The IPO of the Beidouyuan Science and Technology Innovation Board has asked to focus on the two major technical fields of satellite navigation and aerospace measurement and control

The Zhitong Finance App learned that on December 11, Changsha Beidou Industrial Safety Technology Research Institute Group Co., Ltd. (Beidou Institute for short) applied for listing on the Shanghai Stock Exchange Science and Technology Innovation Board and changed its review status to “Inquired”. As its sponsor, Zhongtai Securities plans to raise 709 million yuan.

According to the prospectus, Beidouyuan focuses on R&D, production, and sales of technology and products in the two major fields of satellite navigation and aerospace measurement and control, and has gradually formed three major business directions: navigation simulation and testing, spatio-temporal safety and enhancement, and space measurement, control and testing.

Based on underlying common technology in the field of radio signal generation, measurement and processing, the company has independently developed products such as navigation signal simulators, navigation simulation test systems, drone prevention and control series products, satellite monitoring and control ground inspection products, and signal processing/signal generation/signal enhancement components.

The main products of navigation simulation and testing include navigation signal simulators and navigation simulation test systems, which are an important source of the company's revenue, accounting for more than 50% of revenue.

The company requires many types of raw materials, mainly components, accessories and ancillary equipment, structural parts, modules and components, raw materials and tools for production. In addition to purchasing raw materials, in order to improve production efficiency or meet the special requirements of some customers, the company's external procurement includes outsourcing services such as component screening, PCBA, structural parts processing, and third-party measurement tests.

The company's important suppliers include CLP Group, C5 Unit, Dalian Dongxin Microwave Technology Co., Ltd., Beijing Hangtian River Technology Development Co., Ltd., Hunan Oushi Electronic Technology Co., Ltd. Customers cover various industries such as national defense and military, low-altitude safety, commercial aerospace, energy, transportation, education, etc.

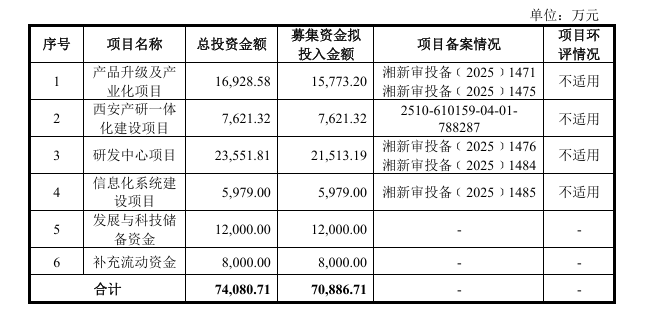

The capital raised by the company from this public offering of shares (after deducting issuance fees) will be used for projects related to the main business. The details of the investment projects are as follows:

On the financial side, in 2022, 2023, 2024, and January-June 2025, the company achieved operating income of approximately RMB 243 million, RMB 285 million, RMB 325 million, and RMB 112 million.

For the same period, net profit was approximately RMB 74.3456 million, RMB 78.33,900, RMB 82.5939 million, and RMB 15.2374 million, respectively.

Nasdaq

Nasdaq 華爾街日報

華爾街日報