on the first half of the year). Furthermore, due to the loss of the real estate target, the total net profit of the six companies - 1,841 billion yuan. Furthermore, the total assets of the six companies were 83.636 billion yuan, accounting for 9.75% of total assets. It can be seen that this separation will have little impact on the company's performance and revenue, but cleaning up loss-making assets will enhance the company's profitability.

It is worth mentioning that the total consideration for the sale of assets is 60.676 billion yuan, which is a very high premium compared to the underlying net assets. China Metallurgical Real Estate lost money all year round due to the downturn in the real estate industry. As of July 2025, its net assets were -16.276 billion yuan. However, this transaction included the packaged sale of the company's 46.164 billion yuan debt, which is equivalent to the underlying net assets of 29.888 billion yuan. The consideration for this portion of the transaction was 31,237 billion yuan, which is equivalent to an added value of 1,349 billion yuan, with a value-added rate of 4.5%.

Photo Source: Company Announcements

In addition, the transaction consideration for China Metallurgical Copper and Zinc was 12.24 billion yuan, with a value-added value of 7.915 billion yuan, a value-added rate of 182.99%; Ruimu Management's transaction consideration was 0.1 billion yuan, with a value-added value of 0.1 billion yuan; China Metallurgical Jinjie's transaction consideration was 5,036 billion yuan, with a value-added value of 1.47 billion yuan, a value-added rate of 789.6%; and a value-added rate of 12.53%.

The buyer of this transaction, China Minmetals and Minmetals Real Estate, will be paid in two installments. The first installment will pay 50% of the total consideration within 20 days after the respective boards of directors pass a resolution to formally approve the transaction, and the second payment will pay 50% of the total consideration on the delivery date.

The net assets of the six companies increased by 19.854 billion yuan. The completion of the sale will increase China Metallurgical's net assets by 11%, and return more than 60 billion yuan in cash. In addition to cash reserves up to the first half of the year, cash in hand may exceed 100 billion yuan. The company disclosed that the capital will strengthen the core business of metallurgical construction and be used to build an advanced research platform. At the same time, it will also promote new industrialization and new urbanization to develop advanced construction technology and upgraded equipment. In addition, it will also be used to develop special businesses such as engineering services, new materials, and high-end equipment.

Poor performance focuses on development, and valuations are falling back to “catch up”

China Metallurgical's performance in the past two years has not been good. In the first three quarters of 2024 and 2025, revenue and shareholders' net profit declined by 13%, 18.8%, 22.1%, and 41.9%, respectively. The three major businesses, engineering contracting, specialty businesses, and comprehensive real estate, all showed a downward trend. The share of revenue from the engineering contracting business continued to decline by double digits. Revenue fell 21.8% in the first half of the year, while the real estate business had large losses, dragging down profit levels.

In the company's engineering contracting business, metallurgical construction accounted for 21.93%, and housing construction and municipal engineering accounted for 78.07%. The company's main business has a strong competitive advantage. It has 12 Class A research and design institutes, 15 construction enterprises, 5 comprehensive Class A design qualifications and 50 special general contracting qualifications, including 6 four-grade construction enterprises, 2 third-grade construction enterprises, and 4 dual-grade construction enterprises, ranking among the highest in the country.

The metallurgical construction business is the company's traditional core business. The scope of business covers new construction, expansion and intelligent, green and efficient transformation projects in the steel and non-ferrous industries, operation services for steel mills and non-ferrous industries. In the first half of 2025, the amount of key metallurgical construction projects signed and contracted exceeded 10 billion yuan. Housing construction and municipal engineering are the company's core business, mainly including high-rise buildings, large-scale urban area construction and renewal projects, and transportation, municipal infrastructure projects, hydraulic engineering, and communication engineering with comparative advantages such as high-grade highways and rail transit. In the first half of 2025, the amount of key housing construction and municipal engineering projects bids and contracts exceeded 36 billion yuan.

On the one hand, the sale of non-core businesses has separated the loss-making real estate business and reduced the pressure on performance in the next cycle. On the other hand, it has also returned a large amount of capital, providing guarantees for the development of the main business. The company disclosed that the funds received will mainly be used to support the company's “one core, two actors, five characteristics” diversified business system, strengthen the core business of metallurgical construction, consolidate the two main businesses of new industrialization and new urbanization, and cultivate the five major businesses of engineering services, new materials, high-end equipment, energy and environmental protection, and digital intelligence applications.

In fact, due to the real estate business, China Metallurgical's operating cash flow has been in a state of large net outflow year after year, but the profitability of the core business increased. The gross margin for the first half of 2025 was 9.58%, up 1.08 percentage points from the previous year. The gross margin of the specialty business was relatively high, reaching 17.62%, up 0.99 percentage points from the previous year. With the separation of the real estate business, it is expected that overall gross margin will increase and operating cash flow will also be optimized.

Overall, China Metallurgical split from its non-main business, accounting for a relatively low share on the asset side and revenue side, and had little impact on reporting. However, splitting off the real estate business, which had serious losses this time, will greatly increase profitability, and will help increase the development of the main business after returning capital. The company also actively rewards shareholders. Since 2013, it has paid dividends every year, with an average dividend ratio of about 20%. Currently, the dividend rate is about 3.4%.

Obviously, the market reacted too aggressively to China Metallurgical's current split, but the valuation retracted back to an opportunity for long-term optimistic investors to “reverse and pick up”. The company's current PB valuation is only 0.3 times, which has a high value ratio.

Nasdaq

Nasdaq 華爾街日報

華爾街日報